By Frik Els

Gold slipped back below $1,300 an ounce on Wednesday and is now trading flat for 2018, but investors in gold-backed exchange traded funds continue to see opportunity in the yellow metal.

New data from the World Gold Council show retail and institutional investors in gold ETFs poured a net $771.3m into global funds in May, despite a pullback in the US, the largest market.

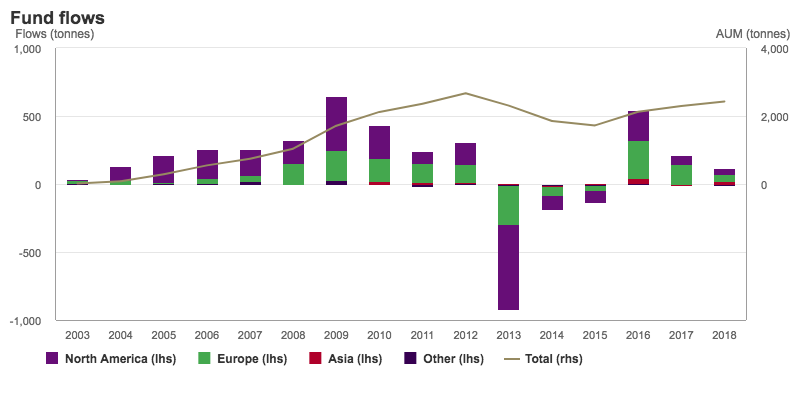

Global vaults now hold around 2,484 tonnes or a shade under 80m troy ounces after net inflows in May of 14.6t brought the year to date total tonnes acquired to 116.3.

US investors dumped nearly 30 tonnes in May, but the outflows were cancelled out by continued buying by Europeans and a surge in buying in Asia.

After spending $820m Asian bullion bulls added nearly a fifth to holdings in 2018. Although it’s still a fraction compared to Western markets at just over 100 tonnes.

Source: World Gold Council

2016 was the best year for funds since 2009 with global net purchases of more than 500 tonnes, primarily thanks to European bullion investors. In dollar terms 2016 was the most successful year for the industry which first emerged in Australia in 2003.

Total global gold bullion holdings hit a record 2,632 tonnes or 93 million ounces in December 2012.

The post Gold price: Investors are pouring $1 billion per month into ETFs appeared first on MINING.com.

From:: Mining.com