By Cory댊

Global Bull Markets Testing A Breakdown Line

The post below is from our friend Dana Lyons. He points to major markets around the world that have all pulled back and are now testing long-term uptrend lines. There are key junctures for markets especially when they are all showing similar patterns. Recent history would tell us that there will be a bounce but for all the bears… maybe this time is different?

Click here to visit Dana’a free blog for more great commentary.

…Here’s the posting…

A slew of global equity markets are testing key bull market Up trendlines.

After a few slow weeks, our #TrendlineWednesday feature on Twitter today was more prolific. Much of that can be attributed to a wide array of equity indices testing key bull market uptrends. Specifically, several are testing their cyclical bull market Up trendlines – primarily from early-2016 lows (although, some of us would argue that the cyclical bull actually still stems back to 2009). In any event, these ~2-year old trendlines hold considerable significance. They have provided the necessary support to maintain the bull markets’ pace of advance thus far. Therefore, a break of such support would undermine the pace of advance, at a minimum – and potentially subject the markets to meaningful downside pressure.

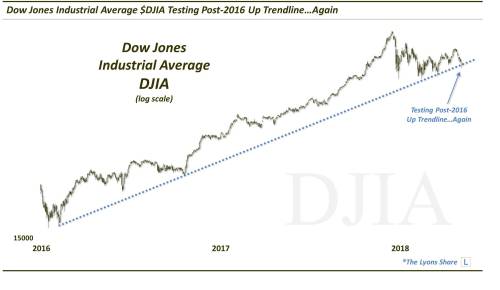

As mentioned, several of these trendlines are under siege currently from a number of equity indices, both domestically and abroad. Leading off, due to visibility, is the Dow Jones Industrial Average which is testing the Up trendline from its early 2016 lows.

Similarly, the broader NYSE Composite is also testing its post-2016 Up trendline.

As we mentioned above, it’s not just U.S. indices experiencing tests of their bull market uptrends. In Hong Kong, the Hang Seng is also testing the Up trendline from its 2016 lows.

And around the world in Chile, we see it’s benchmark stock index, the IPSA likewise testing its post-2016 Up trendline.

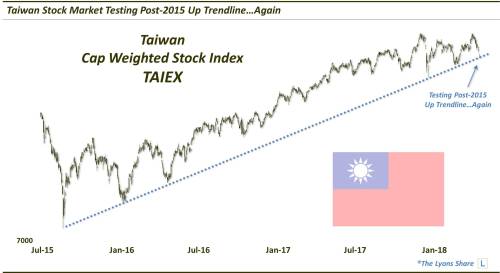

Finally, another emerging market, Taiwan, is testing its Up trendline stemming back to its cyclical low in 2015.

So what will become of all these key trendline tests? Time will tell. There are markets that we like a great deal — and others that we don’t. But the fact that we have an abundance of tests underway simultaneously suggests that we’re at another important juncture in the global market — so stay on your toes.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

From:: The Korelin Economic Report