By Jody Chudley

This post Today’s Buy Alert: A Blue-Chip Juggernaut appeared first on Daily Reckoning.

If you are interested in owning one of the bluest-chip companies on the planet while generating a 15 percent annualized return over the next five years, then Nestlé (NSRGY) is just the stock for you.

At least that is what legendary hedge fund manager Dan Loeb of Third Point Capital thinks, provided Nestlé is willing to heed his words of advice.

I think Mr. Loeb may be just the kick in the pants this great old company needs right now.

Let me explain…

Nestlé — 152 Birthday Candles And Counting

Nestlé is an absolute juggernaut of a business. It has a market capitalization (number of shares outstanding multiplied by the share price) of nearly $240 billion which places the company on the edge of being one of the ten largest companies on the planet.

This is a blue, blue, blue chip if there ever was one.

Nestlé has its base of operations in Vevey, Switzerland. The company had been around for quite some time — 152 years to be exact. I guess you could say that the business has proved to have some staying power.

For an idea of the giant size of this company, consider that other publicly traded companies with a similar market capitalization include Chevron (CVX), Johnson and Johnson (JNJ) and Walmart (WMT). There are literally only a handful of companies of this size in the world.

Nestlé employs an astounding 340,000 people globally, has more than 2,000 brands/products, sells those products in 190 different countries and is the single largest food and drink business (by sales) on our fine planet.

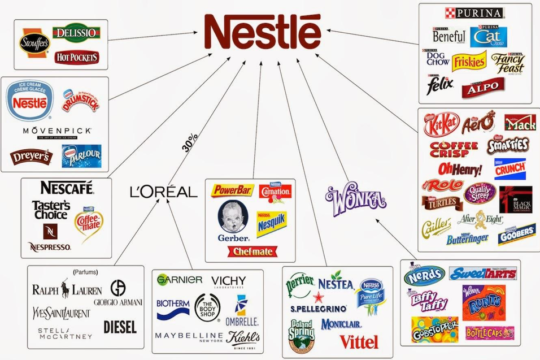

We have all seen the name Nestlé repeatedly, but until you see all of the brands that are actually under the corporate umbrella, you can’t really appreciate how big the company is.

Thirty of Nestlé’s individual brands have sales of more than $1 billion by themselves. Each of those brands alone could be a multi-billion dollar company. Here are a few that you’re already probably familiar with:

Source: Nestlé Website

Nestlé could hardly be more diversified which makes the cash flow that underpins the company’s share price and dividend incredibly reliable.

The company is diversified both by product, but also by geographic region. The United States is Nestlé’s largest market followed by China, France, Brazil, Germany and then down the list.

Dan Loeb Is Looking To Give This Great Company A Jump-Start

Nestlé is clearly a terrific company with dominant brands names that churn out gobs of cash flow.

In recent years though, Nestlé has been missing one thing — growth.

Nestlé’s earnings per share have flat-lined since 2012. Not surprisingly, since it is earnings growth that drives share price performance over time, Nestlé’s shares have also underperformed.

Not to worry, Third Point’s Dan Loeb has a plan to fix all of that. Better still, he believes in his plan (and Nestlé) so much that he has bought $3 billion worth of company shares.

You can check out Loeb’s plan at the website he created to unveil his recommendations called Nestle Now. On the website you can scroll through his 34 page presentation which details his reasoning.

In the plan, Loeb explains how he wants the 152 year old company to embrace a sense of urgency. He thinks that management needs to be bolder, sharper and faster in its decision making and operations processes.

Loeb’s actual words include his opinion that “Nestle’s insular, complacent, and bureaucratic organization is overly complex, lethargic, and misses too many trends”

Given the massive size of this business, I bet that he raises some very valid points.

Loeb had been speaking with management directly for over a year on these matters with no success. Now, he is taking his action plan to the public.

Specifically, Loeb wants Nestlé to spin-off businesses that no longer fit in with the company’s core strategy. Those would include frozen foods, confectionery products and ice cream. Then, he wants the company to split into three divisions — nutrition, beverages and grocery — each of which would have their own independent CEO.

Loeb’s view is that his recommendations, along with a focused share repurchase program that can be funded by the sale of a minority ownership interest in L’Oréal, can set this dominant business back on a growth path.

By incorporating his suggestions, Loeb believes that Nestle could double earnings per share over the next five years. Doing so should provide investors with at least a 15 percent annualized rate of return, more if you factor in the 3 percent dividend.

That sounds good to me.

Even if his plan doesn’t work out exactly as laid out, investors aren’t taking much risk by holding shares of this dominant company. At the very least, owning Nestle shares is going to result in a solid 3 percent plus dividend yield. The upside could see a near 20 percent annualized rate of return over five years with dividend included.

Here’s to looking through the windshield,

Jody

The post Today’s Buy Alert: A Blue-Chip Juggernaut appeared first on Daily Reckoning.

From:: Daily Reckoning