Source: Maurice Jackson for Streetwise Reports 06/01/2018

Matthew Gili, CEO of Western Copper, speaks to Maurice Jackson of Proven and Probable about the company’s plans to go into production.

Maurice Jackson: Today we will highlight the next mid-tier production company. I’m speaking of Nevada Copper Corp. (NCU:TSX; NEVDF:OTC.MKTS), North America’s next copper producer. Joining us for a conversation is Matthew Gili, the president and CEO of Nevada Copper.

Matthew, who is Nevada Copper and what is the value proposition you present for investors?

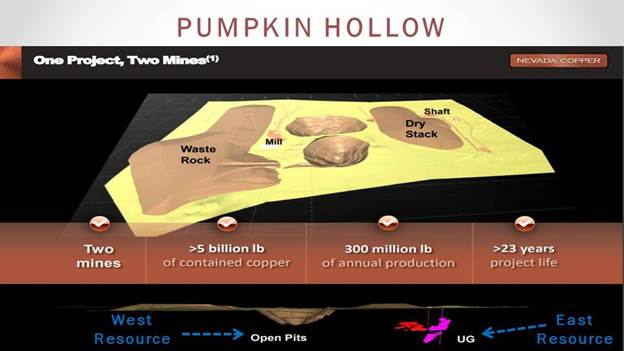

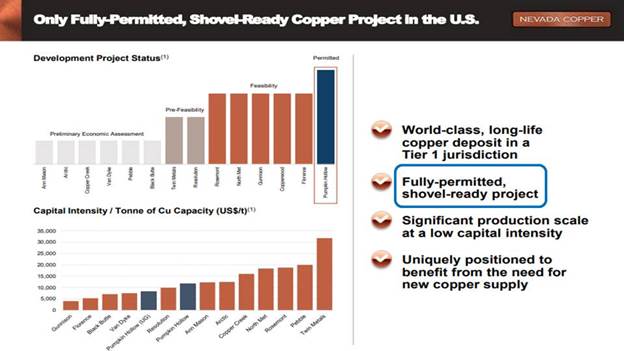

Matthew Gili: Nevada Copper is the owner of Pumpkin Hollow, a 5 billion pound resource of copper in Yerington, Nevada, about 80 miles outside of Reno. There are two projects there, an open pit and and an underground. We are the only major shovel-ready, fully permitted copper project in the U.S. We’re in a tier one mining jurisdiction in a prolific copper district. Yerington historically has been a very large copper producer. We have a lot of blue sky in terms of drilling and potential M & A with the areas around us, and we’ve got strong financial partners to make this project fully financed.

Maurice Jackson: Please provide us with a brief narrative on the background of Nevada Copper.

Matthew Gili: Nevada Copper has been around since about 1999 is when it first was incorporated. It really gained some traction in 2006 and it was focused developing Pumpkin Hollow. That was a time of rising copper prices. It was a time of a lot of excitement for copper and a time when mines were big and projects were big, and the team there did a fantastic job of permitting Pumpkin Hollow. They established a land package of private land. Pumpkin Hollow is entirely on private land, and that required cooperation with the federal government, and the state of Nevada, and the city of Yerington.

They secured that as private land and secured that land package, and were ready to develop this into a major asset. About that time, it got difficult in the copper industry, around 2012 to 2015, and, quite frankly, the team ran out of money. What we’ve done since then is refinance the project. You will see that on press releases, the $375 million refinancing package, and we’re now ready and poised to finish the construction of the underground that was started by the previous team, and then bring on and complete the feasibility studies on the open pit to turn that into a real value making entity.

Maurice Jackson: You alluded to the copper sector here. Why should the market be excited about the copper sector and how does Nevada Copper’s Pumpkin Hollow fit into the narrative?

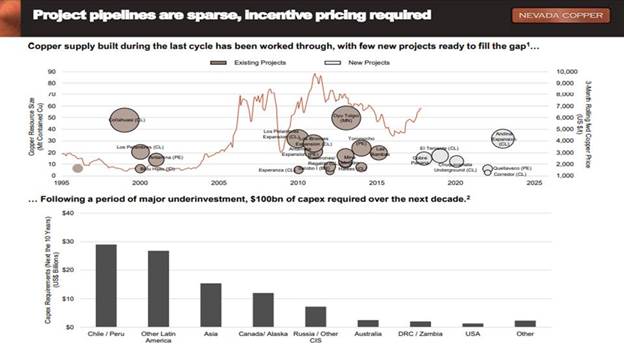

Matthew Gili: Where we see the real growth in copper is in the electrification of the world. Not just electric vehicles, but electricity is a much more efficient way to transfer energy, and you’re seeing that across the world. So if you’ll think about a vehicle, the electrification of a car takes the steel engine block, and transforms that into a copper electric motor, and the transmission of this energy now is not through a pipeline like petroleum, but through electrical conductors, some of which use copper. So that’s really that value proposition we see for copper from the demand side. On the supply side, I just want to stress that there’s been a limited, reduced amount of investment in expanding the copper supply. You’re seeing a lot of permitting issues. You’re seeing a lot of tough jurisdictions to get licenses to operate, and you’re also seeing a lot of existing open pit producers as they wind down, converting over to underground resources that require more capitalization and have a higher operating cost. So, these are the things that we’re seeing that are affecting the supply side of copper, and that’s why we’re so excited as Nevada Copper. We are the only fully permitted property. It takes a lot of time and energy and resources to get permits and to get that license to operate. Nevada Copper has secured that with the stakeholders involved and we are constructing right now.

Maurice Jackson: Walk us through you flagship project, the Pumpkin Hollow. Tell us about the location, metallurgy and scale.

Matthew Gili: Pumpkin Hollow is about 80 miles outside of Reno, Nevada, in a town called Yerington. Historically, Yerington has been a copper producer with a company called Anaconda in the 1950s to the 1970s. Pumpkin Hollow has two mines, an underground we call the East Resource, and an open pit, which we call the West Resource. They’re about four kilometers from each other and so they seem like they’re the same property, but they’re not. They actually are two discrete mines that can be run independently, and we will run them independently. From the standpoint of production, of course, we’ll share infrastructure and those sort of things.

We’re building a 5,000 ton a day underground with its own processing facility on site and the open pit. Right now, we’re in the process of re-engineering. Historically, it had been established a 70,000 ton a day producer and processor of ore. We’re going to re-engineer that and we’re aiming for about half that production rate. But it’s an increase in comparative copper production by increasing the grade. For metallurgy, it’s a very straightforward float copper concentrate with some precious metal credits. It’s exported to a smelter, and so that describes to you the size of Pumpkin Hollow. The underground, we would anticipate producing about 27,000 tons of copper per year in copper concentrate, and the open pit is a number around 100,000 tons per year of copper concentrate.

Maurice Jackson: What are the economics of Pumpkin Hollow?

Matthew Gili: So far $220 million of capital spend has been invested in Pumpkin Hollow by the previous teams that have managed it. We’re looking at a number between $180 …read more

From:: The Gold Report