By Cory댊

Maple Gold responds to misleading statements made by newsletter writer

There has been a lot of attention recently on Maple Gold Mines after the slide Brent Cook presented at the recent conference in Vancouver. We now have a response from the Company which is outlined below.

I am a shareholder and continue to hold even though the shares have been pulling back recently. There should be some more news coming out with more drill results which I will follow up on.

Click here to visit the Maple Gold website for more Company information.

… Here’s the letter to shareholders…

It has come to our attention that a newsletter writer, while participating in a recent conference in Vancouver took Maple Gold Mines to task for the Company’s May 2, 2018 press release, which disclosed drill results for drill-hole DO-18-216. Not surprisingly, many of you were disturbed (as were we) by the conclusions he drew about the results disclosed in the above-mentioned release. As quoted in the first paragraph of the press release “DO-18-216 intersected 52m grading 3.53 g/t Au (uncut), within a broader, 158.2m interval grading 1.25 g/t Au (uncut) from 335m downhole (estimated vertical depth of ~220m) within the south-central part of the Porphyry Zone.” The higher-grade 52m interval was clearly disclosed throughout the press release and was unfortunately overlooked by the newsletter writer in the assessment.

Maple Gold agrees that investors need to read all press releases carefully and critically as the newsletter writer correctly advocates, but these same critical standards need to be applied when reading newsletters or listening to panelists’ discussions. In Maple Gold’s opinion, this newsletter writer erred in several ways on this occasion, which resulted in several erroneous conclusions that the Company believes had a potentially negative impact on the Company’s recent share price:

- Inadequate context was provided about the deposit characteristics and exploration stage

- The conversation was limited to focusing on a single aspect of the press release, i.e. the presence of a 1.5m high grade interval within a broad, lower grade interval

- The use of an interval calculator to obtain a “residual” interval (156.5m) and grade (0.44 g/t Au) described by the newsletter writer as “all waste”, overlooking the 52m long interval averaging 3.53 g/t Au (uncut) shown at the bottom of the broader interval (headlined in the release, highlighted in the first paragraph, table and shown on the cross section).

- The current largely inferred resource cut-off was confused with an eventual mine reserve cut-off to support the declaration that the average “residual” grade as calculated corresponded to waste. For reference, the closest analogue geologically to Douay in the Abitibi, the Malartic mine, has used mine cut-offs of 0.28 to 0.35 g/t Au (Agnico Eagle August 13, 2014 News Release).

Maple Gold appreciates the intention of the newsletter writer to help educate investors, but the way this example was used was not balanced or fair to the Company and resulted in misleading takeaways for investors. The Company acknowledges that, while a significant portion of the drill hole clearly carried robust grade distribution, portions of the top ~100 metres of the drill-hole may not make a pit-constrained resource estimation depending on the cut-off grade applied. Determining what material will be mined, stockpiled or considered waste is premature at this point and will be something considered in a PEA in the future.

In this note, we would also like to set the record straight and show that Maple Gold Mines respected all of the NI-43-101 disclosure and best practice standards, including those that the newsletter writer explicitly outlined in his conversation as being good indicators of a proper press release:

- Provide context for the press release, as well as key related data: We provided hole objective, interpreted drill plan, interpreted geological cross section, table of assay breakdown etc.

