Source: Matt Geiger for Streetwise Reports 08/27/2018

Fund manager Matt Geiger of MJG Capital expresses his view of the current resources market.

After a screaming January to start 2018, it’s been six consecutive months of pain across the mining industry. The catalyst for this has largely been fear that the Trump tariff tantrum will derail global GDP growth, coupled with fears that the U.S. dollar is set to continue its seven-year bull market and stifle raw material demand from emerging economies. The pain has been particularly acute over the past few months, leading many industry observers to question whether we have plunged into a new mining bear market.

This is not an unreasonable question. After all, the TSXV is off 28% since reaching a multi-year high in January as seen in the chart below. (Any drop of greater than 20% is generally considered bear market territory.) Just two weeks ago, money managed short positions in copper hit a new all-time high. It’s a similar story for gold where in early July speculators went net-short the metal for the first time in two years.

The anecdotal evidence is out there as well. In mid-July, the widely followed resource investor Marin Katusa blasted an email to his mailing list announcing that he was “cashing up” and expecting resource stocks to drop to significantly lower levels over the rest of 2018. Not long thereafter, Vanguard announced that its $2.3 billion Vanguard Precious Metals and Mining Fund (VGPMX) was being be renamed to Vanguard Global Capital Cycles Fund and broadening its investment mandate beyond mining. This is exactly the type of behavior that you expect to see in bear markets.

In light of these negative developments, it’s clear that we’re in another mining bear market right? Not so fast. My read is that we are NOT in another bear market and this instead should be viewed as a consolidation period within the mining bull market that began in early 2016. This view stems from a couple of factors.

The first is that, by historical standards, the bull market that began in January 2016 would have been abnormally short and weak if it indeed ended this past January. As pointed out recently by newsletter writer Gwen Preston, the average junior mining bull market has “averaged 47 months with a 202% gain. . .If this [bull] market indeed ended in January (the last high), it would have been the shortest (25 months) and the weakest (73%) in four decades.”

This in and of itself is of course not conclusive evidence that this bull market is still ongoing. It is indeed possible that a decade from now we’ll look back on the two-year period between January 2016 and January 2018 as the shortest resource bull market of the past 50 years.

However, it is my belief that markets generally adhere to Newton’s Third Law: For every action, there is an equal and opposite reaction. This is particularly true for mining, which, like shipping, is abnormally cyclical due to the capital-intensive nature of the business. It is said that bear markets are the authors of the following bull market. And we generally find that the more ugly the bear, the more attractive the bull.

With this principle in mind, it seems unlikely to me that the most severe bear market in a generation (2011–2015) would be followed by the shortest and weakest bull market in four decades. This suggests to me that at least one more dramatic up leg is still forthcoming before we see the next bear.

The second and more persuasive piece of evidence that this bull market is ongoing is that the senior miners continue to deploy capital into junior developers and explorers at a healthy clip. There is the recent M&A activity surrounding Arizona Mining, Nevsun, Novagold, Peregrine and Northern Empire. We’re also seeing an increased appetite for strategic investments into earlier stage juniors. Big boys South 32, Newcrest and Goldcorp have been particularly active on this front.

This is sustainable, at least for the next few years. The senior miners of both base and precious metals have markedly healthier balance sheets than they did just a few years ago. They also have the desperate need to replenish their project pipeline, after years of divestments and minimal development spending through the 2011–2015 mining bear market. More deals are coming, and soon.

For these reasons, I view this current market weakness as consolidation before the next leg up and NOT a prolonged bear market. However at this point you may be thinking:

I don’t care whether this is technically a correction or a bear market. These are just semantics. I’m losing money and I’m tired of it. When will things start going up again? And when they do start going up, how long will the good times last?

We’ll take these one at a time. There are a few potential catalysts in the coming months with the potential to reverse the weakness we’ve seen in metals and in particular juniors.

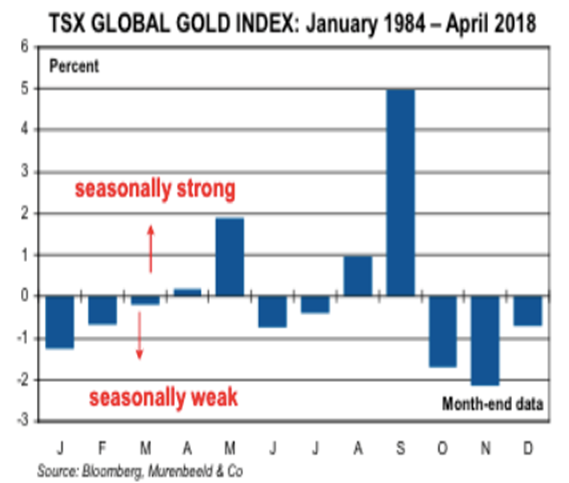

While this may be viewed as overly simplistic to some, it may take something as obvious as traders and fund managers getting back to their desks after the summer holiday. Up until the past couple of weeks, it was a particularly slow summer with low trading volume and investor interest. Given that historically precious metals perform exceptionally well in September (see chart below), it may take a simple change of season to draw attention back to the metals complex. The aforementioned newsletter writer Gwen Preston is one proponent of this view. We’ll learn shortly whether this year is different.

Another possibility is that, after spending the last six months worried about deflation, we could see the market come to the realization that if anything the China-U.S. trade spat is inflationary and does not have the potential to seriously undermine global GDP. As noted by Sprott’s Shree Kargutkar: “The U.S. currently trades approximately $2.3 …read more

From:: The Gold Report