Source: Proven and Probable for Streetwise Reports 08/06/2018

Trey Reik, senior portfolio manager with Sprott USA, speaks with Maurice Jackson of Proven and Probable about the Fed’s recent actions and what effect they are having on the gold and other markets.

Maurice Jackson: Welcome to Proven and Probable. I’m your host Maurice Jackson. Joining us for a conversation is Trey Reik, senior portfolio manager with Sprott USA.

We’re delighted to have you here today to discuss the Federal Reserve’s impact on peripheral markets. Mr. Reik, the Fed is in the process of implementing a dual policy of rate hikes and balance sheet reduction, which appear to have a duplicitous effect on peripheral markets. What are your thoughts on this dual policy and what can we expect from Chairman Jerome Powell during his tenure?

Trey Reik: Do I have about two hours to answer that question? I’m just kidding. There’s a lot of information there. I think that Mr. Powell is obviously very capable of monetary stewardship with an enormous amount of experience and great judgment, and I think he will do a great job. He’s got some difficult parameters to deal with. There is a little bit of a similarity to when Alan Greenspan first took over his Fed stewardship in 1987; he actually ascended to the position in August and tried to show the world that the Fed was on the case and under control, and people may forget but about a month later on consecutive days, the Fed actually raised the Fed funds rate on 25 basis points on two consecutive days.

We had had a big backup in ten-year yields and the S&P had been doing extremely well and all things looked to be in really good shape, and, of course, we had the fall of 1987 very soon thereafter. We have a lot of similarities and so far as Mr. Powell has just taken over and the market has a tendency to test a new chairman, we’ve had this backup in ten-year yields and the S&P’s doing well. We have a chairman who seems to be focused on showing the market that he is control and so we’ve had these rate increases, so a lot of similarities there to ponder.

As we have written in past communications that the history of Mr. Powell’s public statements and now that the extended transcripts from a lot of these meetings are coming out, Mr. Powell since he ascended to the Fed has been a fairly reliable critic of QE programs especially towards the QE3 stage. He ended up voting for QE3 as a Fed governor and permanent voter because that vote came up in his freshman year and generally freshmen don’t rock the boat too much, but his public statements and the ones that are coming out from these extended transcripts demonstrate he argued fairly vehemently against the benefit of QE3 asset purchase along his line of reasoning that the market would always expect more and that the Fed was starting to encourage risk-taking and the search for yield, etc.

Now that he has become the Fed chairman and we have these large amounts of debt outstanding, I really do believe that he will go as far as he possibly can along the telegraphed lines of the scheduled balance sheet reduction. The Fed announced last September that it would roll about $10 billion per month off the balance sheet in Q4 of 2017 and then that would increase by $10 billion per month each quarter thereafter, meaning the monthly total in Q1 would be $20 billion and the monthly total in Q2 would be $30 billion, $40 billion in the third quarter, and then theoretically by the end of this year, in the fourth quarter, $50 billion per month.

The $50 billion per month times three is about $150 billion per quarter or a run rate of $600 billion. Ben Bernanke was fond of saying that every $200 billion or so of QE was equivalent to about a 25 basis points rate cut when it was QE. One would assume that in reverse that equates to something on the order of about 25 basis points. Each $200 billion of rolling assets off the Fed balance sheet should equate to something like a 25 basis points rate hike.

If we are at a $600 billion annual run rate and balance sheet deduction by the end of the year, that would mean that there’s 75 basis points of tightening just from the balance sheet reduction. I think everybody by now is fairly aware that the Fed’s dot plot on average predicts about four rate cuts in the current year and plying two more for the balance of 2018 and another three or four next year, and believe it or not, another one or two in 2020. That’s the telegraphed policy and, as I mentioned, I think Chairman Powell, given that he didn’t support a lot of asset purchases originally, I think he will be as dedicated as possible to try to follow those policies.

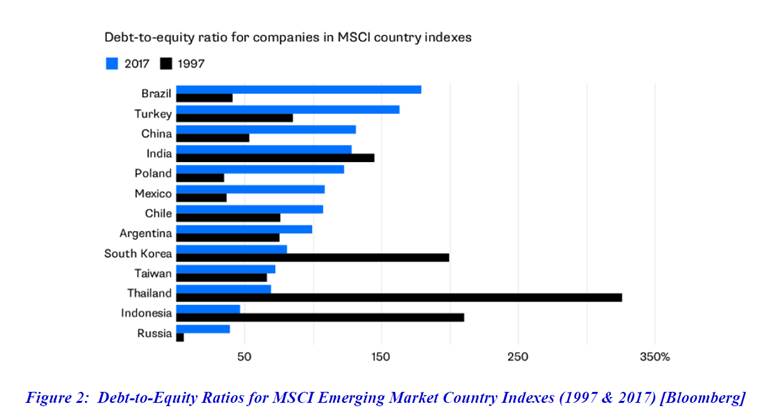

Maurice Jackson: Let’s discuss how the Fed is or will have an impact on the peripheral markets beginning with emerging markets, which I like to term as third world economies. Does the Fed fundamentally grasp the dynamics of the situation?

Trey Reik: Interestingly there was an IMF conference that was hosted in Switzerland a couple of months back at which Chairman Powell was invited to speak on the topic of the impact of Fed policy on other countries and how they can control their own fiscal economies in the environment of Fed monetary decisions. In other words can emerging markets and other countries still run their own fiscal policy when the Fed is involved in changing its monetary policies? It gets to the Triffin dilemma, etc., in terms of whether any country can issue the reserve currency for the world because it sets up a …read more

From:: The Gold Report