Source: The Critical Investor for Streetwise Reports 09/04/2018

The Critical Investor profiles a developer with a copper-zinc project in British Columbia that has been attracting financing despite the current base metals slump.

Despite the summer doldrums, a strong dollar, a developing trade war between the U.S. and predominantly China, and the resulting poor sentiment in commodities and mining stocks, Kutcho Copper Corp. (KC:TSX.V) managed to raise decent money, necessary to fund its ongoing drill program at its flagship project, the Kutcho high-grade copper-zinc project in British Columbia, Canada.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. Dollars, unless stated otherwise.

On August 15, 2018, Kutcho completed its previously announced short form prospectus offering consisting of 9.2 million flow-through shares at a price of C$0.45 for gross proceeds of C$4.14 million. This offering will close in two tranches; the first of C$3.6M is already closed. Kutcho Copper has arranged a second tranche, on a delayed settlement basis, with one additional subscriber for total gross proceeds of C$540,000 to close on or before September 30, 2018.

The offering was conducted by a syndicate of well-known agents led by Haywood Securities, including GMP Securities, Canaccord Genuity, Cormark Securities and Macquarie Capital Markets Canada. These agents received a cash commission of 6% and warrants entitling them to acquire 480,000 common shares of the company at C$0.45 per share for a period of 24 months. A 6% finder’s fee plus warrant is decent, as it is becoming increasingly difficult at the moment to raise cash, due to negative sentiment and cannabis taking up most available investment dollars it seems, especially at a premium (18% at the time of the offering) and with no warrant like this round.

The filling up of the treasury didn’t stop there for Kutcho. The company received its second advance payment as planned on August 21, 2018, from Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) in the amount of C$4.6 million under the agreement previously announced on August 10, 2017, entitling Kutcho Copper to a total of US$7 million. This amount is now fully received, and is meant to fund the ongoing expenditures related to completing its Feasibility Study (FS), like engineering, permitting, environmental work, geotechnical work, etc.

This work is progressing well, as Vince Sorace, president & CEO, stated:

“We have been making good progress in the field the past few months advancing the project towards Feasibility. Geotechnical and metallurgical drilling is almost complete, resource expansion drilling has commenced and environmental baseline studies have been progressing smoothly. The recent financing coupled with Wheaton’s payment gives the Company the capital towards continuing its goal of completing the planned Feasibility Study in Q2 2019.”

As a reminder, resource expansion drilling has commenced two weeks ago, and will be completed at the end of September/mid-October of this year. The FS data collection is on schedule and is also expected to be completed mid-October. The company is looking to complete its field season before the winter break (starting at the end of October), which would make everything more expensive, and according to management the company is on schedule. In the mean time, management acknowledged the issues that several companies had when applying for permits in BC (Taseko, KGHM), and has chosen to take a different road. This resulted in very good working relationships with supportive First Nations, and the company is working together now with the same bands with whom VP Community & Environment Sue Craig already reached agreements with at another, much larger project.

Although everything seems to be running smoothly and is managed very professionally, with a profitable (post-tax IRR of 28% @$2.75/lb copper, @$1.10/lb zinc) project that has a post-tax 2017 PFS NPV8 that is 15 times bigger than its current market cap, investors apparently don’t all seem to appreciate the quality and progress being made, and might still need to be made more aware of Kutcho Copper, as the share price drop was much more than justified based on negative mining stock sentiment and metal prices alone, as more well-known peers like Trilogy, NGEX and Nevada Copper lost (a lot) less during the summer:

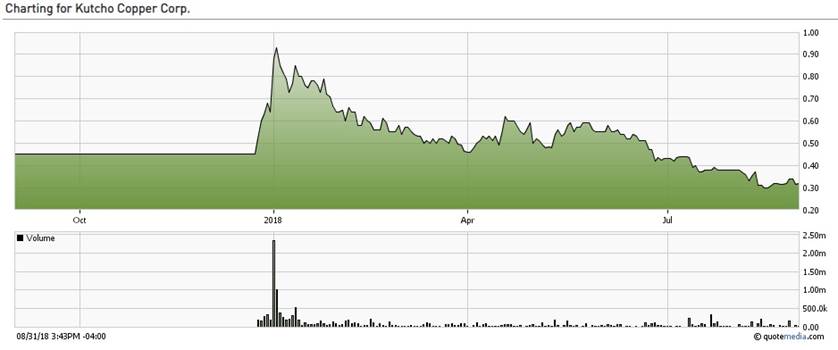

Share price over 1 year period

As it seems the Kutcho share price has found support now, and the market cap has come down to less than half the amount of cash in the treasury after the closing of the most recent offering, the buying opportunity for new investors is pretty good at the moment, and I am considering averaging down as well. I believe a second opportunity could present itself during tax-loss selling season, which usually puts pressure on stocks that have come down a lot during the year, and basically transpires between mid-November and mid-December until the holidays. However, it is also very well possible that Trump reaches an agreement with China on trade tariffs before mid-December, and commodity/mining sentiment could turn fairly quickly by then, and a rising tide lifts all boats.

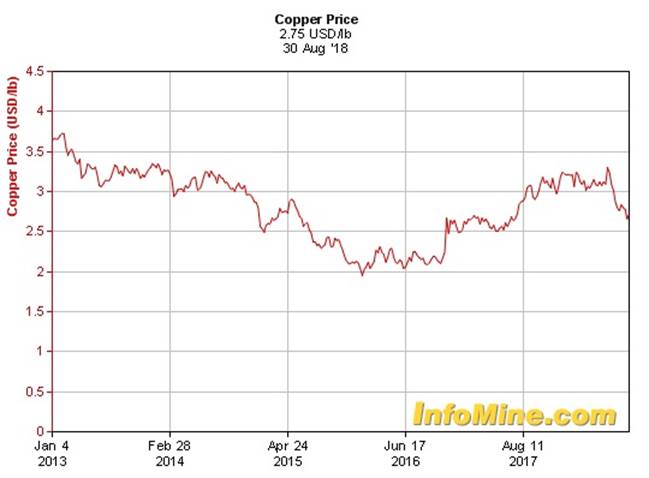

A quick update on metal prices: the copper price finally seems to consolidate at the $2.70–2.75/lb Cu levels, as potential copper mine strike issues (Escondida) and ongoing salary negotiations with other large LatAm mines seem to be dwarfed by China trade war concerns, which might be more or less contained by now for the time being:

The fundamentals for copper are still very strong for the next three years, with a 5–10 Mt deficit expected by 2021. But we are not out of the woods yet, depending on Trump’s goals and agenda. My belief is he will keep looking at the almighty U.S. stock markets, and more or less like the Federal Reserve, will determine his policies by probing and testing his ideas, and watch very closely what the effects will be on the stock markets.

Zinc is developing/behaving differently, as it is less fragmented …read more

From:: The Gold Report