Source: The Critical Investor 07/02/2018

The exceptional zinc mineralization reported could indicate a feeder system, The Critical Investor reports.

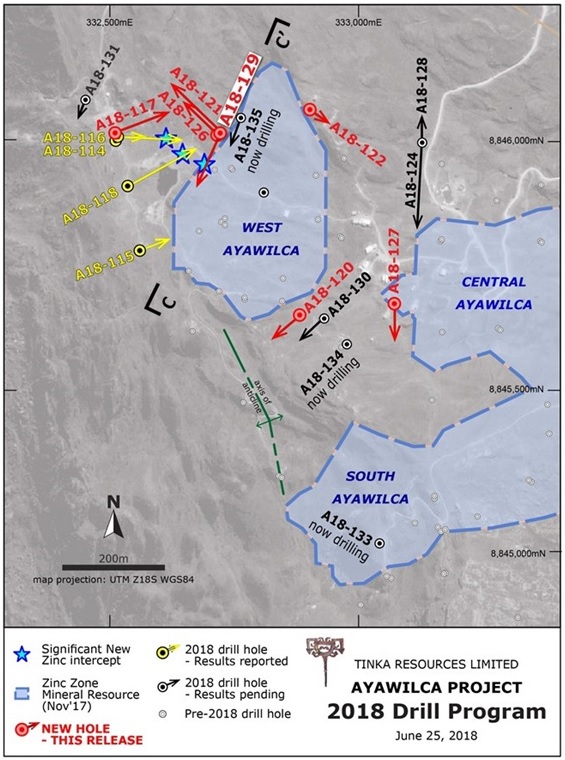

Ayawilca project; drilling location

1. Introduction

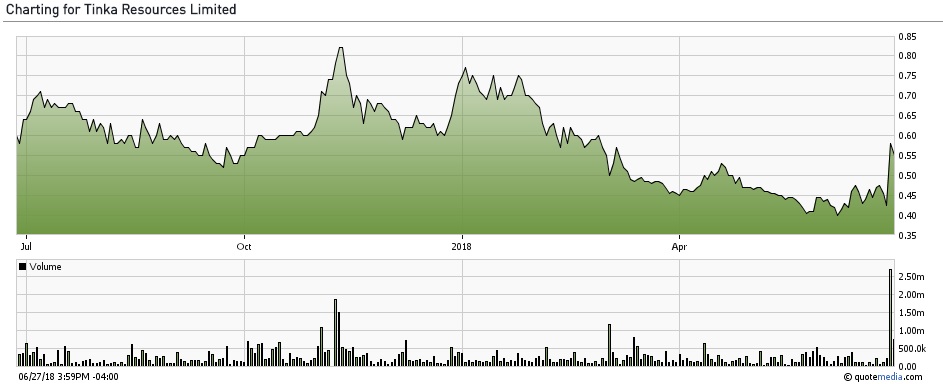

Investors had to wait longer than expected for a big hit, but this week Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) proved that looking for substantially more mineralization first instead of preparing a Preliminary Economic Assessment (PEA) is a viable strategy. The latest hole returned an amazing intercept of 10.4m grading 44.0% zinc (Zn) at West Ayawilca, and what is particularly interesting is that management seems to be verifying their new theory on Ayawilca structural controls of geology with this result. The share price reacted accordingly, with an impressive 36% jump and 2.7M shares traded volume on the day of the announcement:

Share price Tinka Resources; 1-year timeframe; source tmxmoney.com

Obviously lots of investors were impressed, and in my view rightly so, as this news could indicate potential for more and higher-grade tonnage than anticipated. It seems a bottom has formed at CA$0.40-0.45/share, even a bit lower than my forecasted C$0.46-0.48 from the April update, as the selling took longer than expected. Fortunately, this seems behind us now considering the massive volume, also against neutral to slightly negative sector sentiment. The potential implications for the resource and economics can be read in this article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Tinka’s performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka’s management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

2. Exploration Results

It was a pleasant surprise for Tinka Resources and investors to see an impressive intercept like 10.4m @44.0% Zn being returned by step-out hole A18-129, as part of the current drill program at the Ayawilca project in Peru. Management started focusing more on expanding the high-grade West and South zones as Zone 3 didn’t return the results that were hoped for so far, and this seems to be the right move.

Despite all the noise about the latest and pretty large CA$16.2M financing in March-April of this year, I am convinced that Tinka management knows very well what it is doing on the exploration side of things, and it shows so far. It is also always interesting and inspiring to talk to CEO Carman, and hear him elaborating about different geological concepts that might be tested. The Ayawilca deposits don’t look very straightforward, but Carman and his team seem more than able to track them down.

