Shareholders in dual-listed Canadian miner Dalradian Resources (TSX:DNA) (LON:DALR) have been advised to support New York-based private equity group Orion Mine Finance’s acquisition of the company when they vote on the matter next week.

Proxy advisory firms Institutional Shareholder Services and Glass, Lewis & Co have both recommended the approval of the deal, proposed two months ago, and which values Dalradian at Cdn$537 million (roughly $230 million)

The offer is priced at a 62% premium to the explorer’s share price at close on June 20, a day before it was announced, and is likely to go through as it has already secured support from various shareholders with over 30% of its voting rights.

Dalradian has the mineral rights for more than 80,000 hectares of land in Northern Ireland, which includes one of the world’s top ten undeveloped gold deposits by grade.

The board of Dalradian, which is developing a large untapped gold deposit in a remote part of Northern Ireland, has not only recommended the deal and gathered support to push it through before informing investors, but has also said it plans to keep it stakes in the business.

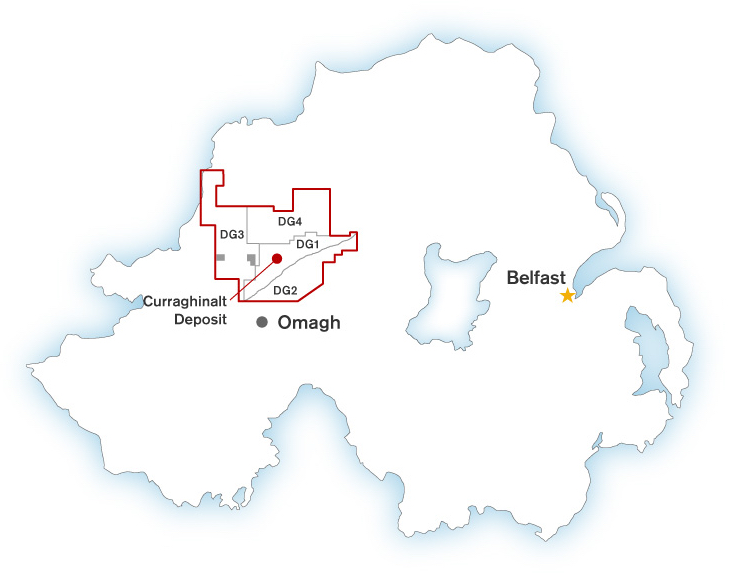

Dalradian acquired mineral rights in 2009 to more than 80,000 hectares of land in Northern Ireland, including the Curraghinalt deposit outside Gortin, identified as one of the top ten undeveloped gold deposits by grade in the world.

Since then, it has carried out exploratory drilling at the asset and compiled a planning application running to 10,000 pages, which it expects to take about two years to process, including a public enquiry.

In May, the company said it planned to operate the proposed gold mine for an initial 20 years, though it noted that Curraghinalt had the potential to remain in production longer than that.

The project, for which Dalradian has yet to secure the permits needed to build it, is estimated to hold 3.1 million ounces of gold reserves — worth about $3.7 billion at today’s prices.

Previous efforts to take Curraghinalt into production have failed, in part because of difficulties getting an explosives licence during the so-called Troubles in the 1980s. Currently, the project faces some opposition from those against the company’s planned use cyanide to extract gold at the site.

If it gets the green-light, Dalradian has said Curraghinalt could transform one of the poorest regions in the UK, boosting investment and creating jobs. The company already employs 100 people on the project and the number would rise to 350 workers once the mine is operating, plus hundreds more indirect jobs.

Northern Ireland has the seventh richest undeveloped seam of gold in the world, but political violence kept most investors away for about three decades.

Project location. (Courtesy of Dalradian Resources.)

The post Dalradian shareholders advised to back Orion Mine’s $230m takeover bid appeared first on MINING.com.

From:: Mining.com