Source: John Newell for Streetwise Reports 08/13/2018

John Newell, technical analyst and portfolio manager with Fieldhouse Capital Management, profiles a prospect generator exploring in and around British Columbia’s Golden Triangle.

Goliath Resources Ltd. (GOT:TSX.V) is a precious metals project generator focused in the prolific Golden Triangle and surrounding area of northwestern British Columbia.

Why the Golden Triangle?

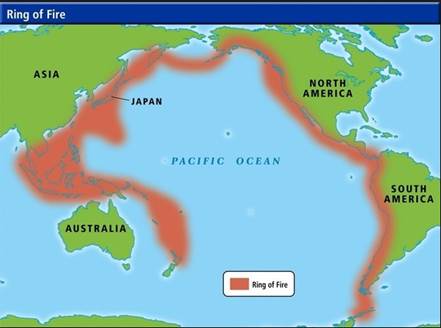

Much has been written about British Columbia’s Golden Triangle, as it is one the richest reservoirs of metal in the world. The Golden “Triangle,” “rectangle” or more aptly, a “Golden Corridor,” as we like to call it, is one of the most richly mineralized areas in the world. This Golden “Corridor” is a small part of a much larger geological feature of the Pacific “Ring of Fire.” It is associated with some of the largest and richest mineral deposits in the world, from Indonesia through Japan, Alaska, the Yukon, down through Nevada, to the metal-rich Mexico, Colombia, Peru, and the massive copper deposits of Chile.

The Golden Triangle is at a much earlier stage of exploration than other mineral-rich areas like Nevada and Chile. However, with the recent snowpack and glacial abatement in the area, new exciting targets are now being exposed at surface and being seen for the first time in +12,000 years. Also, the success of Pretium Resources Inc. (PVG:TSX; PVG:NYSE) that began production last year and Seabridge Gold Inc.’s (SEA:TSX; SA:NYSE.MKT) massive, ever-expanding KSM and Valley of the Kings deposits have encouraged new infrastructure buildout, such as new roads, rail and power lines. The Golden Triangle is coming of age, after more than 120 years of mining history, men’s dreams built and broken, looking for the sweet spot by having to drill through hundreds of meters of ice.

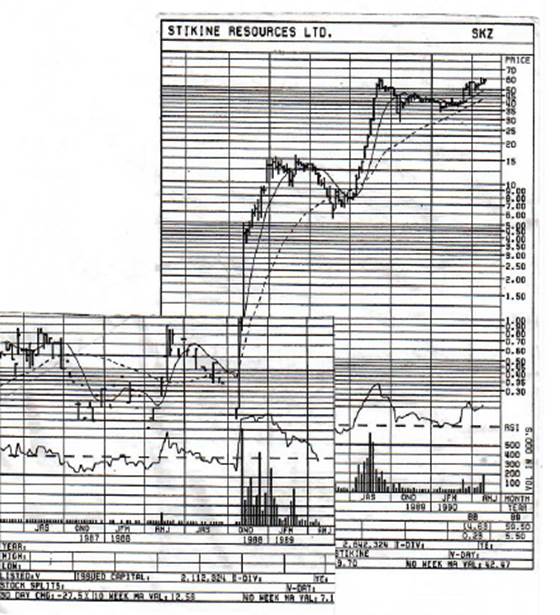

The northern British Columbia deposits are large porphyry copper-gold deposits, but the area has a variety of other deposits. An example is Eskay Creek (Stikine SKZ.V) a Volcanogenic Massive Sulphide deposit that produced more than 3 million ounces of gold, 160 million ounces of silver with grades of 49 grams per ton and 2405 grams per ton of silver, respectively. But it was not an overnight success; first walked over and drilled in 1935, the project was revisited in the years that followed until Stikine, a junior explorer, drilled over 100 holes into the property during the 1990s. Finally the company hit and was later bought out by Barrick Gold Corp. (ABX:TSX; ABX:NYSE). Below is the chart of Stikine; it shows the move after it hit and the incredible wealth that can be made when you explore and discover a precious metal deposit. It also shows that shares are volatile; some investors bought at $0.50, someone sold at $0.30, and then it went to $60.00. Investors must ask themselves why they are in the story, Dimes or Dollars, there is no wrong answer; however, the management of Goliath believe they are on to something important. Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB), also in the Golden Triangle, saw shareholders that sold last week and maybe forgot to ask themselves this important question.

Chart courtesy of StockCharts.com.

Goliath has options to acquire 100% of four highly prospective precious metals properties that include Bingo, Golddigger, Lucky Strike and Copperhead, covering 44,003 hectares.

Shares outstanding: 87,356,532 (believed that ~40,000,000 is in strong hands with family, friends, institutions, geologists and industry professionals).

Fully Diluted: 156,464,036 (average warrant strike price ~$0.18). This would raise abut ~$12,000,000. Therefore, no need to raise additional funds in the market.

Current Market Capitalization: ~ $12,000,000

Special Note: Private Placement shares issued April 12, 2018, become free trading this month.

Corporate Website and Corporate Presentation.

The founder, CEO and president of Goliath, Roger Rosmus, has extensive experience in the capital markets and resource sector. Goliath acquired its four property options from the J2 Syndicate, a private project generator focused on precious metals. The J2 Syndicate managing director and founder, Bill Chornobay, is a well-established project generator and dealmaker, and forms part of Goliath’s senior technical advisors, corporate development and exploration management. This team includes members of the original group that generated, prospected and staked the Coffee Creek claims in 1998. They also discovered the gold in soil anomaly in 1999 and 2000 that now forms the nucleus of the Supremo zone. This discovery evolved into a 5-million-ounce gold resource that was recently bought by Goldcorp for $520 million. The team also includes some of the original members who staked and generated the Plateau Project in the Yukon for Goldstrike Resources Ltd. (GSR:TSX.V), which recently completed an unprecedented CA$53 million JV deal with Newmont Mining Corp. (NEM:NYSE).

Goliath Resources is a prospect generator with four excellent properties. Any one of these properties could be a company maker, as they all have the potential to have elephant-size deposits that would move the needle for senior mining companies looking to replace their depleting reserves in a safe political jurisdiction like Canada. The project generator model is an ideal corporate structure, because if any one of these properties has an economic deposit discovery, that project can be joint ventured, spun out and/or sold, and the company can separately carry on prospecting with the other properties.

All four of Goliath’s properties have returned widespread mineralization of high-grade gold, silver and/or copper grades from exposed bedrock at surface. The new discoveries at Copperhead and Lucky Strike will be drilled shortly during the 2018 exploration program, and those properties will be highlighted today.

In 2017, Goliath purchased a 10% interest in the DSM Syndicate. This private company was formed by Bill Chornobay to pool geological knowledge and expertise relating to certain properties identified in an area of northwestern British Columbia south of Terrace. It staked a total of six properties and is marketing these properties with the intention to option or …read more

From:: The Gold Report