Source: Rick Mills for Streetwise Reports 07/02/2018

Rick Mills of Ahead of the Herd discusses why he believes one company that has a large lithium resource estimate for its Nevada deposit is undervalued.

On June 11, Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:FSE) published its resource estimate for its Clayton Valley Lithium Project in Nevada on SEDAR, detailing the technical report it first published on May 1. Putting the NI 43-101-compliant report on SEDAR gave CYP added exposure to what might become one of the most exciting stories in junior mining this year.

The Vancouver-based company has so far flown under the radar of investors, trading at a ridiculous 0.32 cents a share as of close of trading Friday. Ridiculous in our opinion because the stock price is nowhere near reflective of what Cypress has in the ground, providing junior mining investors with a spectacular entry point. (Read “Cypress has world class Clayton Valley Nevada lithium resource” for our calculation on what CYP should be worth, based on the current market value of lithium in the ground, multiplied by CYP’s resource estimate and divided by its outstanding shares).

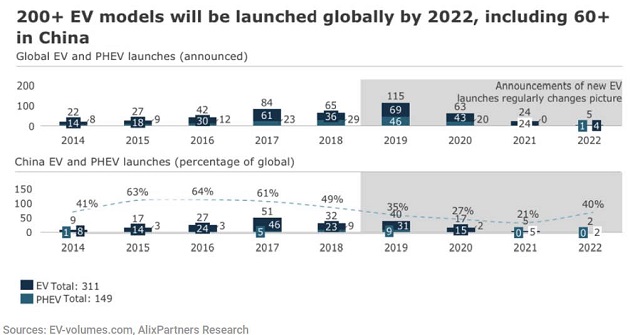

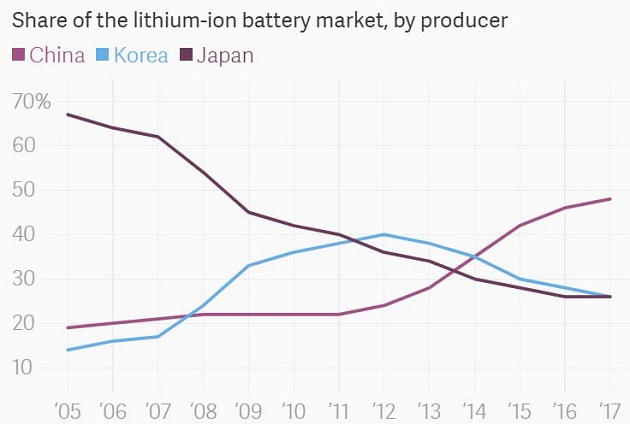

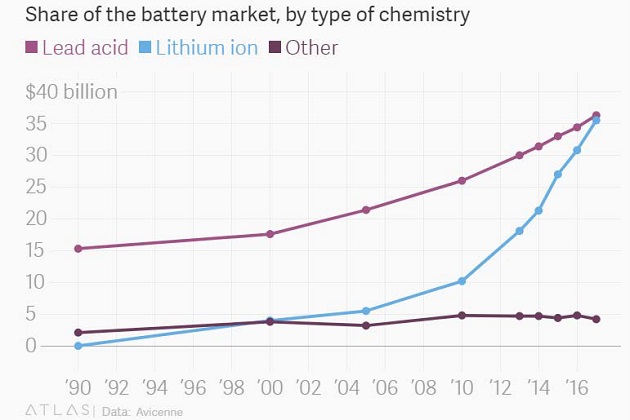

Before we run through the numbers, let’s set the stage with a little background on electric vehicles (EVs) and the lithium market, which is growing daily as countries make the shift from internal combustion engine (ICE)-based vehicles to EVs and more auto-makers and battery manufacturers enter the space.

The EV revolution

While modern electric vehicles have existed as prototypes and with very limited commercial production since the 1990s (General Motors’ EV1—for a great history watch Who Killed the Electric Car?), the real momentum in the switch from cars equipped with gas and diesel-powered internal combustion engines to vehicles powered with lithium-ion batteries started in 2009 by then-President Obama. Obama announced his administration was putting aside $2.4 billion in order for American manufacturers to produce hybrid electric vehicles and battery components.

