Source: Michael Ballanger for Streetwise Reports 08/19/2018

Sector expert Michael Ballanger muses on the potential for a historical reprise of market events of 2015-2016, as well as on how algobots and bankers affect the precious metals markets.

History doesn’t repeat itself but it often rhymes.

– Samuel Clemens (Mark Twain)

I decided that before I sat down to write the weekly recap and outlook for the gold and silver markets that I would go to a few of the great commentary sites such as Streetwise, 321Gold, Goldseek and Gold-Eagle and read what the other “experts” are saying about the precious metals markets before I attack the keyboard. Earlier in the week, I had been working on a Western Uranium Corp. story and was astounded how stress-free it was writing about an energy deal as opposed to a sound money deal. After perusing perhaps two hundred paragraphs from some pretty smart guys and gals, it occurred to me that we are all looking at the same data and the same charts and reading the same headlines in an effort to sound original in our assessment of the metals

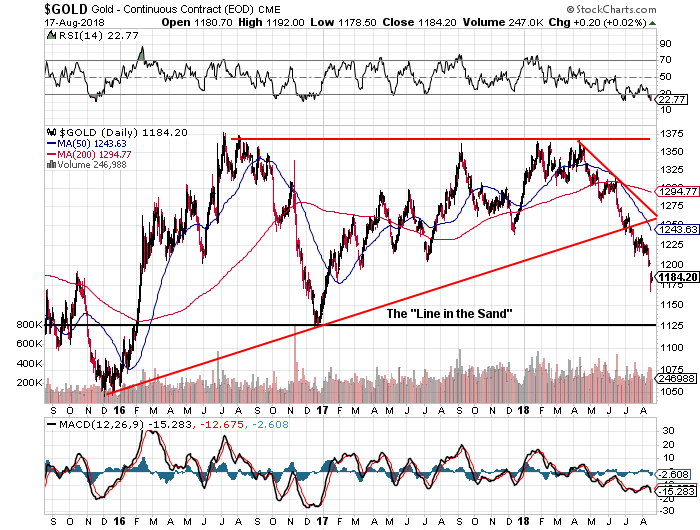

But what we are all missing are two very important and, in fact, crucial realities of today’s markets and I am going to focus on these in today’s missive. I could write about the COT report due out any moment (which I predict will be a doozy, with the Commercials recording a net long position for the first time ever), or I could drone on and on about RSI and MACD and the histograms and inverted teacups and screaming Dojis and hallucinating haramis, but it is all meaningless drivel in the context of the primary drivers for gold and silver. All that matters is that since the 2016 top at around $1,365 per ounce, gold has been unable to sustain any upward momentum thanks largely to the drivers.

Driver #1: Computerized Trading and Algobots

In 1998, I was first introduced to the concept of pattern-recognition algorithms that could trade stocks based upon the software’s uncanny ability to scan predictive movements and formations and execute buy or sell programs on such interpretation. The growth of computer-driven money management has now resulted in trading “floors” nearly devoid of human interaction, with carbon units only present to make sure the machines don’t go berserk (which they have on multiple occasions).

In vast, highly liquid markets like Forex and bonds and stocks, these algobots can operate fairly effectively, but in thin markets like commodities (and especially gold and silver), the algobots have a habit of feeding off each other. Once a short-term trend has been established, the ‘bots pounce and, in fact, extend and exaggerate it to the point of insanity. Once the ‘bots get control of the near-term trend, all other life forms join the party and the meme-du-jour becomes status quo, and there is no economic, financial or geopolitical event that will reverse it. The ‘bots do not analyze; they simply react and execute.

For this reason, I refute the idea that the Chinese are rigging the gold market by pegging the yuan to gold via the USD/CNY exchange rate. For most of the 2014-2018 period, a number of the blogger-gurus chortled on about how gold mirrored the JYP/USD cross—and before that the USD/EUR cross—but all that was, IMHO, was the pattern-recognition software picking up a working correlation and reacting to it. The more it worked, the more the ‘bots did it, and the cycle repeats itself over and over and over until the algo-scanners detect a “new kid on the block” of correlation. At that point, they run with it.

And because it is so completely warped in its extent and its intensity, the carbon-based trading units get on the keyboards and post accusatory rants about some sovereign entity rigging the price with all the fancy gold-yuan overlay charts being irrefutable “proof.” All it really proves is that the ‘bots have detected a correlation trend, and they have hijacked it. If any trading platform can abuse the system with not even the slightest of regulatory repercussion, it is the computers.

So, driver #1 is the existence of the algobots, and while it is entirely possible they are the riggers of the precious metals markets, they do so not from anything sinister or policy-driven; they are simply following the code written for them by the programmers.

Driver #2: Central Banks and Currency Regimes

Lord Rothschild said, “Give me control of a nation’s money and I care not who makes its laws.” And nowhere is that more evident than in the attitude of the banking community toward sound money. Bankers make fees from currency, and the more currency they control, the more fee income they derive.

For this reason, currency debasement is the primary incentive of all bankers. Take the financial crisis of 2007-2008. The global economy was humming along just fine, with the exception of the U.S. mortgage and housing market, where lack of adequate regulation allowed the markets to get out way ahead of their skis, resulting in a crash.

However, the only people affected were the banks and, technically, they were all toast. But since that would have vaporized shareholder equity for the elite class (primarily the bankers), it would have been a relative non-event for the rest of the working and middle class.

Now, this is a point of fierce debate because it is said that everyone was going to be impacted because “the system was freezing up,” which included deposits, but the vast number of Americans whose balances were well below the federal deposit insurance guarantee ($100,000 in Canada) were not at risk. Only the owners of the banking shares were at any real risk, so rather than allow the natural elimination of those entities that took unnecessary risks and failed, Hank Paulson begged Congress for, and received, a massive bailout through printed, fabricated, phony counterfeit money. In this manner, the …read more

From:: The Gold Report