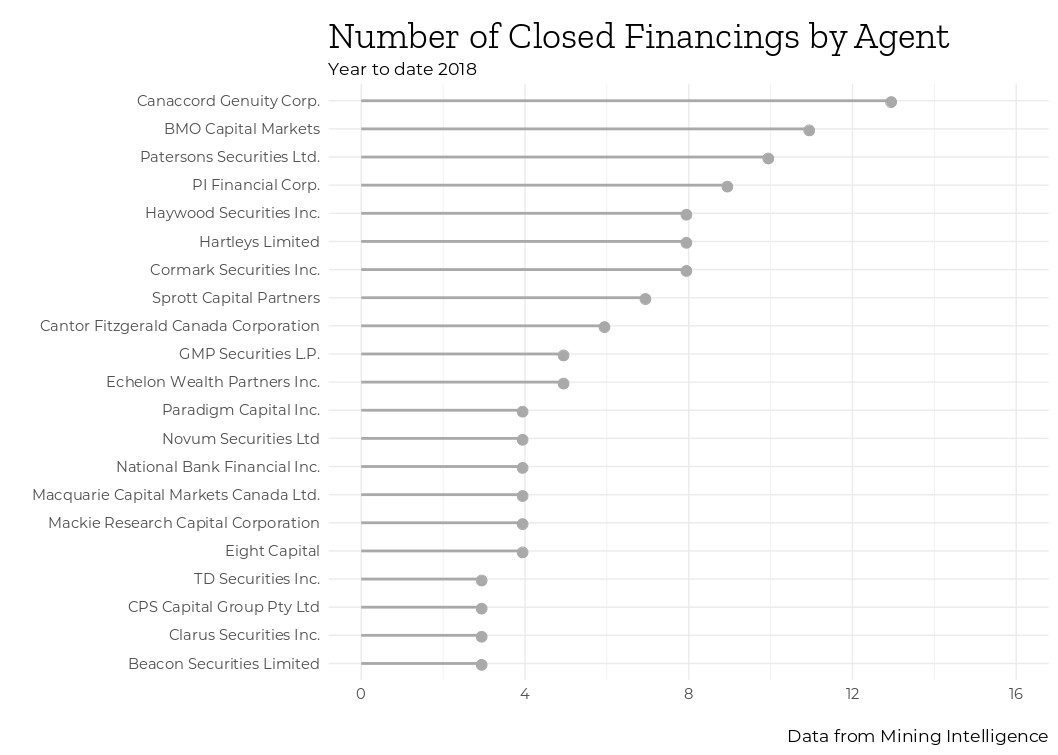

Canaccord Genuity has been involved in the most mining deals in 2018.

Canaccord has been an agent in 13 mining closed mining deals year to date ranging from lead underwriter to selling agent. Second is BMO Capital Markets with 11 deals.

Total number of agents that made mining deals in 2018 year to date were 99. Top 20 are graphed below.

Over US$4.4B financing was closed year to date with 42% of total arranged through agents.

Data is from Mining Intelligence looking at closed financings over US$10 million. Stock exchanges used are TSX, TSX-V, ASX, LSE, LSE-AIM, NYSE and JSE. Only completed placement offerings were compiled.

Here is a breakdown of the top deals supported by the top three agents:

Canaccord Genuity

Canaccord’s biggest deals this year was with battery material miners.

Nemaska Lithium – Canaccord was a selling agent for Nemaska Lithium’s US$217M project in Whabouchi, Quebec.

Mason Graphite – Canaccord was one of the syndicate underwriters for Mason’s US$36M that is developing its Lac Guéret natural graphite deposit.

Millennial Lithium – Canaccord was co-lead syndicator for Millennial’s US$18M financing for exploration and development activities at the company’s lithium properties in Argentina.

BMO Capital Markets

Like Canaccord, BMO’s biggest deals were in the battery material space.

Nemaska Lithium – BMO was was co-lead underwriter for Nemaska Lithium’s US$217M project in Whabouchi, Quebec.

Clean TeQ – BMO was co-underwriter for Clean TeQ’s US$114M financing to develop the Sunrise nickel-cobalt-scandium project in Australia.

Victoria Gold – BMO was a financial advisor to Victoria Gold’s US$99M financing of its Eagle project in the Yukon.

Paterson Securities

Walkabout Resources – Paterson was lead manager for Walkabout’s US$5M financing of the Lindi jumbo graphite project in Tanzania.

Crusader Resources – Paterson was joint lead manager for Crusader Resources’ financing funding the company’s Brazilian gold assets.

Metminco – Paterson was lead manager for Metminco’s US$4.3M financing. Funds were directed towards exploration activities.

Creative Commons image of finance board courtesy of Dick Thomas Johnson

The post Agents with the most mining deals in 2018 appeared first on MINING.com.

From:: Mining.com