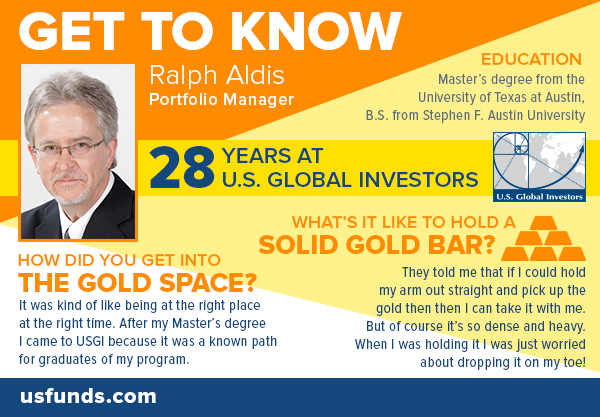

Meet Ralph Aldis – one of the longest standing members of the investment team at U.S. Global Investors. Ralph is responsible for analyzing gold and precious metals stocks in his role as co-portfolio manager for the World Precious Minerals Fund (UNWPX) and the Gold and Precious Metals Fund (USERX). As part of his gold stock research and analysis, Ralph frequently meets with key players in the mining space, including company management. Whether he’s visiting a mine site in another country or speaking on a panel at a gold conference here in the states, this tacit knowledge is a crucial part of his success as a fund manager.

I invite you to learn more about Ralph’s role and hear his insights into the gold world in this short Q&A.

Where do you expect to see gold production in the next few years?

It’s possible that the U.S. could see a rise in gold output this year. China production fell last year, Australia production has been going up slightly and Russia production is somewhat flat. I think with some of the new revisions to the Environmental Protection Agency (EPA) rules, mining projects could move forward on a more known timetable. One of the things the Trump administration has been trying to do is simplify the process of obtaining a mining permit. If companies can get the permits more easily then I think we’ll see some production growth in the U.S.

What are your top three gold stock picks right now?

One of my favorite gold stocks right now is St. Barbara Ltd. The company is based in Australia and has two mining operations. It’s been hitting it out of the ballpark in terms of performance driven by strong management. The CEO came in to our office about two years ago, Bob Vassie, and the stock price was 18 cents then and today it’s 5 dollars. I think St. Barbara is consistent in terms of management and has solid execution – everything that you’d want in a gold miner.

|

Another stock I like that’s in the mid-cap space is Wesdome Gold Mines based in Canada. One of its mines that is on care and maintenance recently had phenomenal drill hits down to deeper levels. What we’ve been finding with mines in the last few years is seeking funding in order to drill deeper to find deposits. I think it will probably be one of the next take outs in Canada, in terms of someone seeking a safe jurisdiction to operate in.

A third stock I like right now that is a micro-cap is Barksdale Capital Corp., a base metals exploration company located in Arizona. Its property sits right next to Arizona Mining’s property, which was recently bought out for $1.4 billion. Right now Barksdale has a market capitalization of $30 million. This valuation difference is massive and I think someone will probably want to buy them too and develop the project, since it’s too cheap to just leave it.

Describe a memorable mining project visit.

I visited a gold discovery site in Ecuador many years ago and for this particular visit it was very difficult to reach the site. It was in the southern part of Ecuador, near the border with Peru, a previously contested area, which is why it had not been explored and discovered for some time.

We first took a commercial aircraft to Quito, then from there we took a charter aircraft to get to another location. Then we rode in a helicopter and then a canoe! We canoed for a while since the helicopter couldn’t land closer to the site due to heavy tree coverage. It was a relatively new discovery and, in fact, it’s only just now going into production 10 years after I visited it.

During the trip we were evaluating the potential of the project and its deposit size, but since there was thick jungle coverage it was difficult to assess. Often times there will be a deposit discovered with high drill grades of grams per ton, but it has to be large enough to eventually justify the capital to build an operating mine.

Explore investment opportunities in gold and precious metals!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 06/30/2018: Klondex Mines Ltd., Barksdale Capital Corp., Wesdome Gold Mines Ltd., St. Barbara Ltd.

From:: Frank Talk