Katanga boasts one of Congo’s biggest reserves of copper and cobalt, but it has underperformed for decades. (Image: Musonoie-T17 open pit mine. Courtesy of Katanga Mining.)

Congolese-American businessman and convicted fraudster Charles Brown has brought back a lawsuit against Glencore (LON:GLEN) the company considered dead, becoming the third court challenge the mining and commodities giant faces this year for control of its DRC mines.

Brown, one of the founders of Mutanda Mining — the world’s No.1 cobalt producer —, claims he’s owed $1 billion in compensation for a 19% stake he previously held in that company, and which was allegedly sold to Glencore in two fraudulent transactions, in 2007 and 2012.

The legal battle is the latest drama in the Congo after British regulators revealed in May they would open a formal bribery investigation into Glencore’s deals with Dan Gertler, an Israeli mining tycoon implicated in the payment of bribes to the country’s President Joseph Kabila.

Previously, Glencore’s partner on the Kamoto copper and cobalt project, state miner Gécamines, began legal proceedings to dissolve the joint venture because of persistent high debts.

And in March, a High Court in Kinshasa ordered Glencore chief executive Ivan Glasenberg, Aristotelis Mistakidis, head of the company’s copper trading business, and former Mutanda shareholder Alex Hayssam Hamze, to appear at a public hearing on July 2. According to Bloomberg News, they’re accused of using “violence and threats” to make Brown sign a document abandoning his May 2012 claim:

Brown says he was forced to sign the 2012 agreement against his will less than two weeks before Glencore announced a $340 million deal to boost its interest in Mutanda to a majority stake. He received a payment of $6.39 million in compensation at the time, according to the summons.

Emery Mukendi Wafwana, a Congolese lawyer accused in the summons of detaining Brown at his Kinshasa offices, said Brown negotiated and signed the agreement freely, before getting the document notarized and identifying the account to receive the funds.

Glencore was not aware of any payment made to Brown in May 2012, but was aware that he and Hamze were negotiating a settlement to end the dispute, the company said.

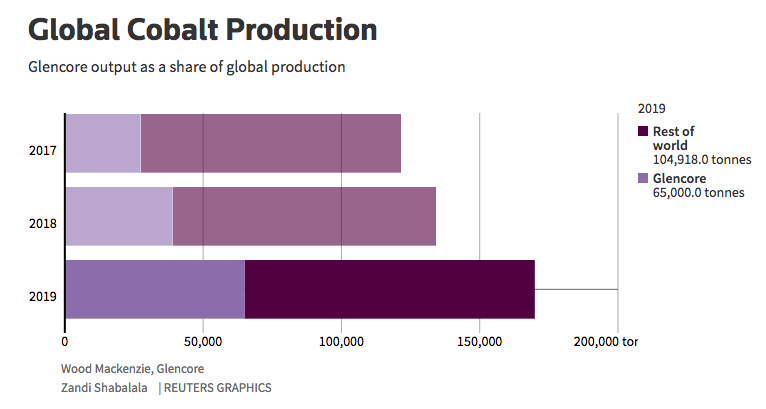

Glencore is the world’s No. 1 cobalt miner, while Congo is the largest producer of the key component for batteries that power electric vehicles. This latest development, then, reinforces the risks to global supplies created by a controversial mining code signed into law by President Joseph Kabila in March.

Source: Reuters.

Any disruption could push up cobalt prices from already historic highs of $90,000 a tonne to six figures sooner than expected. Copper could also be affected by any troubles in Congo, but any impact is likely to be less dramatic as the African country is only the world’s No. 5 producer of the red metal.

Citi, a US investment bank, calculates that Katanga together with Glencore’s Mutanda mine in the DRC will contribute 35,500 tonnes or 27% of global supply during 2018. Those figures are set to rise to 59,300 tonnes and 39% next year.

The Swiss company’s mounting troubles in the DRC could make it sell a stake in one or both of its local copper and cobalt mines, with the most likely candidates seen as Russian or Chinese companies, analysts say.

Bringing in a partner could help Glencore mitigate against future risks in the country, where elections will be held later this year. However, the move would also add another player to the market, just as automakers are trying to lock up cobalt supplies and so meet aggressive plans to increase electric car production.

Regardless, analysts are already predicting a price spike in Cobalt and other battery metals coming years. Citi says prices for cobalt are set to rise by a further 20% over the next two years hitting $100,000 a tonne by the fourth quarter this year, and average $110,000 by 2020.

The post Glencore faces third Congo legal challenge this year appeared first on MINING.com.

From:: Infomine