All investors start their adventure in the capital markets with dreams of immediate wealth, luxurious cars, yachts, holidays in five-star hotels and making all the people around happy in a million ways. Virtually all investors have to lose a lot of money before they learn hubris and realistic expectations. Some give up investing completely, others become very conservative and claim that you can only count on long-term buy-and-hold types of investments.There are approaches which can bring investors closer to their goals, the price to pay is the time and knowledge necessary to conduct research.

Some of the people who survive the first – unavoidable – losses never give up their initial dreams and continually seek ways to make them come true. Are they doomed to fail spectacularly over and over again? Skeptics will say that searching for the Holy Grail of speculation has no sense and that the market is simply a complicated tool to drain naive investors of their capital. Enthusiasts, on the contrary, will try to convince you not to listen to the skeptics since you shouldn’t “blame the floor if you can’t dance.”

Where does the truth lie? There are approaches which can bring investors closer to their goals. Each of them has its price. The approach I describe later in this article applies to the main part of the precious metals investment portfolio – long-term investments. Because of that, it can strongly influence overall returns.

The price to pay is the time and knowledge necessary to conduct research. An additional condition is that this approach is not applicable to all markets. To spice things up, using it doesn’t mean exiting investments, so the main tenet of the classic approach to long-term investing is preserved. This means you don’t have to worry that you will miss out on part of the bull market in precious metals, or on part of the gains.

To allocate their capital that way, investors usually simply buy their asset of choice (e.g. gold) and then wait many years to sell. Sometimes, they decide to buy several or a dozen assets (e.g. gold, silver and mining stocks) to limit the risk. However, in both cases they rarely decide to change the once-chosen proportions over the whole investment horizon. It doesn’t have to be like that! You can think differently. And you can profit more.

In the previous article of this series, we showed that for many precious metals investors (naturally, we can’t speak for everyone) it may be optimal to invest in an asset mix consisting of gold, silver, large gold and silver mining stocks, and smaller companies exploring their potential deposits of precious metals. But, once we have bought these assets, can we forget about them?

As long as their prices are going up and down at roughly the same rate over time, this could seem justified. It is a common belief that in the short run the price moves might differ in particular parts of the precious metals sector, but the differences become negligible in the long run.

It is a secret, known only to a handful of investors, that this isn’t the case.

Knowing when miners are going to lead the metals, or the other way around, is the key to multiplying gains.

It suffices to buy the asset which will appreciate the strongest and then to shift in the portfolio from this asset to another one which is about to “take up the baton”. When the rate of change of prices diverges again, we shift the composition of the portfolio again. We repeat this for any bigger move. As time goes by, it will turn out that thanks to these temporary shifts between assets, the gains are much higher compared with a buy-and-hold approach, even though we have never really closed our investment position, only adjusted it cleverly. There will be additional transactional costs associated with the above strategy, but they seem negligible compared to the potential gains.

Do you want to increase the chance of making your dreams come true? The dreams which made you an investor in the first place? If you want to do it right, you have meticulous research to do. You will need to build an econometric model, optimize its parameters, test it on various datasets… Or you can read the next dozen or so paragraphs. The good news is that we have already done all this for you.

Show me the profits!

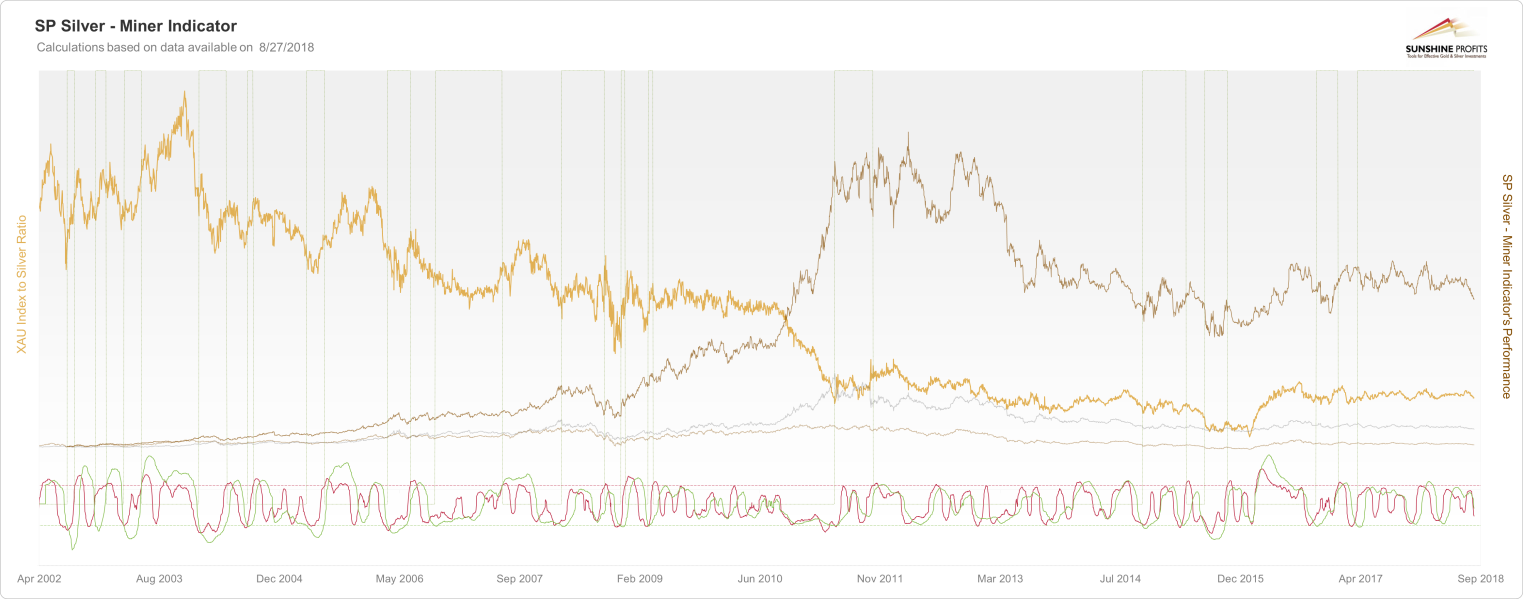

What’s even better, we’ll start with the analytical dessert and we’ll show you the indicator that we designed for moving from silver to mining stocks and vice-versa and we’ll tell you how much it could have improved an investor’s profitability. You can see the indicator (comprised of two separate indicators) in the lower part of the chart below.

On a technical note, the chart below is huge, and it has to be this way – there are too many details that need to be featured together for the chart to be small. It would not be readable in any smaller resolution. If it’s not clearly visible and you can’t click on it to zoom it, you can do so on our website, using this link. If the link doesn’t work, simply Google “buy-and-hold on steroids SunshineProfits.com.”

Before discussing the details, let’s discuss the results.

Between July 30, 2002 and August 27, 2018, silver moved from $4.66 to $14.89, and the XAU Index moved from 61.71 to 68.79. Percentagewise, silver increased by 220% and the XAU Index increased by 11%. The XAU to silver ratio declined from 13.24 to 4.62.

So, what was the rate of return of moving from the XAU to silver and vice-versa according to the signals from the SP Silver-Miner Indicator?

Almost 2,000%.

Yes, we didn’t push the zero button too many times. Approximately one thousand eight hundred percent of profit. Precisely 1,764%.

What? But how? That’s impossible!

Excited? Outraged? Good. We wanted to get your attention. Now that we have it, we have some explaining to do.

That’s the amount that we get based on optimized parameters. “Optimized parameters”, meaning ones that provide the best results in …read more

From:: Mining.com