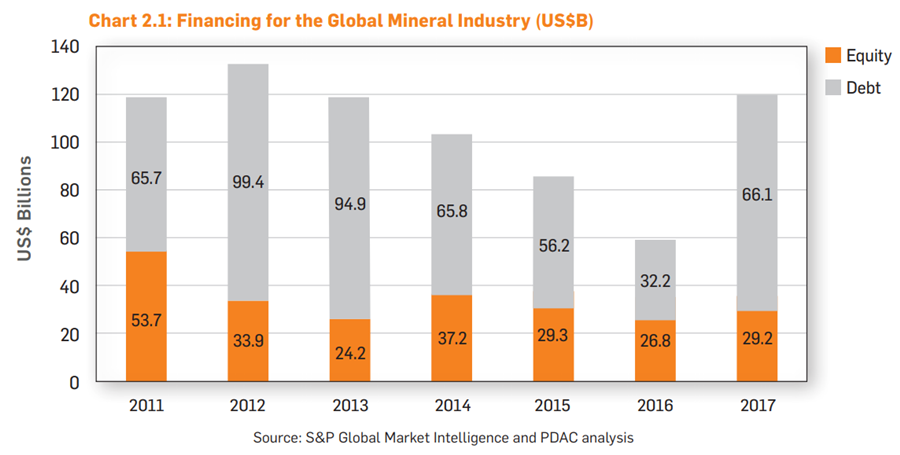

Debt financing doubled between 2016 and 2017, writes the PDAC in its mineral financing report released last month.

While the amount of financing recovered from mid-decade lows due to a cyclical upswing in global economic activity, the composition of financing changed.

“Equity financing, which accounts for on average roughly 35% of the funds raised globally, declined the most in 2013 but has subsequently improved modestly and essentially flattened out over the last three years,” writes the report’s authors.

“Debt financing declined sharply in 2016 only to increase significantly in 2017, doubling its value compared to 2016. It is important to note that debt financing is not a typical fundraising option for non-revenue generating companies such as mineral exploration companies.”

The authors don’t speculate on the cause for the shift but note the change is consequential.

“Given that debt is not a typical financing vehicle for non-revenue generating exploration companies, debt expansion may suggest that a shift in market dynamics for the mineral industry is underway.”

Creative Commons image of Toronto courtesy of shankar s.

The post Debt financing doubles appeared first on MINING.com.

From:: Mining.com