The Gold Report: You recently observed in your newsletter that gold has been acting more like a commodity, like pork bellies, than like a currency. That misclassification has discounted the value of precious metals, depressing the price. Why do you think that is?

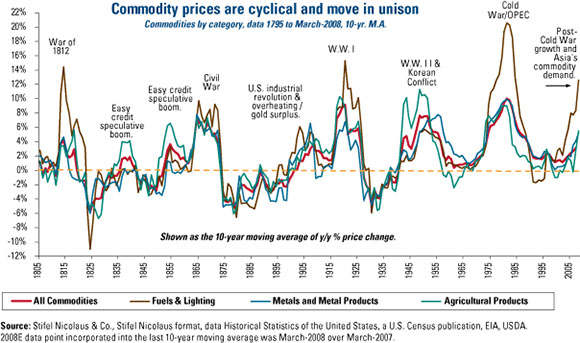

Louis James: Commodities, as a group, tend to move together. We see it with copper and other industrial metals, and we see it in other commodities, including pork bellies. The commodities index is not just an average line. It actually is fairly representative of the sector as a whole. That matters right now because the trend for commodities is downward, plus the fundamentals are. . .scary. China’s slowdown is accelerating, for example. If gold were just another commodity used to make jewelry or fillings, it would be logical to lump it in with iron ore—and therefore be bearish. But it plays another role that is much more valuable. It is the currency of choice in an uncertain world.

The good news is that the perception seems to be changing. When China’s stock market tanked and the rest of the world hemorrhaged a month ago, gold prices jumped. Gold acted as a safe haven asset; it acted like money. It was where people went when they were scared. That was an important validation. That doesn’t mean everything is hunky dory now. But it is a reminder that with sufficient provocation, gold still does its job.

TGR: What are some of the things that cause the fear-o-meter to jump? Is it the Federal Reserve? Is it ISIS? Is it Russia? You mentioned the Chinese stock market. I know a lot of people think a presidential election is a scary thing. Are we going into a season of fear?

LJ: Financial fear trumps political fear when it comes to impacting precious metal prices. The China stock market crash was indicative of what we can expect in the future. Wall Street doesn’t really pay attention to what’s going on in Eastern Ukraine and President Putin’s macho posturing. Those sorts of events are important, and they certainly have financial consequences, but the markets react more to immediate stimuli. They tend to be pretty shortsighted about what is going to affect the bottom line this quarter.

TGR: The market seems hyper-focused on every twitch from the Federal Reserve and what it plans to do about interest rates. Brien Lundin recently said an interest rate increase is already priced in, and the actual event could be a good thing for gold because people can put that behind them. Do you agree with that?

LJ: The Fed may raise rates by some nominal amount, just so it has the option to lower them again later. Brien’s right that that’s largely been priced in, but the reality often comes as a shock to those who don’t believe it. Even a nominal change can have dramatic results. There are so many fragile points around the global economy today. Any jolt can cause follow-on crashes, collapses—all the volatility we have come to know and love since 2008.

I understand why some investors are largely in cash right now. I can’t blame them. But people going long things that do well in a crisis—like gold—are playing it smart. They should not panic: hold on. People who want to make new speculations need to be sure they know which way the Fed will go to go to place a bet. My general advice is to wait and see what happens. If you are absolutely convinced you know what the Fed is going to do, there might be some interesting options you can try, but don’t kid yourself about the nature of your gamble. For most investors, that’s just not wise.

TGR: If, as Rick Rule has said, we are getting close to capitulation and the metals prices will soon start to turn up again, what companies will benefit first—the majors, the junior producers, the explorers?

LJ: The majors are always the first line, the go-to money, when gold starts to shine. They are also, however, the least responsive. It takes a lot more to move a company with a $10 billion market cap 10% than one valued at $10 million, let alone double. But a highly prospective junior that has a rich discovery can easily move by that much just because of a turn in sentiment.

TGR: Is that true with both the explorers and the smaller producers?

LJ: The junior producers will benefit first along with the development stories. These are the people who have already made a discovery and are advancing toward production, or they’ve already gone into production and margins are high enough to endure the downturn. Those are the companies that will be best positioned when the market turns, the first magnets for new money coming back into the market.

