By Cory

Personal Recollections of the Crash of 1987

Our friend Dana Lyons is running a special on his Lyons Share website. Please check it out and consider supporting a friend of the site.

I hope everyone has a great weekend!

…

The following guest post is a first-hand account of the events surrounding the Crash of 1987 by JLFMI President, John S. Lyons.

Personal Recollections of the Crash of 1987 on its 30th Anniversary

“There was no ‘smart money’ that day.”

What do the assassination of President John F Kennedy, the beginning of Desert Storm and 9/11 have in common? Provided you are old enough to recall JFK’s assassination, the answer probably is that you remember exactly where you were on the day of those events. If not that old, there is most likely another event that is so memorable that you recall where you were and what you were doing at that moment.

Being in the securities business for many, many years, the Crash of ’87 on October 19th of that year is right up there with JFK’s assassination and 9/11 as one of the mind-numbing catastrophes I’ve witnessed. In retrospect only, it was fortunate that I had entered the brokerage business in 1969 and immediately weathered a 36% market decline into 1970. On the heels of that decline, I then endured one of the worst bear markets in modern history in 1973-74 when the Dow Jones Industrial Average lost almost 50% of its value. As a result, I was weaned on risk in my new profession. And I learned early on that if a career that centered around the stock market were to be endurable, I had to find a way to practice risk management.

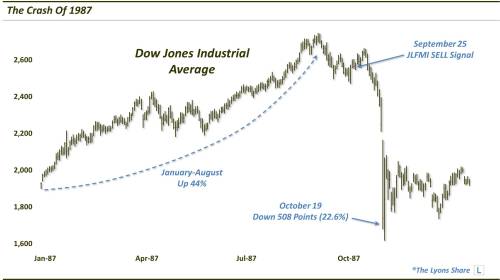

As a result, I developed a risk model during the 1970’s as a means of guarding against such disastrous losses in the future. Fortunately, the model has been of very valuable assistance, protecting clients from every major decline since its inception in 1978. Its Sell Signals have occurred prior to insignificant declines as well, but its risk avoidance guidance supersedes those times. On September 25th of 1987, for example, our model issued a Sell Signal and I sold over half of my clients’ holdings. I was reminded just recently by an associate of mine at that time about how he passed by my office that day and was amazed at the pile of sell orders on my desk.

The Friday prior to the October 19th crash ended with the first triple digit decline in the history of the Dow Jones Industrial Average. In total, the market lost just over 10% that week. The apprehension of professionals in the business was palpable to say the least as we entered the weekend and yet there was no seemingly immediate cause for a significant decline. I have learned that such unexplained declines are the most insidious. On Saturday night, at dinner with friends at a restaurant in Chicago, I could not eat my food!

On Monday morning, the market opened and headed south immediately. There were no buyers …read more

Source:: The Korelin Economics Report

The post Dana Lyons Commentary – Fri 13 Oct, 2017 appeared first on Junior Mining Analyst.