By Jody Chudley

This post Shanghai’s Crippling Health Crisis… And How Xi Plans To Stop It appeared first on Daily Reckoning.

For years, China has been struggling with a terrible air pollution problem. The country has seven of the ten most polluted cities on the planet.

The reason for the problem is the country’s heavy reliance coal as an energy source. I’m sure you have seen pictures like the one below that shows people literally choking on the air.

But for Chinese residents, the summer of 2018 has offered a breath of fresh air — actually several months of fresh air.

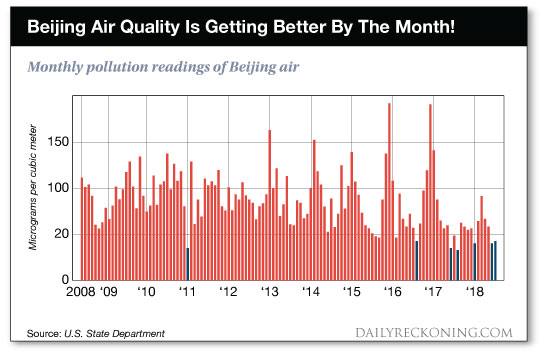

This summer, China’s residents have been able to breathe the cleanest air that they have experienced in a decade. Since 2008, five of the seven lowest readings of monthly pollution in Beijing have been recorded in just the last few months.1

China’s air pollution problem has started to improve thanks to the aggressive anti-smog plan President Xi Jinping had the country embark on. The core of that plan involves moving China’s energy production away from coal and towards natural gas.

When used for power generation, natural gas is by far the cleanest hydrocarbon. Natural gas emits as 50% less carbon dioxide than coal while generating virtually no sulfur dioxide, nitrogen oxides, mercury or particulates, all of which are undesirable side effects from burning coal.

For China — and the many other developing world nations following their lead — natural gas is the no-brainer option in the future. And it will have huge implications on the amount demanded going forward.

Projected Growth In Natural Gas Demand — The Numbers Are Staggering

The natural gas demand story all starts with China, but it most certainly doesn’t end there.

Last October, the Energy Information Administration (EIA) provided its latest long-term outlook for the global natural gas market. In it, the EIA projects that global natural gas demand is going to grow from 340 billion cubic feet per day in 2015 to 485 billion cubic feet per day in 2040.2

That 145 billion cubic feet per day figure is an absurdly large increase that will be very difficult — if even possible — for the global energy industry to meet with enough supply.

What complicates the story further is that the heavily populated countries like China and India, where natural gas demand is surging, are not blessed with an abundance of natural gas reserves. These countries are not going to be able to come close to supplying their own needs.

That means that China and India are going to need to import much of the natural gas that they will consume… which presents a buying opportunity for savvy investors.

Canadian Natural Gas — Ready For A Revival

Shell is currently working towards finalizing a decision to begin construction of a $40 billion liquefied natural gas (LNG) facility in Northern British Columbia, Canada.

This LNG facility will take natural gas and cool it to the point where it becomes a liquid. This process will allow the commodity to be safely shipped across the globe — more specifically to Asia where it can be sold at even higher prices.

This project is called LNG Canada and it is huge. Once up and running, it will demand 3.5 billion cubic feet per day of Canadian natural gas.

How significant is that?

Consider that the entire country of Canada currently produces only 16 billion cubic feet per day. That means that LNG Canada alone will require the entire country to raise production by almost 22 percent.

A sudden demand increase like that has to do good things for Canadian natural gas price. Similarly, an increase in natural gas prices has to do good things for Canadian natural gas producers…

So how do we play it?

Let’s keep it simple and take a look at Canadian Natural Resources (CNQ), the single largest producer of natural gas in Canada.

Canadian Natural is doing just fine with natural gas prices where they are. The company currently yields over 3 percent, has a solid oil production business that diversifies operations and also has a rock solid balance sheet. Coupled all together, these make CNQ a great investment without a spike in natural gas prices.

But If Canadian natural gas prices do increase in the coming years — like I expect them to — no company will benefit more than Canadian gas giant CNQ who will now be able to sell gas at higher prices.

That’s the kind of risk-reward play I want in my portfolio. And I recommend you add it to yours.

Here’s to looking through the windshield,

Jody Chudley

Senior Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1Beijing Enjoys the Bluest Skies in a Decade, Bloomberg

2China leads the growth in projected global natural gas consumption, EIA

The post Shanghai’s Crippling Health Crisis… And How Xi Plans To Stop It appeared first on Daily Reckoning.

From:: Daily Reckoning