“Gold is the currency of choice in an uncertain world.”

That said, if you really want to buy low and sell high, the maximum leverage you can get is if you invest before a discovery is made. To do that, you have to follow the competent prospect generators who have, can and will come up with the next discoveries. Those stocks will not be the first to respond to a market rebound, but for people who want absolute maximum gain, they offer the highest leverage with the best risk mitigation possible.

TGR: Is there a prospect generator that would be a good example of this strategy?

LJ: Renaissance Gold Inc. (REN:TSX) is Ron Parratt’s team. He’s been a multiple winner for us in the past. The company spun out of AuEx Ventures Inc. and has projects in Nevada and Utah.

I also like Almaden Minerals Ltd.’s (AMM:TSX; AAU:NYSE) spinout, Almadex Minerals Inc. (AMX:TSX.V). The original company has made a big discovery and now the same team is tasked with exploration on some 20 projects in Mexico, Nevada and Southern British Columbia.

Both of these teams are very strong. Both are stories that the market is yawning at right now, but if you believe in backing the jockey and not just the horse, these people deserve your attention.

TGR: What are some of the small producers with growth potential that fit that description?

LJ: One of my favorites is Klondex Mines Ltd. (KDX:TSX; KLNDF:OTCBB). It’s a high-grade gold story in Nevada. Klondex has actually been one of our best performers in the portfolio over the last year. It’s been up even while gold was down, because it is mining up to half an ounce per tonne. It is making money hand over fist, even at current prices. Obviously, that attracts a lot of attention.

TGR: Klondex recently announced that it discovered some new veins at the Fire Creek project, and it’s going to be doing a resource update. What are you looking for in that update?

LJ: I think it will get bigger, and I think it will get better. But the most important thing is that this is not just surface drilling on some prospect that may or may not be mineable at some point. This is underground exploration. These new discoveries are near existing underground development so they could be put into production quickly and easily. This is a company that already has a profitable, fully permitted plant in operation within trucking distance of these discoveries. That’s one reason why I think this story has done so well despite how poorly the market has done. You can see how close these high-grade discoveries are to hitting the bottom line.

TGR: Are there other companies with similar upside?

LJ: A similar story is Kirkland Lake Gold Inc. (KGI:TSX). It’s actually not so similar if you get into the technical details of the deposit, but it is a high-grade vein story. This one is in Ontario, Canada, another nice, mine-friendly jurisdiction. It is deep, and it’s more expensive mining than Klondex, but the company has many things going for it. Management has been retooled, and is cutting costs. Mining underground is going into increasingly higher-grade stopes. The company has growth already in its existing reserves, as well as lots of exploration potential. The great thing is that the mine plan works at current prices. Even if gold prices go down, Kirkland is mining into higher-grade ore, so the company could continue to do well—and it should do phenomenally well at higher gold prices.

TGR: Are there more companies with that kind of potential?

LJ: Two more are up-and-coming producers. One would be Guyana Goldfields Inc. (GUY:TSX) and the other is Rubicon Minerals Corp. (RBY:NYSE.MKT; RMX:TSX), which is in Red Lake. Both have just built world-class mines based on high-grade deposits. Rubicon’s is underground. Guyana Goldfields has an open-pit operation in Guyana. Both have poured their first gold.

“Financial fear trumps political fear when it comes to impacting precious metal prices.”

Guyana Goldfields has been doing better on the stock market. In fact, it’s gone up more than 300% since its low last year, a move that is common as a development story transitions into production. The market likes it when a company succeeds. Hats off to management and the whole team. I have high expectations. If it keeps going, I could easily see another double on that stock, even without higher gold prices. My only concern is political uncertainty. There have been troubles with the local government, nothing mining related, just internal political fighting. There’s also been some trouble with the psychotic regime in Venezuela, over the border. Anyone considering a company in Guyana needs to understand the political risk, but the project is doing great.

The next catalyst will be reporting how much money is going to the bottom line. It should be announced after the next quarter at the latest. If I were new to the story and the political situation remained calm, I would want to own that stock before it reports its first net income.

