Source: The Critical Investor for Streetwise Reports 06/27/2018

The Critical Investor delves into the first new copper project fully permitted in Arizona in a decade.

Johnson Camp Mine

Despite copper and other base metals being punished these days, and mining sentiment not at its best with China being drawn into a potential trade war with the U.S., Excelsior Mining Corp. (MIN:TSX; EXMGF:OTCQB) proved a lot of nay-sayers wrong on June 25, 2018. The company was granted the second (and most difficult to obtain) operational permit, the Underground Injection Control area permit (UIC) by the Environmental Protection Agency (EPA). It was quite an ordeal, as it took Excelsior from October 25, 2017 (receiving the draft permit) until now, which is almost exactly eight months. In comparison, the first operational permit, the APP permit, took not even three months going from draft permit to granted permit. On an important side note: the APP permit was finalized after another five-week appeal period, which returned no appeals at all, fortunately. It can be assumed that the UIC permit also has to go through this kind of appeal period before management has it in hand. As I explained in an earlier update on the permitting process, I view the chances of no appeals on the UIC permit to be equally as good for Excelsior Mining. This period is likely reflected in the effective date, as per the news release:

“The EPA has issued Excelsior a UIC Permit with an effective date of August 1, 2018. Once effective, the UIC Permit (along with the Aquifer Protection Permit), requires the Company to be in compliance with protective permit conditions prior to the initiation of production activities. The UIC Permit is good for production of up to 125 million pounds per annum; this is the final operating permit required to get into production.”

Also note that this permit is covering the nameplate production capacity, so no additional extensions/expansions on the current permit, etc. are needed.

As Gunnison is the first new copper project in Arizona in a decade being fully permitted, and the first greenfield ISR copper project in North America to be fully permitted (nearby Florence got just a pilot plant permitted not too long ago, not the full project), plus Arizona as a jurisdiction is very strict on mining regulations, this is clearly quite an achievement. I fancied the chances of Excelsior a great deal, but with permits you always have to wait for the element of proof: a granted permit. A lot of credit goes to VP Sustainability Rebecca Sawyer, very familiar with Arizona agencies, who led the permit application process, and to CEO Stephen Twyerould who worked tirelessly to inform nearby communities on a very regular basis.

As Excelsior raised US$30 million in January of this year, the company is sufficiently cashed up to start the construction phase this summer, as CEO Twyerould indicates in the news release. Because of the staged construction, the initial capex is very small, just US$49 million, so some of the current cash position can already be used to start with upgrading and constructing the SX-EW plant, the ponds, power and transmission and the pipelines from the wellfield to the processing plant. After arranging the necessary balance of capex, the wellfield can be constructed.

Management indicated to me that they want to raise US$50–60 million, as they forecast a need for about US$25 million in working capital (which has already been raised more or less with the US$30 million). Such an amount (actually really small, although there are always capex overruns in mining projects, but it sure helps there already is an existing processing facility, and the project is relatively small compared to those multi-billion-dollar traditional giant copper mines) should be easy to finance for management. Usually I would say, that the equity part is almost a done deal in a typical 1/3–2/3 equity/debt capex funding, and the remaining US$50–60 million could easily be all debt.

However, the reality is these days that the debt financiers also like to have an additional equity sweetener, so it could very well be possible that Excelsior could indeed arrange US$45–55 million in debt, but also has to accept another estimated US$5–8 millin in equity. I would prefer all debt, of course, in order to avoid more dilution, but such an amount would be limited, assuming such a raise would happen at C$1.00 or higher (F/D share count stands at 222 million at the moment).

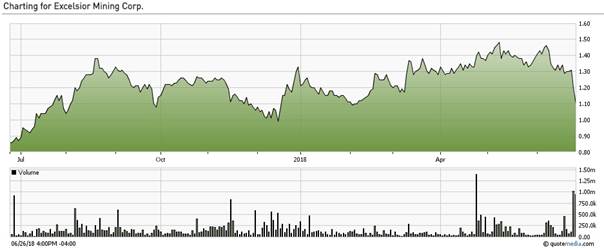

Speaking of C$1.00 share price levels, the UIC permit announcement caused a pretty intense liquidity event, as can be witnessed here:

Share price MIN.TO, 1 year time period; source tmxmoney.com

It can be speculated that some of the participants in the US$30 million round of December 2017 and January 2018 were selling some of their positions for a quick profit, but coming from C$1.00 and having to dump at C$1.10–1.30 a mere six months later doesn’t really sound very convincing. Excelsior is a long-term copper play, and institutional parties using this as a trading vehicle would instantly flag them as unreliable flippers. Therefore, in my view this is all retail, aiming to exit at a hoped-for spike on the news. Unfortunately for them, market- and metal sentiment isn’t very strong, and marketing on Excelsior is light, so there wasn’t enough buying pressure.

Notwithstanding this, I view this as a convincing buying opportunity once the selling has subsided. The undervaluation on Excelsior is pretty substantial after this sell-off, which I will show in a minute, especially after being fully permitted very recently. Another subject to consider is the changed corporate tax regime in the U.S., thanks to President Trump. We can say a lot about the guy, but he isn’t bad for mining projects in the U.S. I sure hope he quiets down on the impending trade war with China, which could send the entire world economy …read more

From:: The Gold Report