By Frik Els

Gold enjoyed one of its best trading days in months on Tuesday, bouncing off its 2018 low struck on Monday. Gold for delivery in August, the most active contract on the Comex market in New York, touched a high of $1,258.50 an ounce in the morning.

Surprisingly brisk pre-holiday trading saw 28m ounces exchange hands, pushing the metal up 1.3% from yesterday’s settlement price. The recovery came after two weeks of relentless selling that wiped more than $50 off the price and pushed gold through several support levels.

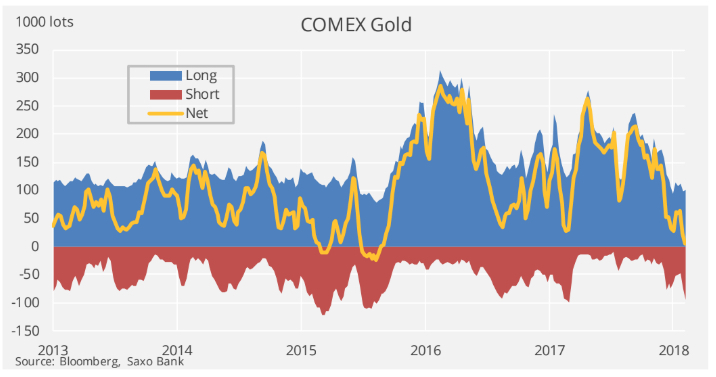

The reduction in net longs has been the equivalent sale of 700 tonnes of gold that the market has absorbed during 2018

Hedge funds and large-scale speculators active on the derivatives market seemed to have lost confidence in gold’s ability to move higher and last week all but abandoned their bullish positions, cutting longs – bets on a higher gold price – by 82%.

According to the CFTC’s weekly Commitment of Traders data up to 26 June released on Friday speculators now have a net long positions of just 4,186 lots or 13 tonnes after adding significantly to short positions – bets that gold could be bought back at a lower price in the future.

Bullish positioning is now at levels last seen at the end of 2015 when gold briefly dipped below $1,050 after the market went into a net short position for only the second time since 2006, when government first started to collect the data.

Ross Norman of Sharps Pixley, London’s top bullion broker, in a blog post writes that with speculators surrendering their long positions “the market is now at least clear for a rally”:

Yes, the US dollar has provided headwinds this year, but it has been that overhang of stale spec longs that for me has weighed on sentiment in the market.

The reduction in net longs has been the equivalent sale of 700 tonnes of gold that the market has absorbed during 2018.

With the market in the dog days of mid-Summer doldrums [a rally] probably seems unlikely … but better a little early than a little late.

Gold bugs must be hoping for a rerun of hedge fund moves following the six-year low hit December 2015.

By July 2016 speculators owned an all-time record number of net long contracts equal 893 tonnes boosting the price by more than $300 an ounce over the period.

Source: Saxo Bank via www.TradingFloor.com

The post Gold price ‘cleared for rally’ after hedge funds dump 700 tonnes appeared first on MINING.com.

From:: Mining.com