Source: Thibaut Lepouttre for Streetwise Reports 07/23/2018

Asserting this is “about as good as it gets,” Thibaut Lepouttre of Caesars Report describes the prospects following the release of assay results from this company.

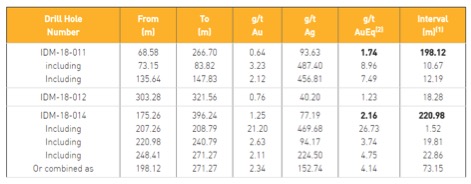

Last month, Integra Resources Corp. (ITR:TSX.V; IRRZF:OTCQB) reported on the assay results of three RC holes that were drilled on the DeLamar gold-silver property in Idaho. The results were absolutely excellent, as the drill bit intersected long, thick and relatively consistent intervals of gold and silver in an area that was barely explored. Kinross Gold Corp. (K:TSX; KGC:NYSE), the previous owner and operator of the project, didn’t drill deep enough, as the few holes it drilled at Sullivan Gulch didn’t go much deeper than 100 meters. That wasn’t sufficient to encounter the mineralization, and the Sullivan Gulch area represents the low-hanging fruit for a resource expansion.

Of the intercepts, 64% and 59% were encountered outside of the mineralized resource envelope (which contains the current 2.67 million-ounce [Moz] gold equivalent [AuEq] resource estimate). That’s great for resource expansion purposes, but there’s another important and interesting takeaway from this ratio.

It does seem to indicate the average grade of the current resource at DeLamar (118 Mt at 0.7 g/t AuEq) might have been underestimated; it would be a huge coincidence if most of the holes drilled at DeLamar would encounter abnormal grades of in excess of 1 g/t AuEq. Sure, this is just speculation on our part for now, but keep in mind the assay results of the first few holes that have been released also contained quite a bit of rock grading in excess of 1 g/t AuEq.

We also noticed the gold equivalent calculations were using a very conservative 85:1 silver/gold ratio. That’s interesting, as it once again emphasizes the conservative nature of Integra’s reporting. Applying a more common 75:1 ratio (which is the silver/gold ratio used by most peers calculating a gold-equivalent resource, with the silver credit converted into gold) would increase the gold-equivalent grades to 2.28 g/t AuEq over 221 meters and 1.89 g/t AuEq over 198 meters. “Pretty good” would be an understatement, given excellent (historical) metallurgical recoveries.

Using a higher silver/gold ratio could indicate ITR might be underreporting its gold-equivalent grades compared to other gold-silver exploration companies.

But let’s take a second to explain the importance of the metallurgical test work. Historical records show a recovery rate of 92% of the gold and 75% of the silver in a mill circuit, while the historical recovery estimates for the heap-leach scenario averaged 84% gold and 64% silver. As Kinross never optimized its heap-leach plans, we would expect some fine-tuning to increase the recovery rates to in excess of 85% for the gold and to about 65-70% for the silver. But to err on the cautious side, let’s assume recovery rates of 80% for gold and 60% for silver.

There’s an important detail to mention here. It’s not unlikely the transitional and sulfide ore could also be heap leached. The common misperception is that heap leach only works on oxides, but that’s not true. In DeLamar’s case, Kinross noted a very consistent metallurgical performance, whether it was milling oxide, transitional or sulfide rock. The amount of data for a heap-leach scenario is more limited, so Integra Gold will be focusing on optimizing the heap-leach potential of the project.

It will be interesting to see the recovery rate of the sulfide mineralization at DeLamar. It definitely is possible to see an elevated recovery rate. For instance, Minera Alamos Inc. (MAI:TSX.V: MAIFF:OTCQB) is leaching sulfide mineralization in Mexico at an acceptable recovery rate. Should Integra’s metallurgical test work (results are expected in Q4) confirm the transitional and sulfide material could be successfully leached (a recovery rate of 65-70% for sulfides would be great), then that’s a game-changer for the project.

Integra Resources is doing everything right. Its exploration program is stepping out and adding more tonnes to the total size of the mineralized envelope (which could push the next resource update to 5 million ounces gold-equivalent), while the higher grade nature of the mineralization could make this project even more profitable than we originally assumed.

We are looking forward to the next batch of drill results, as well as the metallurgical test results, by the end of this year. If the met work confirms our suspicions, Integra Resources could very well be sitting on one of the most exciting advanced-stage exploration projects in the USA. A 5 million-ounce heap-leachable project on a past-producing mine site is probably as good as it gets.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

[NLINSERT]

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: a long position in Integra and Minera Alamos; no position in Kinross. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with Integra Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any …read more

From:: The Gold Report