By Jody Chudley

This post 2X Your Money With Today’s #1 Cord-Cutting Myth appeared first on Daily Reckoning.

Households across the United States are increasingly saying goodbye to satellite and cable subscriptions in favor of cheaper online streaming methods.

Today, I’m going to tell you how to profit from this trend and possibly double your investment in just three years!

Surprisingly, what will really knock your socks off is the specific business that I’m going to recommend.

Because it’s not Netflix. It isn’t the parent company of Hulu or Sling TV.

Believe it or not… It’s a cable company.

Americans Are Cutting The Cord In Droves

The rate at which people are cutting the cable cord is accelerating. In fact, it has tripled in the past five years as viewers instead opt for the wide world of streaming entertainment available from providers like Amazon, Netflix, Hulu, YouTube, Sling TV and others.1

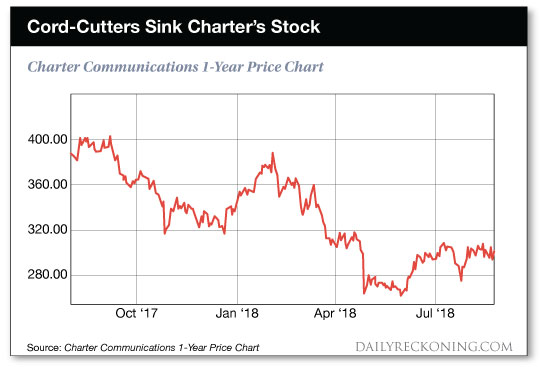

The market reaction to this trend of cord-cutting has been seemingly quite sensible. Investors have thrown a wet blanket on the share prices of the media companies that provide cable and satellite content.

But seemingly sensible and actually sensible are two very different things.

I believe that the market’s pessimism towards at least one cable company is creating an excellent opportunity for thoughtful investors. Yes, I’m saying that the market is wrong.

Cutting The Cord But Not Cutting Into Profits

What the market has missed in punishing cable providers is that a customer who cuts the cord on cable isn’t the same as a customer who is ending their relationship with the cable provider altogether.

The reason is that the cable provider is most often the same company that is supplying them with broadband service.

Further, once that customer who has cut the cord moves exclusively to streaming entertainment, what usually happens is that they decide to get a faster connection. The customer does that so that they can stream video across multiple devices and actually enjoy it without lags.

That faster broadband connection is more expensive — which means more revenue for the broadband provider.

If you have ever tried to watch a streaming video that is constantly pausing, you know that not upgrading to a faster connection is not an option. The repeated starts and stops of watching a constantly pausing/freezing video is torture!

So not only does the cable company generally retain the cord-cutting customer as a broadband customer, the company does so while selling the customer a much higher margin product.

The margins on cable are thin. The cable company has to pay for the content being provided which in recent years has become incredibly expensive. Have you ever checked out the deals that some television and movie stars are getting?

Meanwhile, the margins for selling broadband space are fat. Very fat.

Charter Communications (CHTR) is the second largest cable company in the United States. Charter supplies television, telephone and internet services to 27 million customers through its huge cable infrastructure.

Over the past year, the cord-cutting threat has depressed Charter’s share price. You can see what has happened in the chart below.

Yet, customers discontinuing cable subscriptions with Charter and instead buying more broadband service is not a bad thing. Charter’s profit margins on cable are well below 30 percent while its broadband margins are in excess of 50 percent.

Those wider margins mean that each dollar of broadband revenue creates as much income as two dollars of cable revenue.

Charter’s shares are currently undervalued and the company itself is taking advantage. Over the past year, the company has repurchased a whopping $13 billion of its own shares. That has resulted in a 12 percent reduction of the outstanding share count.

As the share count comes down, remaining shareholders are entitled to a bigger, more value piece of the pie.

I just finished reading an excellent Q2 investment commentary from Avenir Capital.2 In it, the value investing shop noted that continued share repurchases could drive 20 percent annualized free cash flow growth for Charter over the next several years.

If you assume that the Charter continues to trade at the current valuation of just 5 percent of free cash flow, those share repurchases alone would result in a share price of nearly $600 three years from now.

That would be a double from where we are today, which over three years equates to an annualized return of 25 percent. Sign me up!

Here’s to looking through the windshield,

Jody Chudley

Financial Analyst, The Daily Edge

EdgeFeedback@AgoraFinancial.com

1The number of cord-cutters has tripled in the last 5 years, and it’s starting to hurt the TV channels, BGR

2Charter Communications Could Pop By 100%, Avenir Capital

The post 2X Your Money With Today’s #1 Cord-Cutting Myth appeared first on Daily Reckoning.

From:: Daily Reckoning