This post 315% Gains And Counting (Could be 400% By EoY) appeared first on Daily Reckoning.

Since 2009, the bull market has turned every $10,000 invested in the S&P 500 into $41,500.

That’s a 315% return in just over nine years, all by investing in the broader market.

Unfortunately, many people have missed out on these historic gains.

Maybe you’re one of them…

These people include the retail investors who have kept money on the sidelines in anticipation of putting that money to work during a downturn, and the “permabears” who are consistently bearish and never miss an opportunity to point out the flaws in today’s stock market.

“This bull market is just days away from being the longest running in history!”

“The Fed is artificially propping up stock prices!”

“The yield curve is flattening, and it’s got a perfect record at predicting recessions!”

I’ve heard them all.

Unfortunately for both, they’ve both missed out on historic gains that could’ve quadrupled the size of their retirement account.

But today, I’m making a point to explain why this bull market still has legs. To do so, I want to talk about three of the most important factors when determining a market’s direction, and explain why all three point to profitable times ahead…

Three Pillars Of A Bull Market

Let me introduce you to the three pillars of a bull market. These are three fundamental factors that have historically been useful in predicting the future of the stock market. The three pillars are profits, interest rates, and the dollar.

Let’s break them down…

Pillar #1: Profits — We’ve hammered this point home countless times here at The Daily Edge. Over the long-term, profits are the most important factor in determining stock prices.

Higher profits lead to higher stock prices.

And this earnings season has certainly validated today’s higher stock prices.

Of the S&P 500 companies that reported earnings over the last several weeks, 66% of them reported a positive EPS surprise and 67% reported a positive sales surprise.

In addition, many firms are actually UPPING their full-year guidance going forward. This is incredible for an economic expansion heading into its tenth year!

Pillar #2: Interest Rates — Rising interest rates are what caused the initial volatility shock back in early February.

Higher than expected wage growth in the January jobs report scared investors into hedging against the Fed possibly raising interest rates faster than originally anticipated.

But there’s just one problem…

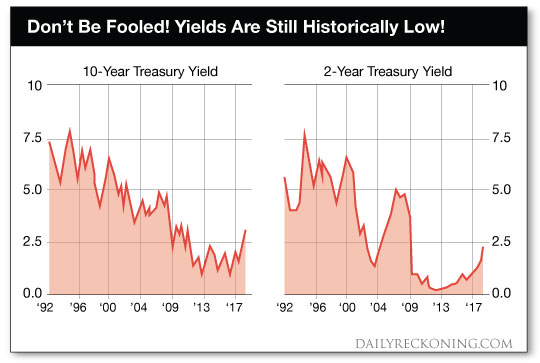

Interest rates are still hovering around historic lows!

Do you really think businesses are going to slow investment because interest rates rose to half of their pre-crisis level? And do you really think investors are now going to sell stocks in favor of a measly 3% return for ten years?

The interest rate argument seems overblown to me.

Pillar #3: The Dollar — Unfortunately, a rising dollar has been collateral damage in the trade war with China, Europe and now Turkey.

With the U.S. being the strongest economic power embroiled in the trade war, many investors see it as a safe haven of sorts, which has boosted the Dollar Index to a one year high.

This is bearish for U.S. businesses as U.S. goods are now more expensive to foreign buyers.

But as my fellow Daily Edge contributor Alan Knuckman has previously explained, neither the stock market, the gold market, nor the VIX seem to be buying the trade war worries. Which for him points to the dollar quickly resuming its slide once the conflict inevitably ends.

“When the trade war fighting stops, the dollar — which had been in a solid downtrend before the trade talks — will resume its dive.”

That makes all three pillars point to a continuation of the bull market.

So, whether you’re a permabear just waiting to be right or a retiree waiting for a downturn, just know that it’s not too late to make money in this market.

Here’s to a stable retirement,

Patrick Stout

Managing Editor, The Daily Edge

EdgeFeedback@AgoraFinancial.com

The post 315% Gains And Counting (Could be 400% By EoY) appeared first on Daily Reckoning.

From:: Daily Reckoning