By Brian Maher

This post An Omen of Approaching Inflation appeared first on Daily Reckoning.

Disinflation has Janet Yellen by the snout.

Core inflation fell from 1.9% in January… to 1.6% by April… to 1.3% by August, the most recent reading.

Many expect September’s numbers to deepen the grip… and October’s too.

But today we bear information that may deliver the Federal Reserve chair from her sufferings…

Our agents report hearing whispered, unconfirmed rumors of a bubbling inflation.

Details to follow…

Following the 2008 financial crisis, the Fed ran the printing presses 24 hours of the 24, seven days of the seven.

Asset inflation — but not consumer price inflation — was the result.

Jim Rickards has explained the absence of price inflation many a time…

It’s not enough that the Fed prints money. That money must enter the economy through the banking system.

But the banks have been afraid to lend… and debt-soaked consumers have been afraid to borrow.

Hence, little inflation.

Jim:

The Fed has been printing money, but few loaned it or spent it. The banks haven’t wanted to make loans, and consumers haven’t wanted to borrow…

Money supply does not cause inflation. It may add fuel to a fire, but it’s not the spark. The Fed has created $3.5 trillion of new money since 2008 and there’s no inflation in sight. What causes inflation is not money supply but psychology expressed as velocity. Velocity is the speed at which money turns over through lending and spending.

We noted the lack of consumer inflation above with this year’s personal consumption expenditure index (PCE), for example.

But there is one inflation tracker with a handsome long-term batting average…

And its most recent reading suggests that inflation, long dormant, could finally be finding its legs…

We speak of a creature called the Manufacturing Purchasing Managers’ Index (PMI) report.

It tracks the raw materials purchases, production, inventories, orders, prices and employment data of over 400 industrial concerns.

It tracks the basic ingredients that constitute the national economic pie.

And September’s PMI numbers indicated manufacturing increased at its fastest pace in 13 years, defying all expectations.

In all, 17 of 18 tracked industries expanded.

But it’s what the PMI’s rising numbers have to say about inflation that counts today…

Analyst Matt Simpson, via FXStreet:

This highlights the higher prices manufacturers are paying for raw materials, which suggests inflationary pressures are building at the lower end of the value chain.

Renaissance Research, an independent market analyst, says the PMI is “traditionally viewed as a good indicator of business sentiment regarding future inflation.”

If the PMI numbers rise, inflation tends to follow.

Renaissance:

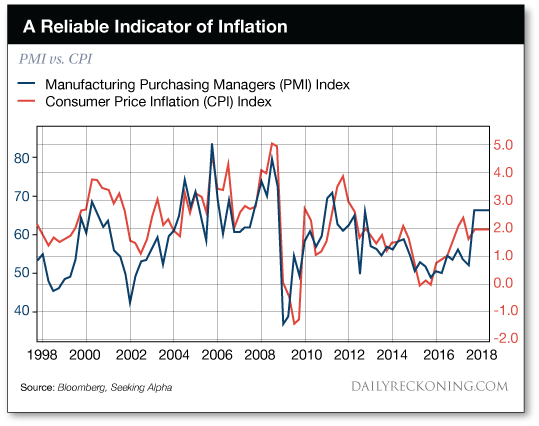

Over the past 20 years, there has been a very strong positive correlation between the [PMI] and the Consumer Price Inflation (CPI) Index. Notably, the ISM Prices Paid Index has been a reliable leading indicator of the CPI data so far.

Here, in graphic form, the overall match between PMI and CPI:

We hazard that Janet Yellen would envy this PMI’s forecasting power.

It certainly excels her own… as do tarot cards, tea leaves and balls of crystal.

Meantime, September CPI numbers came out this morning.

They recorded the …read more

Source:: Daily Reckoning feed

The post An Omen of Approaching Inflation appeared first on Junior Mining Analyst.