Source: Rick Mills for Streetwise Reports 08/13/2018

Rick Mills of Ahead of the Herd discusses the current state of the uranium market and the factors that he believes are pointing to higher uranium prices.

The Trump Administration is at it again. On July 18, the financial press got hold of a story that said the next target of the Trump tariffs is likely to be the uranium/nuclear energy sector. In what looks like a repeat of what happened with steel and aluminum, the White House said it would investigate whether uranium imports threaten national security, given how dependent the United States is on the nuclear fuel. If the sector is threatened—and why wouldn’t it be, where 90% of the uranium needed for American nuclear reactors comes from abroad—import tariffs would likely be imposed.

If that happens, it would hurt nuclear power plants, who are already struggling with low electricity prices and flat demand, Bloomberg noted in reporting the story.

But this isn’t really about national security, or in legal terms, section 232 of the 1962 Trade Expansion Act, which allows the U.S. government to impose tariffs without a vote by Congress if imports are deemed a national security threat. Section 232 was used to slap 25% tariffs on steel imports and 10% on imports of aluminum in March.

It’s about two U.S. uranium producers who are fed up competing with state-owned companies in Russia and Kazakhstan (i.e., Rosatom and Kazatomprom). Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.American) and Ur-Energy Inc. (URG:NYSE.MKT; URE:TSX) petitioned the government in January for the probe. Notably absent from the complaint was Uranium Energy Corp. (UEC:NYSE.MKT), which mines uranium in the United States and Paraguay and processes it in Texas.

Since they supply less than 5% of the uranium needed for U.S. nuclear power plants, Energy Fuels and Ur-Energy feel threatened, and want protection. Are they likely to find a sympathetic ear in the U.S. government? You bet. Despite the prices of practically everything made from imported steel and aluminum going up, including of course, cars (GM is already losing money), this government doesn’t seem to get the fact that slapping tariffs on strategic metals that are in short local supply will hurt domestic industries that must buy those raw materials from abroad.

If the complaint is successful, two things could happen: a “buy American” quota that limits uranium imports and reserves 25% of the market for domestic production, or a requirement that utilities purchasing nuclear power buy U.S. uranium. We’ll address the likely impact of section 232 on the uranium market in another section, but the truth is, 232 is a red herring.

It’s a distraction from what is really going on with uranium, which is the setting up of an extremely bullish scenario for uranium investors due to supply shortages in the face of high demand for the nuclear fuel as a result of the ever-growing need for clean power globally. The supply-demand imbalance will mean higher prices. This article will explain how this will come about, and why now is an excellent time to be investing in junior uranium companies that offer the greatest leverage to a rising commodity price.

Demand picture

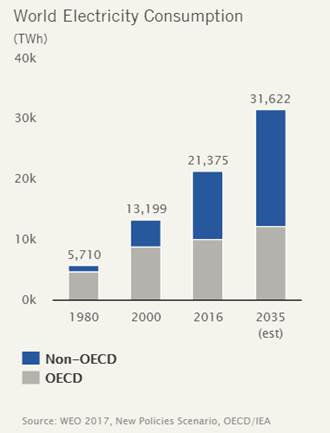

Demand for uranium, of course, is directly tied to the need for nuclear power, which is growing exponentially especially in Asia due to the problems with air pollution from coal-fired power plants. The global demand for electricity is expected to increase by 76% by 2030, and while everyone knows about the electric vehicle “revolution,” what is not often talked about is how will all that extra power be generated. Much of it will have to come from nuclear.

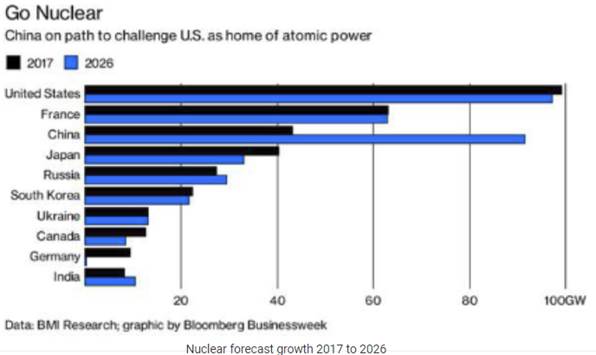

There are currently 452 operating nuclear reactors and 56 new ones under construction globally. According to the World Nuclear Association, China with its appalling air pollution is the leader with 17 new reactors under construction and 184 planned or proposed. Up until recently Japan was out of the nuclear mix, with all but a handful of nuclear reactors shut down for safety checks following damage to the Fukushima Daiichi plant during the 2011 earthquake/tsunami. But Japan, which has no oil and gas of its own and depends heavily on nuclear, now has nine reactors back in operation—a tripling from 2017—and aims for nuclear to represent just under a quarter of its power mix by 2050. Japan’s Abe Administration is pro-nuclear. Russia is building nine new reactors and India is constructing seven.

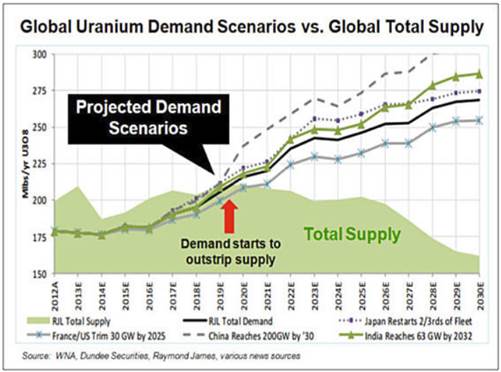

A 2015 chart from Thomas Drolet, head of Drolet & Associates Energy Services, was extremely accurate

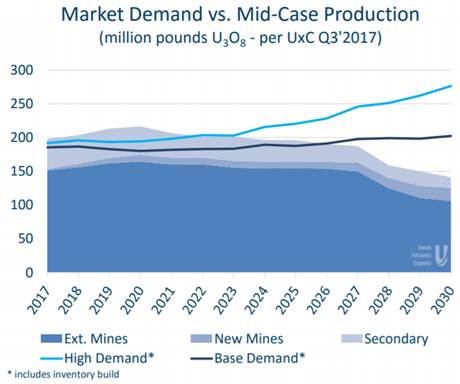

According to nuclear consultant UxC, this means the global capacity for nuclear power is expected to grow by 27% between 2015 and 2030. And that means a whole lot more uranium. How much? UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8 to 300 million pounds by 2030.

September 2017, Uranium Participation Corporation

But there’s a problem. Uranium supply has been steadily dropping since 2016. That year total mined supply was around 163 million pounds, in 2017 it was 154 million, and this year it’s estimated to be under 135 million. With current U3O8 demand at 192 million pounds, that leaves a shortfall of at least 57 million pounds. More on why that is in the next section, but first, it’s important to understand uncovered uranium demand.

Uncovered demand

Nuclear utilities buy uranium on long-term contracts, in order to lock in the price. These contracts usually last four to 10 years. The long-term demand for uranium is calculated by figuring out utilities’ requirements for U3O8 that is not covered by contracts. This is known as uncovered demand. According to UxC, uncovered uranium demand is projected to increase by up to 54 million pounds by 2020, or just under a third of total demand that year. Then it just …read more

From:: The Energy Report