Source: Bob Moriarty for Streetwise Reports 07/19/2018

Bob Moriarty of 321 Gold discusses the relative prices of gold, silver and platinum and highlights two exploration companies, one with platinum and one with silver.

I’ve written about both Group Ten Metals (PGE-V) and Metallic Minerals (MMG-V) before. I’m going to group the two companies in one piece today for a number of reasons. The companies share management. One, Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTC), is a platinum/palladium company. The other, Metallic Minerals Corp. (MMG:TSX.V), is oriented toward silver in the Keno Hill silver district.

Inflation is directly responsible for the price increase of everything. That doesn’t mean that all commodities or financial instruments go up in unison, they don’t. But soybeans or silver are not inherently more valuable today than they were a hundred years ago. What has changed is the value of the dollar, not the commodity. Markets search constantly for the correct price. That is why prices go up and prices go down. The market never quite knows what is the right price for anything so it searches until buyers and sellers are satisfied with price and make a transaction.

Human behavior causes distortions in price between commodities. It’s like dancing. Sometimes you lead. Sometimes you follow. An astute investor can profit when the price of one commodity in comparison to another deviates from the mean. We can be assured that eventually price will regress to the mean. Understanding how deviation from the mean and the ultimate regression to the mean allows savvy punters to speculate on the price difference between two commodities without the need to place a bet on the direction of price for either. I explain all of this at length in Nobody Knows Anything.

Over the past one hundred years the ratio of silver to gold has varied from about 17-1 to just over 100-1. That means it took seventeen ounces of silver to equal one ounce of gold at the extreme. The average ratio has been about 53-1. Therefore without guessing what price will do, we know from factual history that when silver is below 53-1 gold is relatively cheap and above 53-1 silver is relatively cheap. As I write the ratio is about 80-1 which means silver is a lot cheaper than gold. So either silver goes up, or gold goes down or both at the same time and eventually we will regress to the mean of history.

Likewise, for 95% of the time since the discovery of platinum in 1748 the metal has had a premium to the price of gold due to it being a lot more rare than gold. Lately the prices of the two commodities have inverted and platinum sells at about a $420 discount to gold. That’s a record by the way.

Buying or selling anything when it is an extreme of emotion is the best way to profit. We can only guess from one day to the next what the correct price is for anything. But a study of the history of prices will immediately reflect when you are somewhere never gone before. In short at least compared to gold, both platinum and silver are cheap. If the level of debt in the world makes you think that maybe spending is not a surefire way to profit and debt is the same as slavery, it might be nice to own something that you can hold in your hand that has always had some value. Gold, silver and platinum make great insurance policies in times of financial chaos. Right now both silver and platinum are relatively better value than gold and those companies who are going to produce them should increase in value more than those of gold.

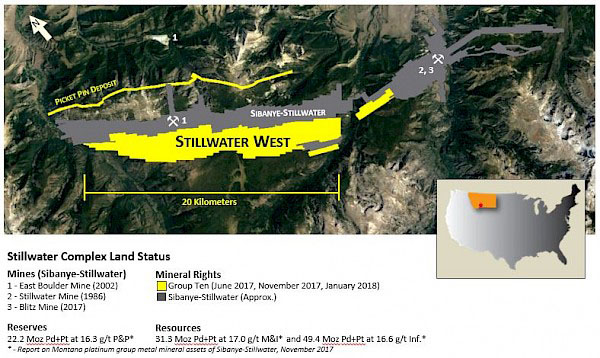

Group Ten Metals has put together a large land position in the Stillwater Complex in Montana adjacent to the 80 million ounce Pt/Pd resource belonging to the Sibanye-Stillwater Mine. The exploration on the Group Ten package is brownfields with management having a solid background and experience with PGMs and Ni projects including Stillwater, Wellgreen and Goldfields.

The 54 square km land package the company refers to as the Stillwater West project shows an 18 km long PGM soil anomaly also containing cobalt and gold. Just like the Stillwater Mine next door.

Within the Stillwater West property are found 12 major geophysical anomalies from 3 to 6 km in length to overlie the soil anomalies. Group Ten has drill data from 215 holes with over 28,000 meters of drilling. They have 11,000 meters of drill core. The Phase 1 exploration program in progress consists of relogging and assaying the 11,000 meters of core and putting together all the data into a geological model. At the conclusion the Phase 2 portion will drill test the highest priority targets. A drill permit has been applied for and the company believes drilling will commence later this summer.

I should remind readers that 78% of platinum production comes from South Africa. Certain political parties in the country are calling for an open season on white farmers. When South Africa goes the way of Zimbabwe it will leave Russia as primary producer of the PGMs. There is, of course, a coup d’état in progress in the United States with various powerful three-letter agencies determined to overthrow the democratically elected president and to go to war with Russia. I happen to believe that is the worst of bad ideas but who am I?

Should South Africa go the auto-stupid route and the coup succeed, it might be nice to have another alternative source for PGMs.

Both companies are headed by Greg Johnson; he has used the same model as he used with Novagold going back to 2000 in Alaska. He targeted a mineral and then put together a package of land properties in the same region. He has done …read more

From:: The Gold Report