Let’s have a look at the latest drill result first, as mentioned in the latest news release. Six holes were reported from the West Ayawilca area (holes A18-117, 120 to 122, 126, 129) and one from the Central area (A18-127).

Key Highlights of the West Ayawilca Area:

Hole A18-129:

- 11.9 meters at 39.6% zinc, 0.8% lead, 45 g/t silver & 761 g/t indium from 339.4 meters depth, including

10.4 meters at 44.0% zinc, 0.4% lead, 43 g/t silver & 869 g/t indium from 340.6 meters depth; - Shallower intercepts in A18-129 include:

- 21.2 meters at 9.0% zinc, 0.1% lead, 13 g/t silver & 53 g/t indium from 260.0 meters depth, including

4.2 meters at 19.2% zinc, 0.1% lead, 17 g/t silver & 186 g/t indium from 277.0 meters depth; and - 6.5 meters at 11.0% zinc, 0.1% lead, 8 g/t silver & 52 g/t indium from 290.5 meters depth.

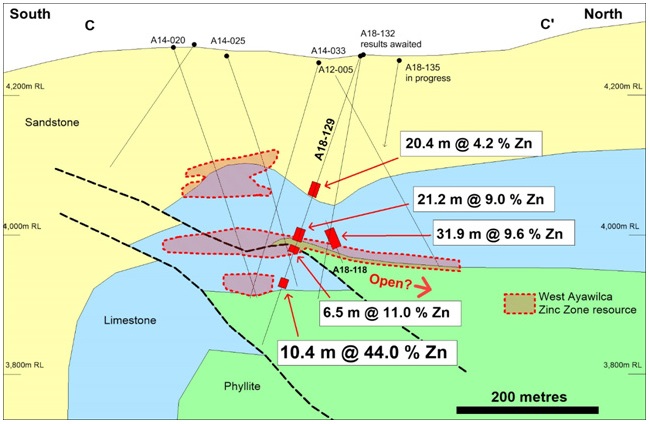

An average grade of 44.0% Zn in a substantial intercept in sulfides is world class, and is only encountered in Tier I deposits like Arizona Mining Inc.’s (AZ:TSX) Taylor deposit (up to 31.7%Zn) and Ivanhoe Mines Ltd.’s (IVN:TSX) Kipushi deposit (their average grade is even a freaky 34.9% Zn, twice as high as the next highest average grade zinc deposit, according to Wood Mackenzie). As this is a step-out hole, drilled about 50m west of the boundary of the outlined West Ayawilca ore body, it is interesting to see that the existing ore body extends to the west via the shallower intercepts, which are at the same depths, and have very decent width and grade as well.

- Other significant recent drill intercepts include:

Hole A18-117: - 7.8 meters at 8.1% zinc, 5.1% lead & 183 g/t silver from 94.0 meters depth*.

- Hole A18-122:

- 2.4 meters at 14.9% zinc, 0.3% lead, 25 g/t silver & 163 g/t indium from 351.3 meters depth.

- Hole A18-126:

- 1.0 meters at 23.7% zinc, 24 g/t silver & 30 g/t indium from 101.1 meters depth*; and

- 1.7 meters at 18.9% zinc & 28 g/t silver from 111.5 meters depth*; and

- 8.7 meters at 3.9% zinc, 1.4% lead, & 117 g/t silver from 235.7 meters depth.

There is a lot of consistency in the mineralization throughout the property, as almost any mineralization shallower than say 300m is relatively narrow (<10m) in width/thickness, veiny and hosted in sandstone. Hole A18-120 and A18-121 weren't mentioned in the highlights, so I assume these results weren't economic. As can be seen at the map of the latest drill collar locations, (very) economic results like A18-126 and A18-129 can be located very close to uneconomic results like A18-121, so a lot of drilling is needed to precisely define mineralized boundaries:

It appears that A18-120 just remained outside the mineralized horizon, but when we start looking at the C-section, it becomes clear what the geologists were looking for: a stacked system of two or more potentially layered limestone host rock. They came to this concept after analyzing the cores more in detail on structural controls, and discovered a few low-angle thrust faults west of West Ayawilca, in the large, semi-vertical North-South trending fault area (which runs west of West and South Ayawilca), potentially capable of laterally (horizontally) displacing the mineralized limestone:

This is why hole A18-129 proved them right. …read more

From:: The Gold Report