Source: John Newell for Streetwise Reports 09/05/2018

Portfolio manager and technical analyst John Newell of Fieldhouse Capital Management profiles a company exploring for gold in Ontario’s Red Lake District that has seen its share price more than triple this summer through the drill bit.

Combining Fundamental and Technical Analysis

The two disciplines of fundamental and technical analysis are often set against each other and investors may think that they must make a choice.

This doesn’t need to be the case and there is a middle ground. You can consider combining the two approaches as part of your overall investment plan. This is what I do. I look for certain chart patterns and try to research the fundamental reasons behind why the chart patterns look either bullish or bearish. Chart patterns have changed since the days of Robert Edwards and John Mcgee’s classic “Technical Analysis of Stock Trends,” although still very relevant, when they recognized recurring patterns that occurred from the stock operator pools of the day. Today, we must deal with computer algorithms and high-speed communications that have made the stock markets much faster than in the past, so new and different patterns have emerged, and that is what I focus on today in my work.

Fundamental analysis attempts to determine the value of a share by analyzing a company’s financials from its annual report and using qualitative data about the environment in which it operates. This value is often called intrinsic value. The simplest form of fundamental analysis is by using fundamental ratios such as the P/E ratios, Price to Sales ratios, or the dividend yield. However, in the case of junior explorers like Great Bear Resources Ltd. (GBR:TSX.V) and other junior mining shares, we simply don’t have that luxury; the nature of these companies is that they are cash burning machines and don’t have much in the way of fundamentals.

However, there is help. Many people write about the sector, and one of many I like is “J. Taylor’s Gold, Energy and Tech Stocks Newsletter,” and his radio show. Jay does a great job of looking at the fundamentals behind the junior mining companies: property assessment, drilling results and all-important management interviews; he also highlighted Great Bear Resources (GBR.V) in his letter starting in January of this year. Jay also highlights the famous “Momentum Structural Analysis” of Michael Oliver every week, so he doesn’t ignore technical analysis either. If you are super keen, you can find the genetic DNA on just about any junior miner at John Kaiser’s Kaiser Research Online site.

Technical analysis offers a different view of a stock. It is based on the belief that the combined minds of the world are making decisions about a company on a moment-by-moment basis, and all that is known about a stock is reflected in its price and volume. The market is made up of a very large number of people who may have very different views on the market, making both long- and short-term decisions on both long and short positions. The activity of these very large numbers of investors and traders results in different patterns emerging in the market. (An example could be as simple as a cook is told to cook extra meals for more guests, a helicopter pilot is booked to bring in banking analysts and investors, drillers see the core they are drilling, and on and on. We can imagine that all these minds are at work assessing a company.) Technical analysts attempt to recognize these patterns and take advantage of them when making their investment decisions.

In the Shadow of Giants: Red Lake, Ontario, Canada

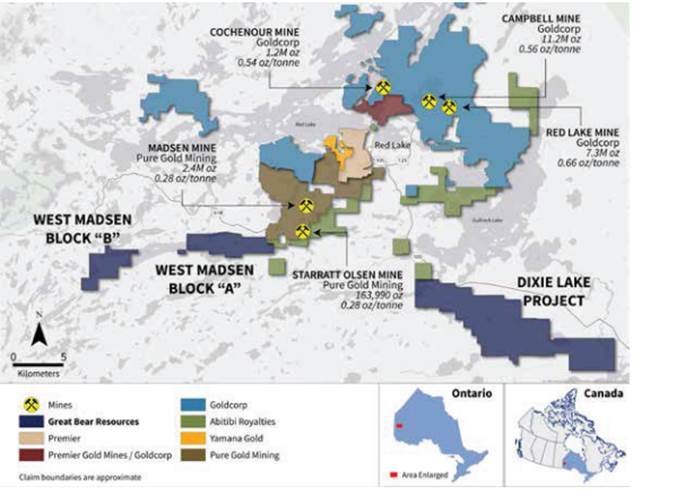

When looking for a mining company in today’s markets, in a world where majors must build up their ever-declining reserves, we start by looking for projects with district-size potential or large land packages put together by great management teams and geologists. Great Bear Resources is one of those companies. Great Bear Resources is exploring in the famous Red Lake Mining District in Ontario, a mining district in northern Ontario, Canada, where about 30 million gold ounces have been recovered from the time it was first discovered in the mid-1930s by approximately 15 companies. Great Bear Resources’ properties sit about 30 km from the famous Red Lake mine owned by Goldcorp, in keeping with the old mining adage, “the best place to find gold is next to where it already has been found.” It’s a strategy that has already been paying off for Great Bear Resources with high-grade drill results within an expanding mineralized gold system. The Red Lake area has always proven to be geologically very fertile for important gold discoveries, and mines that have a gift of keep on giving, the deeper you go.

About Great Bear Resources (GBR.V)

Great Bear Resources is a Canadian precious metals exploration company engaged in advancing projects with special merit in leading mining regions, currently working the famous Red Lake District in northwestern Ontario. Great Bear Resources is earning a 100% royalty-free interest in the Dixie and Madsen properties, which consist of a total of 10,000 hectares in the Red Lake District. All Great Bear’s Red Lake projects are accessible year-round through existing roads. The company is led by Mr. Chris Taylor and a team of experienced and proven mine finders in many mining districts, but they have also been very successful in the Red Lake mining camp. See information about the team here.

Shares Issued and Outstanding: 23,176,169

Stock Options: 1,936,000 various prices between $0.23 and $2.50 (weighted average $0.33) expiring between July 17, 2017 and October 5, 2021

Warrants: 10,437,217 between $0.20 and $0.70

Fully Diluted: 35,549,386

It is believed that management, family and friends own about 30% of the outstanding shares and warrants.

Special Note: On August 24, 2018, Great Bear issued ~7 million new shares and warrants that increase the share and warrant count written above. Further, the company announced …read more

From:: The Gold Report