Of course Tesla Inc. (TSLA:NASDAQ) was a few years ahead of Obama, forming in 2003 and producing its first model, the all-electric Model S sedan, in 2008.

Electric vehicles have far fewer moving parts than gasoline-powered cars—they don’t have mufflers, gas tanks, catalytic converters or ignition systems. There’s also never an oil change or tune-up to worry about. But the clean and green doesn’t end there. Electric drives are more efficient than the drives on ICE-powered cars. They are able to convert more of the available energy to propel the car therefore using less energy to go the same distance. And applying the brakes converts what was wasted energy in the form of heat to useful energy in the form of electricity to help recharge the car’s batteries.

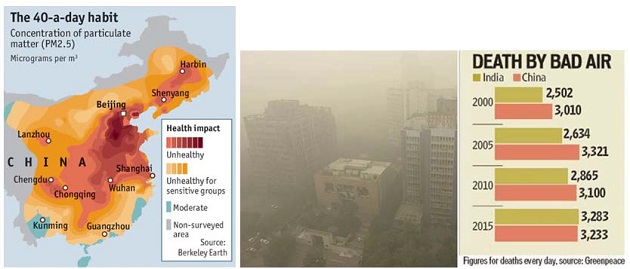

Electric vehicles are totally emissions-free. China, the world’s second-biggest economy, in a move to cap its carbon emissions by 2030 and curb worsening air pollution, said it will set a deadline for automakers to end sales of fossil-fuel powered vehicles and push into the market, led by Chinese EV juggernauts BYD and BAIC Motor Corp. India, France, Britain and Norway are doing the same.

But the key to EV market penetration has always been the batteries. How can they be made cheaply enough to compete with gas-powered vehicles, and with a reasonable range that doesn’t have the driver frantically searching for a charging station in the middle of nowhere? (As a personal aside, during a recent short drive from Kelowna to Vancouver an aheadoftheherd.com technician saw two EV charging stations at highway rest stops. The infrastructure is coming, folks.)

Part and parcel to this question is lithium. Lithium carbonate and lithium hydroxide are key components of the lithium-ion battery cathode, making it an extremely sought-after battery ingredient.

U.S. lithium dependence

The Clayton Valley in Nevada started producing lithium in 1966 and the Silver Peak lithium brine operation owned by Albemarle is currently the only producing lithium mine in the U.S. In 2008 the National Research Council saw lithium as potentially becoming a critical mineral due to the expected growth of hybrid vehicle batteries. Two years later the U.S. Department of Energy’s Critical Materials Strategy included lithium as one of 16 key elements. The country currently imports most of the lithium that it consumes—with import reliance today pegged at greater than 70%. Lithium is among 23 critical metals President Trump recently deemed critical to national security, and signed a bill that would encourage the exploration and development of new U.S. sources of these metals.

It’s unfortunate for the United States that its dependence on lithium coincides with the ramping-up of demand for the white metal. But it’s also an extraordinary opportunity for Cypress.

Demand outstripping supply

Approximately 215 kt LCE was produced in 2016. Chile was the world’s largest producer in 2016 with 37%, followed by Australia with 34%.

By 2025, if a very reasonable 30% of mining projects come to term, 700 kt LCE will be produced. Australia will supply 45% of world production at this time; Chile and Argentina will each supply 15%, China 10%, and the rest of the world 15%.

According to Roskill’s 15th edition market outlook report, demand from companies that produce batteries to power electric cars, laptops, cell phones, etc. is expected to increase 650% by 2027, with overall lithium demand forecast to rise more than threefold over that period. Electric vehicle lithium-ion battery pack manufacturers’ share of the overall market for lithium-ion batteries will grow from 46% in 2017 to 83% by 2027.

Use of lithium hydroxide will increase from 25% of lithium compounds used in rechargeable batteries in 2021 to 55% by 2027.

The Chinese vehicle market is forecast to grow to 29.1m units this year, on its way to 38.2m in 2025 (equal to 52% of global volume growth over that period). By 2030, 40% of vehicle sales in the region will be EVs. The European car …read more

From:: The Energy Report