Source: Rick Mills for Streetwise Reports 08/13/2018

Rick Mills of Ahead of the Herd discusses the recently released drill results from the first hole of the summer season, which he terms “spectacular.”

Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB) whacked it out of the park on Thursday with the release of assays from the first hole of the summer drill program at Forrest Kerr, its property in the highly prospective Golden Triangle area play of northwestern British Columbia.

Multiple high-grade zones

ABN’s 2018 drilling in the North Boundary, a new mineralized zone discovered at the end of 2017’s drilling season, has intersected multiple high-grade zones and precious metal values, near surface. Hole FK-10, the first of eight holes drilled during the first batch of the current 4,000m program, features four separate high-grade zones all within 190 meters downhole. The hole was drilled 35 meters northwest of discovery holes FK17-04, 05 and 06 from last summer. It significantly increases the North Boundary Zone of precious and base metal mineralization, according to ABN’s press release.

The highest-grade zone assayed at a whopping 331 grams per tonne (g/t), or 9.65 ounces per tonne, over 1.0m, within a broader zone of 38.7 g/t over 10m. The results from other high-grade zones in the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m. The hole was drilled 230m north of a high-grade historical hole drilled by Noranda in 1991, which hit 326 g/t gold.

“The high-grade gold and base metal values in the first hole of the 2018 drill program have far exceeded our expectations and confirm the presence of a robust and strong mineralizing system at the recently discovered North Boundary Zone,” said Jim Pettit, president and CEO of Aben Resources.

“We are now looking at an area that extends 230m south to the historic high-grade Noranda drill hole from 1991 and although the geology is complex we believe more drilling will delineate additional high-grade mineralization. The target areas in and around the Boundary Zone are relatively shallow and continue to provide strong discovery potential as we look to value-add the project using a systematic exploration methodology.”

Ron Netolitzky, Chairman of Aben Resources, stated: “The presence of multiple mineralized zones associated with mesothermal veining and adjacent to major structural breaks is very encouraging. Close proximity to infrastructure will facilitate ongoing exploration.”

Netolitzsky has an extensive exploration background and is best known for discovering and putting into production the Eskay Creek and Snip mines in the Golden Triangle, and the Brewery Creek Mine in the Yukon.

The goal of this year’s drill program is to expand the mineralization at the North Boundary Zone, and test other prospective targets. According to Aben, this part of the Forrest Kerr property hosts gold-silver-copper in rock and soil anomalies that span over 2 km by 4 km and remain relatively under-explored. The zone’s mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets currently being drill-tested.

45% gain

The market responded well to the news on Thursday morning, with Aben spiking up 70% in the first 20 minutes of trading. By 10:17 am in Toronto, 6.4 million shares were changing hands, and by the end of the day, volume was at 22.5 million shares traded.

The stock closed Thursday at 29 cents per share, a gain of 45% from the open. Assays are pending for seven more drill holes.

The right time for gold

Smart gold investors know that we are in discovery-hole season, with most Canada-focused gold juniors running full-bore to get their drilling done before the snow starts flying in a couple of months. They also know that gold has been drifting downward during its normal period of summer weakness, providing an excellent entry point for gold stocks.

Over the last six weeks the precious metal has dipped from US$1,267 on June 22 to $1,213 on Wednesday, a difference of $54. Part of the reason gold has flopped is seasonal weakness, the other reason being the U.S. dollar, which has increased by 60 cents during the same period. Gold and the dollar typically move in opposite directions.

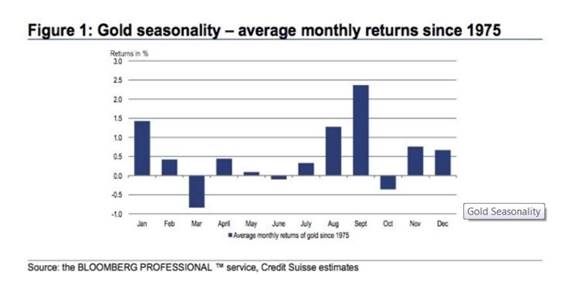

Historically gold’s worst month is March, with January and September the next best months to look for a rally. September is when gold demand spikes in India due to the buying of jewelry for weddings to correspond with the Diwali festival in October-November. April to July is when gold usually drops below its average monthly return. So we are only a few weeks away from the month of September when gold historically rallies.

This fall’s gold season looks particularly promising due to all the geopolitical tensions we outlined in a previous article, plus the inflationary pressures in the United States due to Donald Trump’s trade war. Everything from beer and Coke to cars are going up, as countervailing duties bite.

The import tariffs on goods imported into China and the U.S. have just taken effect, so it’s a little early to say how they will play out in the U.S. economy. So far the U.S. dollar is holding steady, and that has meant no love for gold, as investors funnel funds into dollars instead of gold amid the uncertainty of a trade war.

However the good news for gold is that as higher prices trickle through the economy (imported steel and aluminum are already more expensive), the inflationary effects will benefit gold. “As the tariffs take hold and the market adjusts to the effects, we expect inflationary pressures to increase, which will benefit holders of gold and commodities,” Reuters quoted the CEO at fund manager GraniteShares Inc.

While the trade war has punished commodities including gold there are other less obvious signals that gold is poised for a rally. On July 3, MINING.com …read more

From:: The Gold Report