Source: John Newell for Streetwise Reports 08/31/2018

Portfolio manager and technical analyst John Newell of Fieldhouse Capital Management profiles an explorer whose recent drill results may be revealing the highest-grade porphyry in the Yukon.

In this article, we will take a brief look at the Yukon, the prolific Tintina Gold Belt and drill down to the Dawson Range, which makes up part of the belt, and what could be Triumph Gold Corp.’s (TIG:TSX.V; TIGCF:OTC) strategic position and district-size potential in the Yukon Tanana Terrane that makes up part of the prolific Tintina Gold Belt.

Why the Yukon: Canada’s Yukon Territory is a mining-friendly jurisdiction with a long, proud history in mining and exploration, starting with the 1897 Klondike Gold Rush. Mining is an important part of its economy today, as the Yukon experiences a new, modern-day gold rush. For much of this time, smaller companies, placer miners “working the creeks,” dredging barges “working the rivers,” prospectors and mining entrepreneurs have walked and staked the ground throughout the Yukon.

However, this is changing because the majors are discovering what the juniors have long known: This region is largely underexplored, has exceptional geology, and has strong potential for district-size mining operations that can replace the declining mineral reserve profiles that the majors are experiencing.

Mining companies continue to invest in the Yukon, not only because of the strong mineral potential, but also because of the clarity provided by all levels of government, programs and partnerships with First Nations. The mining-friendly Yukon ranks only after Saskatchewan and Quebec for mining investment attractiveness within Canada.

The Tintina Gold Belt, which extends from British Columbia to Alaska, is underexplored in its central section spanning the Yukon Territory, including where it crosses the un-glaciated Dawson Range. The Tintina Gold Belt is a 1200-km-long and 200-km-wide arc, extending from the south corner of Alaska into the northern part of British Columbia. Production mines and significant exploration and mine development projects demonstrate the geologic potential in the Dawson Range. Over 50 million ounces of gold have been discovered in this belt over the last 20 years. (See maps below.)

The White Gold District and the Dawson Range experts call the “Best Hope for New Gold Deposits,” Northern Miner, May 13, 2018

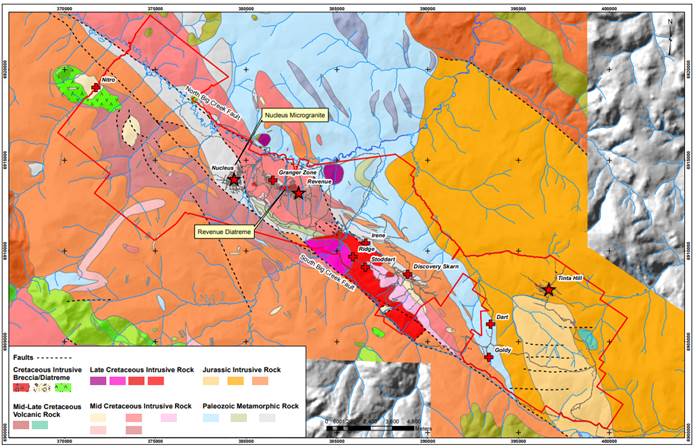

The Yukon’s Dawson Range (map above) gold belt is a northwest-trending series of gold-rich epithermal vein deposits, copper-gold porphyry deposits, minor skarns and extensive placer deposits that stretch for approximately 100 kilometers parallel to the Big Creek fault, northwest of Carmack, in the south-central Yukon.

Most of the placer gold recovered in the Dawson Range to date is from the still-active Revenue Creek, one of the prolific placer creeks in the Yukon, that runs through the property. The hunt for the source of that gold continues at Triumph Gold. Triumph Gold’s district-scale Freegold Mountain Project is surrounded by the Minto Mine, formerly owned by Capstone, Copper North, Rockhaven, Teck Resources, Western Copper, and Goldcorp’s Coffee Creek project, further to the northwest.

Many geologists and experts believe there are many more hard-rock sources to all this placer gold. While exploration for hard-rock deposits has been limited in the past, this started to change in the past 10 years, when over 7 million ounces have been discovered in this area. Over time, education, new technology, innovation and more experience has continually enhanced companies’ abilities to discover new deposits, as well as expand on existing ones, which is encouraging senior miners to take a closer look and invest in the district.

In addition, the Yukon territorial governments, along with the Canadian federal government, have committed $360 million to build improved roads and infrastructure throughout the Yukon, including the White Gold District surrounding areas. This heavy infrastructure spending should drive down capex costs and improve project economics for companies in the area. Investors can see from the insert below how the landscape is changing in the area, as major gold producers are moving heavily into the area. To re-cap, the reasons are excellent geology, vast areas of under-explored prime terrane, geopolitical stability, infrastructure that is decent and improving, a mining friendly culture, and new large deposits being found, examples being Goldcorp’s Coffee project, Victoria Gold’s Dublin Gulch and ATAC’s Carlin style target. The rush back to North America will likely intensify as events continue to become more volatile worldwide, and large mining corporations must look forward at least 10-15 years to be sustainable.

“The best place to find a new mine is next door to an old mine or existing mine,” – Tom Zoellner

Triumph Gold’s location in the Yukon:

The back story: Triumph Gold Corp., formerly Northern Freegold, was the first mining company I was involved in from its initial public offering, after being called to market on September 6, 2006, at $0.50 per share, and it quickly doubled its value. It was on a field trip to the site that I first met Mr. Bob Moriarty of 321 Gold, the Sprott Global Mining team and the Casey Research guys. As I recall, Bob smashed a loose rock on Freegold Mountain and found wired gold or free gold on the first day. The company was poised to do very well.

The project was a land consolidation of over 100 individuals and companies that owned the claims, and due to the efforts of the previous management team, this large land package was formed and developed into a 43-101 compliant mineral resource of about 3 million ounces of gold and a gold equivalent resource of over 5 million ounces, if the copper and molybdenum are converted to gold ounces, into what is now Triumph Gold Corp. The former company also did metallurgy as part of the PEA and got 98% recovery rates at Nucleus and 90% recovery rates at Revenue. However, the cyclicality of mining came in play beginning in 2008 and extended through until early 2016, and those years took the wind out of the earlier success enjoyed at …read more

From:: The Gold Report