This post PEAD: 4 Letters That Can Multiply Your Bank Account appeared first on Daily Reckoning.

Are there any baseball fans in the house?

Wrigley Field is a 20 minute Uber ride from the Chicago Mercantile Exchange trading floor, so it’s easy for me to go over after work for a few innings.

And naturally, it goes without saying that I’m a die-hard Cubs fan.

They have played some great ball this year, and are in prime position to advance into the postseason. (They’re currently a few games up on the rest of their division… Go Cubs!)

But one feat that has eluded them this year is the elusive “triple play.”

A triple play in baseball is not something you see very often…

It happens when the defending team gets all three outs during the same continuous play.

As you can imagine, it takes a lot of coordination!

But did you know the financial markets have their own version of a triple play?

When a company beats earnings estimates, revenue estimates, AND raises forward guidance all in one earnings report…

That’s what we call an earnings triple play — coined by research firm Bespoke Investment Group in the mid-2000s.

And just like in baseball, the investing crowd goes WILD on an earnings triple play…

We’re talking easy one-day double digit returns when a company reports that kind of strength!

Now to be clear, I’m not suggesting you buy into a company the day before their earnings report date — no matter how confident you are in a stock it’s a risky move.

Luckily, there is a safer method for capitalizing on the upside of a triple beat after a company reports…

I’m talking about playing up post-earnings announcement drift (PEAD) to your advantage. This is a phenomenon I’ve talked a lot about recently with my paid-up Dollar Trade Club subscribers.

The concept is very simple. If a company’s reported earnings come in better than expected, its stock tends to “drift” slowly higher over the next several months. If the company doesn’t meet estimates, its price usually drifts lower.

And when you combine an earnings triple play with the effects of PEAD… that’s how you hit a home run!

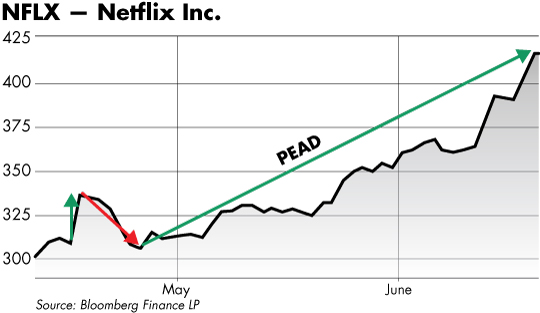

Check out the chart below for the tricks of the trade…

This is a two month chart of Netflix, Inc. (NFLX) starting just before reporting first quarter earnings this year.

To start things off, NFLX announces an earnings triple play at the close on April 16th. The stock goes vertical on news of the blowout quarter, causing shares to gap up over 9% the following day.

After the triple play kicks things off in style, the next signal to look for is a pullback in share price.

You’ll notice shares of NFLX sell off and completely erase the near double-digit gains caused by the earnings beat after just a few days.

The drop may seem extreme, but the nine percent move higher that Netflix experienced after its earnings report is a HUGE one-day pop for any stock.

Naturally there would be profit-taking here.

At this point Netflix may be down, but it’s far from out of the game…

Because a company beating on earnings, revenue, and raising guidance is as bullish as it gets.

This pullback is exactly what you want to wait for, and provides a perfect entry point on a stock with very positive earnings momentum — right as PEAD is kicking in.

Next, the share price is going… going… GONE, running up from $300 per share to over $400.

And that’s it! Just to recap…

Identify a company you like that gaps up BIG on an earnings triple play.

Wait for a pullback of 50% or more of the one-day price surge…

Then pull the trigger before PEAD kicks into high gear.

With PEAD working in your favor, you’ll become an unstoppable force in the market!

Yours for weekly profits,

Alan Knuckman

P.S. For my best picks on how to profit from this market phenomenon (PEAD), click here right now.

In addition, you’ll receive a FREE copy of my book, The Bull Market Manifesto, just for joining!

That’s an extra 40+ actionable recommendations to grow your wealth!

But this offer won’t last long. Only 178 copies are available today.

Click here to reserve your copy.

The post PEAD: 4 Letters That Can Multiply Your Bank Account appeared first on Daily Reckoning.

From:: Daily Reckoning