By Zach Scheidt

This post 7.5% of Paychecks Go To This… And It’s Making Our Economy Tick appeared first on Daily Reckoning.

As a kid, Sunday mornings were the best…

My dad would come into the bedroom I shared with my little brother and wake us up for church. As we rolled out of bed, he would place three shiny quarters on the dresser for each of us… Our allowance for the week.

Each quarter had a specific purpose.

One quarter was for spending… I could use this quarter for whatever I wanted that week.

One quarter was for giving… I would take that quarter and put it in the offering plate at church.

And one quarter was for saving… This quarter went into my piggy bank for a big purchase I would save up for each year. One year, I added up all of my savings to buy a remote-control airplane!

I’m thankful my parents taught me to save at a very young age. Because too many of my friends never learned that lesson.

But today, it looks like Americans are finally starting to figure it out. And that’s GREAT news for the market, for our economy, and for your investments.

The U.S. Savings Rate Gives Us a Safety Net

You’ve heard the term “save for a rainy day.”

If you’ve been around the block a few times, you know that unexpected expenses can hit you out of the blue. A car repair, a busted water pipe, or a trip to the emergency room.

People who are living “paycheck to paycheck” can be totally derailed by one or two of these events.

But if you have some money set aside in savings — hopefully invested in some good dividend stocks or other income opportunities — these expenses won’t hurt you. You’ll have quick access to the cash you need to pay for those little surprises.

Did you know that savings can also help our overall economy?

It’s true!

When an entire country is purposeful about saving some of their money for a rainy day, it naturally makes things more stable for the overall economy. And that’s exactly what is happening right now.

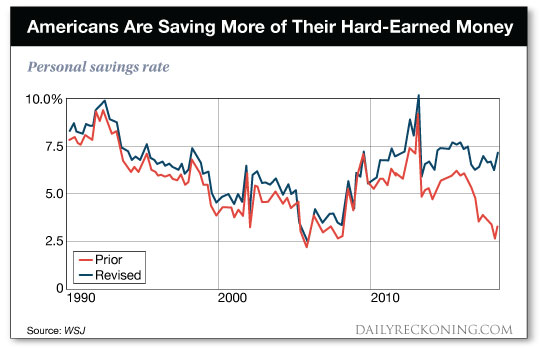

A few weeks ago, the U.S. Commerce Department released a report that showed Americans are saving much more of their income. In fact, nearly 7.5% of the average paycheck is being socked away in savings.

That 7.5% is a big number… Especially when you note that it’s nearly three times the previous estimate.

When Americans save, it helps to protect our economy from a recession.

In the past two weak economic periods (the dot-com bubble and the financial crisis), savings rates were extremely low. And that meant when the economy stumbled and consumers were afraid, they stopped spending money. After all, they couldn’t afford even a short time of unemployment if they were laid off.

But this time around — thanks to extra savings in American’s accounts — a pullback won’t cause the same sort of panic. If a few workers get laid off, they can use savings to continue to cover life expenses while looking for work.

And since spending won’t drop suddenly, the entire economy should be supported by the safety net of savings.

It’s definitely a healthy spot for our economy to be in.

Savings Is a Big Part of The Market’s Acceleration

Another thing to keep in mind is that these “saved” dollars are finding their way into the stock market.

A large portion of the capital saved by Americans is being placed into retirement accounts or traditional brokerage accounts. And this money is being used to buy shares of stock.

Of course, the buying pressure from savings, along with more than a trillion in cash that private equity firms have access to, is helping to prop up the stock market. And the strength in corporate earnings only adds to that dynamic.

As the market breaks to new highs, I expect more of this cash to come flooding into stocks, helping to accelerate this bull market and send stock prices higher. We’ve been talking about this dynamic for some time now and I hope you’ve already put your cash to work ahead of the market’s breakout.

If not, you’re running out of time!

Make sure you are setting your own capital aside to keep your savings rate growing… And invest that cash in the stocks that we’ve been covering here at The Daily Edge.

It’s a great time to be an American, a great time to be a saver, and a great time to be building profits in the best investment opportunities.

Here’s to growing and protecting your wealth!

Zach Scheidt

Editor, The Daily Edge

Twitter ❘ Facebook ❘ Email

The post 7.5% of Paychecks Go To This… And It’s Making Our Economy Tick appeared first on Daily Reckoning.

From:: Daily Reckoning