TGR: What is the story on Rubicon’s stock price?

LJ: Rubicon has reported some unexpected developments underground, which it is currently negotiating. The company has been taken out behind the woodshed and thoroughly thrashed over this. The share price is back where it was before it even started building its plant, and the plant is actually working better than expectations.

Of all the difficulties mining companies routinely face when they start up, problems with the plant are the most potentially fatal. It is really a very complicated chemistry set. You’re shoveling a bunch of dirt through it and if it doesn’t work right, it may never make money. Underground, if things are not quite as you expect, as long as they aren’t too bad, you can adapt your mine plan and usually get to where you were going. In fact, this happens to the biggest players in the field. Goldcorp Inc. (G:TSX; GG:NYSE) just announced that it has to revise its mine plan at Éléonore, one of the highest-profile, new underground gold mines in Canada. That’s a spare-no-expense, five-star mine, and it is still adjusting to the realities once it is in operation. Until we hear that Rubicon encountered a seriously fatal problem, I think it’s oversold and a real opportunity.

TGR: When gold prices increase, do you see silver prices following or leading?

LJ: They always vary together. They can, as you know, vary by larger or lesser amounts. Right now, it’s a relatively large amount. It’s not quite a record amount, but it is close. It’s about an 80:1 ratio last I looked. That’s pretty far from the recent norm of 50 to 60:1. That means it might move more quickly. If you push that elasticity, a rubber band wants to snap back.

TGR: That’s what Eric Sprott has told us.

LJ: He’s right, but never forget that silver, in addition to being a precious metal, is an industrial commodity. It is produced as a byproduct more than by pure silver mines. Actually, there are really no pure silver mines. Even silver primary mines are largely zinc or lead mines that have a lot of silver in them. The point is that silver production is largely determined by demand for other metals. Several mega-copper projects coming on line soon in places like Peru have very strong silver credits. So we could see supply exceeding demand on the industrial side and affecting the price, regardless of what gold does. Or it could go the other way, if Glencore International Plc (GLEN:LSE) and a lot of other companies do scale back operations. It is unpredictable short term. Long term, it has to come back.

TGR: Are there some silver companies you like?

LJ: My favorite right now in silver production is Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE). Fortuna’s main focus currently is the San Jose project in Mexico, where the credit is not lead or zinc, but gold. I like gold as a credit in my silver mine. Fortuna recently drilled off a new zone that’s even higher grade than what it’s mining now. Fortuna also has a cash cow called Caylloma in Peru that’s been mined on and off over 400 years. There’s some stability there, and there’s exploration potential in both camps. What I like most is this company is actually profitable at current prices, or lower.

TGR: You are going to be sharing more ideas at the Casey Research Summit in Arizona in October. What can attendees expect to take away from that conference?

LJ: This will be the first year we are putting on the conference as part of Stansberry & Associates family, so you know it will be a first-class experience for attendees. That means the speakers and the amenities will be top notch.

It’s also going to be the only opportunity I will have to answer questions directly from readers for the rest of this year. That’s because, for legal reasons, I am no longer able to correspond directly with them. But I can answer questions from the podium, so attendees will hear it all first-hand. This is also the one time a year investors can shake hands with Doug Casey, talk to him, ask him questions. He’s very easygoing and less restrained than I am.

This conference will cover a wide range of sectors, from metals, to energy, to technology, to water. On that last one, with El Niño gaining strength and all the environmental hype about water scarcity, this is a topical story. But there’s a lot of money to be made in all these sectors.

TGR: Thanks for your insights.

Louis James, Casey Research managing editor of the International Speculator, is fluent in English, Spanish and French. He has a background in physics, economics and technical writing, and travels the world, evaluating highly prospective geological targets and visiting explorers and producers at the far corners of the globe, getting to know their management teams.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Guyana Goldfields Inc. and Klondex Mines Ltd. Goldcorp Inc. is not affiliated with Streetwise Reports. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Louis James: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

( Companies Mentioned: AMX:TSX.V,

FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE,

GUY:TSX,

KGI:TSX,

KDX:TSX; KLNDF:OTCBB,

REN:TSX,

RBY:NYSE.MKT; RMX:TSX,

)