Source: Rick Mills for Streetwise Reports 08/02/2018

Rick Mills of Ahead of the Herd discusses the changing economics of uranium and profiles one company that he believes will thrive.

To be a uranium bull lately is to take the classic contrarian investor position. The last hot uranium market, before 2011, ran the spot price up to $138 per pound, and made investors a lot of money. High prices though begets production, and supplies from Canada, Australia and Kazakhstan, the top three producers, started to flood the market. Then came the Fukushima Daiichi nuclear reactor incident in Japan, and poof, the bull market was over.

Japan shut down all of its nuclear reactors for safety checks, and the world soured on nuclear, with some countries (e.g., Germany) saying they planned to phase out nuclear for good. Un-needed uranium for Japan’s nuclear reactors flowed into the spot market, further depressing the price, which slid to around $20 a pound, rendering three-quarters of uranium production uneconomic.

For years now, utilities have been buying up spot supplies to take advantage of low prices, but over the last six months, those supplies have disappeared. Soon utilities will have to sign new long-term supply contracts, in the shadow of a looming supply deficit.

Big producers like Cameco in Saskatchewan and Kazatomprom, Kazakhstan’s state-owned uranium company, have been cutting production, with Cameco’s McArthur River Mine shut down last year. But Cameco needs to keep buying large volumes from the spot market to fulfill its contracts including 11–15 million pounds through 2019, which is over 20% of the spot market. On top of that, big funds are being set up to hold U3O8 (triuranium octoxide, aka yellowcake), which are removing more supply from the market.

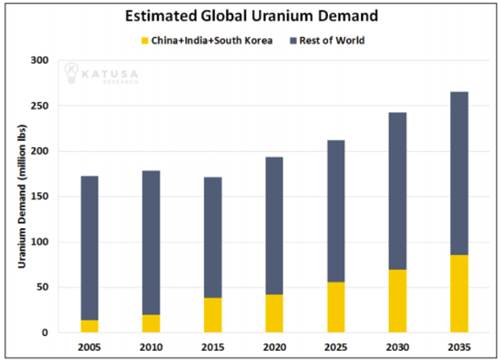

Meanwhile, uranium demand keeps rising, as the world’s need for electrification intensifies. Global demand for electricity is expected to grow by 76% by 2030; much of this demand will be met by nuclear. According to the World Nuclear Association, there are currently 452 nuclear reactors operating in 30 countries, supplying around 11% of the world’s energy. Fifty-six reactors are under construction, with the majority, 17, in China, plus another 481 planned or proposed. Nine reactors in Japan have restarted. UxC, a nuclear industry consultant, estimates nuclear power capacity will increase from 379 gigawatts to 483GW by 2030, while uranium demand could grow from 190 million pounds to over 300 million pounds by 2030—a 60% jump.

When the spot market runs dry, utilities will have to renew their contracts, fast. They don’t really care what the spot price is, they just need to ensure their uranium needs are covered. When that happens, the uranium price is expected to go gangbusters.

Buying into the uranium market now really means being ahead of the herd. So how to invest in this coming uranium bull? Well, the best place to look for returns is the juniors, where the uranium bear market of the last seven years has decimated share prices, meaning very attractive entry points. And the preferred location is Saskatchewan’s Athabasca Basin, home to the world’s highest-grade uranium jurisdiction, where the largest uranium mine (McArthur River) is, along with Cameco’s Cigar Lake Mine, and some very notable recent high-grade discoveries including Fission Uranium’s Patterson Lake South/Triple R, Rio Tinto’s Roughrider deposit and NexGen Energy’s high-grade Arrow deposit.

A lot of exploration is happening around the Basin, and one of the best companies to have amassed a large, prospective land position is Skyharbour Resources Ltd. (SYH:TSX.V;SYHBF:OTCQB).

The Strategy

Skyharbour started about five years ago in the pit of the uranium downtown, when good properties in the Athabasca Basin could be snatched for pennies on the dollar. The Vancouver-based firm has spent around $4 million acquiring roughly 200,000 hectares, including the highly prospective Moore Project, which it optioned from Denison Mines back in 2016. Denison, listed on the TSX and NYSE, is Skyharbour’s largest strategic shareholder and its president, Dave Cates, is on Skyharbour’s board. Moore hosts the Maverick Zone, where historical drill results feature 4.03% equivalent U3O8 over 10 meters, including 20% eU3O8 over 1.4m starting at a depth of 265m, as well as 5.14% U3O8 over 6.2m. Recent drilling by Skyharbour returned 21% U3O8 over 1.5m, at a depth of 265m. This project is the main focus for the company and will see continued drilling and exploration as Skyharbour’s team looks to expand on the known high-grade zone while homing in on additional discoveries.

The Fraser Institute Annual Survey of Mining Companies, 2016, rated 104 jurisdictions around the world based on a combination of their geologic attractiveness for minerals and metals and their policy attractiveness. In 2016 Saskatchewan ranked as the top jurisdiction in the world. In 2017 Finland ranked as the most attractive jurisdiction in the world for mining investment, followed by Saskatchewan.

Skyharbour also owns 100% interests in the Falcon Point, Yurchison and Mann Lake uranium projects on the east side of the Basin. The Falcon Point property hosts an NI 43-101 mineral resource of 7 million pounds U3O8 inferred at an average grade of 0.03% U3O8 and 5.3 million pounds thorium dioxide inferred at an average grade of 0.023%.

The company also has a 50% interest in the Preston Project—one of the largest land packages (75,965 hectares) in the Basin—strategically located near Fission Uranium’s Patterson Lake South Triple R uranium deposit and NexGen Energy’s Arrow deposit, both of which contain high-grade uranium.

While Skyharbour is a top-tier uranium explorer, with the expertise to back that up (see Team section below), the company is also a prospect generator, meaning its strategy is to ink option agreements on its secondary properties, thus allowing other companies to come in and incur exploration expenditures in return for earning stakes on those properties.

CEO Jordan Trimble explains the dual-pronged strategy.

“First and foremost, we offer high-grade discovery potential in the best uranium district in …read more

From:: The Energy Report