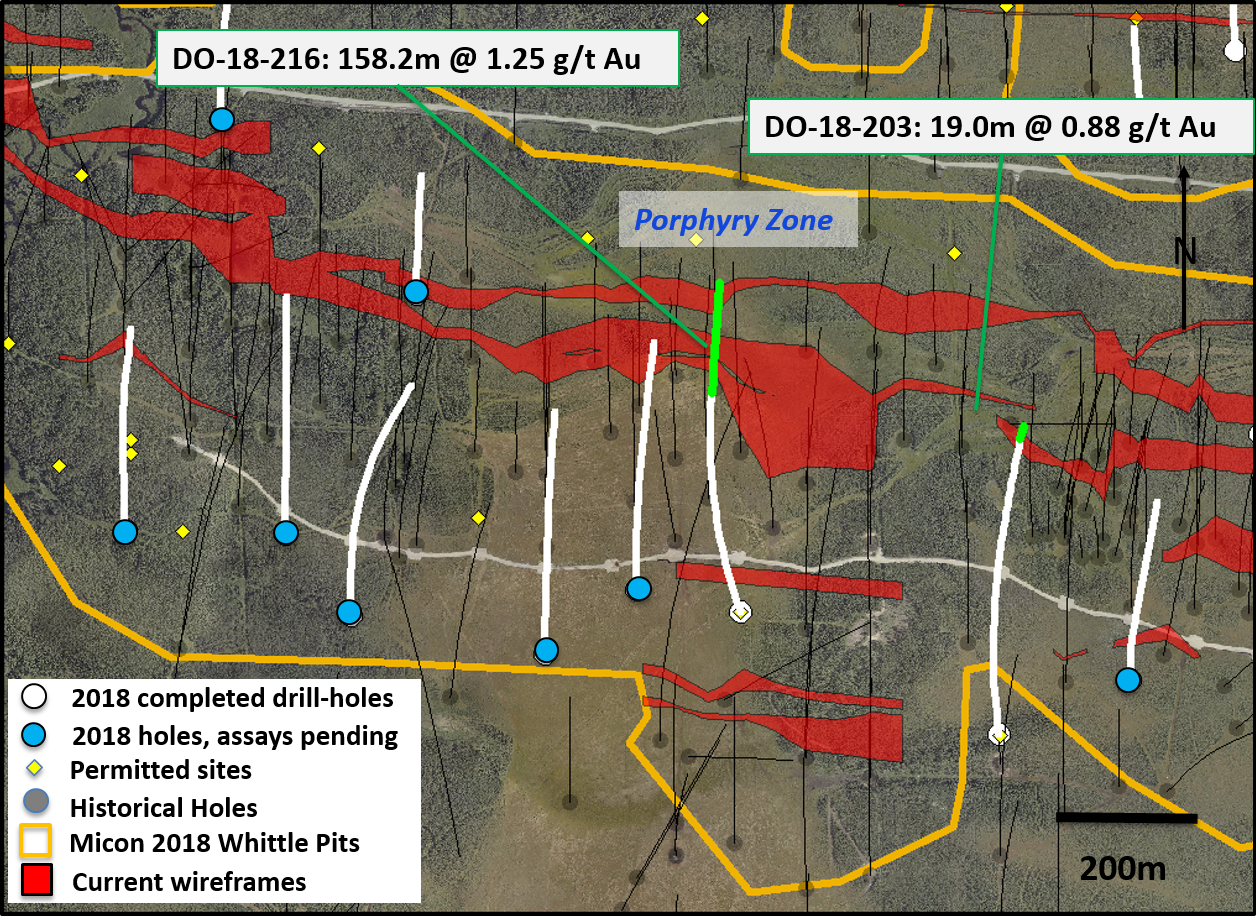

- Provide a plan map and geological/analytical cross section: The plan map (Fig. 1 below) clearly showed how the intercept released related to existing mineralized zones within the Douay resource area, and the section (Fig. 2 below) clearly showed both geology and gold grade distribution down the hole using a histogram format.

- Provide a table showing not only the intercept quoted, but also the higher grade intervals within it: This also formed part of the press release, and together with the grade distribution on the geological section again clearly showed that the higher grade portion of the intercept occurred in the last 52m. NI-43-101 standards require disclosure of any higher grade intervals within broader lower grade intercepts, as well as of location, azimuth and plunge of drill-holes, location of sample downhole, an estimate of true width vs downhole width, analytical methodology as well as the name of the lab where assays were completed, all of which were provided (see Table 1 below to view table that was included in the May 2, 2018 press release).

- Additional relevant information: Maple Gold provides high resolution core photographs so investors can view the nature of the host rock associated with mineralization.

Fig 1: Plan view, with context for the broader DO-18-216 mineralized envelope (Porphyry Zone). Wireframes defined at 0.1 g/t Au cutoff. Note distribution of historical drillholes, with a spacing of over 150m in several areas, …read more

From:: The Korelin Economic Report