By Frik Els

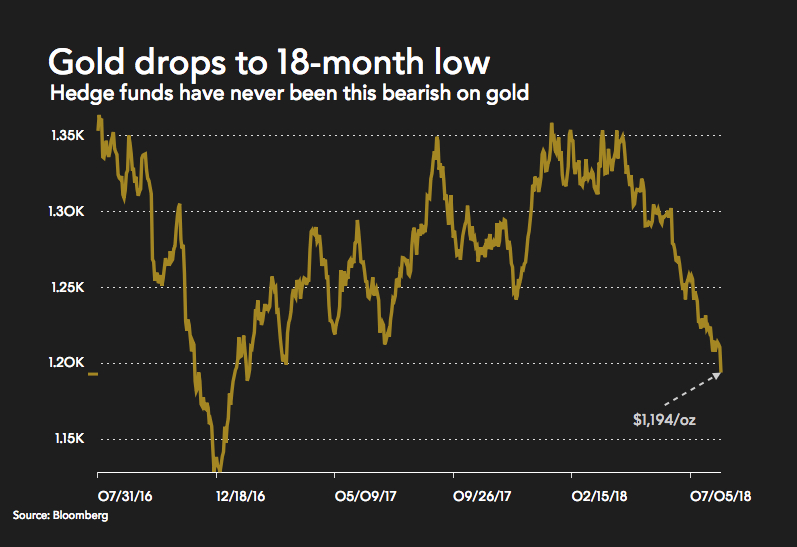

Gold fell to fresh 18-month lows on Monday as the attractiveness of the hard asset continues to wane on the back of rising interest rates in the US and a strengthening dollar.

December futures trading in New York declined 1.5% to $1,201 a troy ounce, the lowest since February last year and now down more than 12% from its 2018 high reached in January. Spot prices dropped through the psychologically important $1,200 level with a dip to $1,193.15 an ounce.

Gold usually moves in the opposite direction to the greenback and has a strong negative correlation to interest rates as the metal produces no income and investors have to rely on price appreciation for returns.With speculative short positions at record highs implying trend projection, market participants run the risk of being caught on the wrong side of any reversal

At the same time US stock markets are humming and gold is trading near its lowest relative to S&P 500 Index futures since the start of the global financial crisis in 2007/2008 according to Bloomberg calculations.

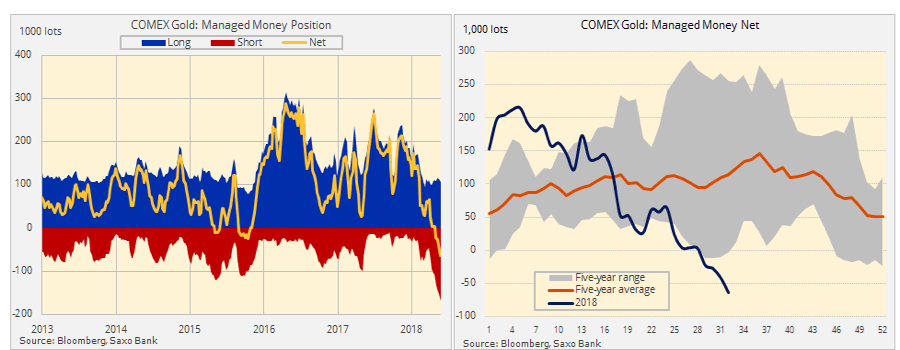

Hedge funds and large-scale speculators active on the gold derivatives market are betting on further declines.

According to the CFTC’s weekly Commitment of Traders data up to August 7 released on Friday speculators pushed the net short position (bets that gold will be cheaper in future) to a record of 63,282 lots or 197 tonnes. Bearish positioning now exceeds levels last seen at the end of 2015 when gold briefly dipped below $1,050.

According to the CFTC’s weekly Commitment of Traders data up to August 7 released on Friday speculators pushed the net short position (bets that gold will be cheaper in future) to a record of 63,282 lots or 197 tonnes. Bearish positioning now exceeds levels last seen at the end of 2015 when gold briefly dipped below $1,050.

Retail and institutional investors in other paper markets for gold are also abandoning the market.

Holdings in SPDR Gold Shares, by far the largest physically-backed gold ETF, last week shrank to the smallest since early 2016 at 786 tonnes. Investors have pulled nearly $2 billion from the New York-based fund so far this year.

A report released earlier this month by the World Gold Council shows gold demand for the first six months of 2018 sank to its weakest in almost a decade on the back of waning investor demand.

July was the fourth straight month of declines in the gold price, the metal’s longest losing streak since 2013.

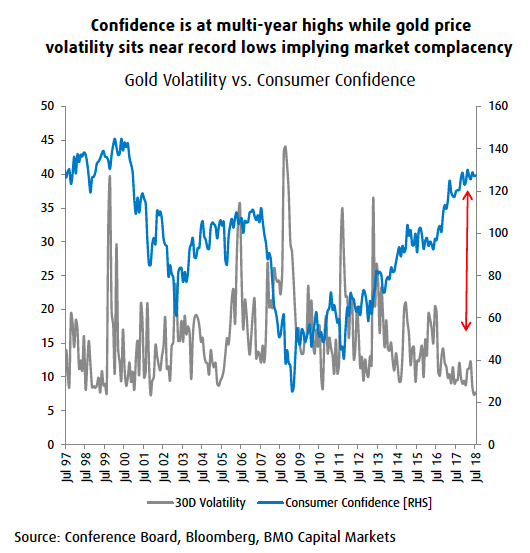

A note by BMO Capital Markets, an investment bank, released before the latest weakness for gold cautions bears to be wary of complacency:

Volatility in gold prices is at its lowest level since 2001 – when the dot-com bubble was unwinding – such that the last four months have seen steady decline. Historically, when prices have exhibited such a trend it’s been largely due to headwinds from a stronger USD.

In our view, with speculative short positions at record highs implying trend projection, market participants run the risk of being caught on the wrong side of any reversal in price

action with China-US trade friction continuing to escalate.

The post CHARTS: Warning for bears as gold price drops through $1,200 appeared first on MINING.com.

From:: Mining.com