Source: Clive Maund for Streetwise Reports 05/29/2018

Technical analyst Clive Maund discusses the probability of copper breaking out to the upside.

Copper is at an interesting juncture. On its latest 8-month chart we can see that within the next few weeks it will be forced to break out of a Symmetrical Triangle pattern that is now rapidly closing up. Although it could break in either direction, the rather positive Accumulation line and rising 200-day moving average suggest a higher probability that it will break out upside. However, we cannot grasp the big picture using only an 8-month chart, so now we will zoom out and see what it looks like on a longer-term chart.

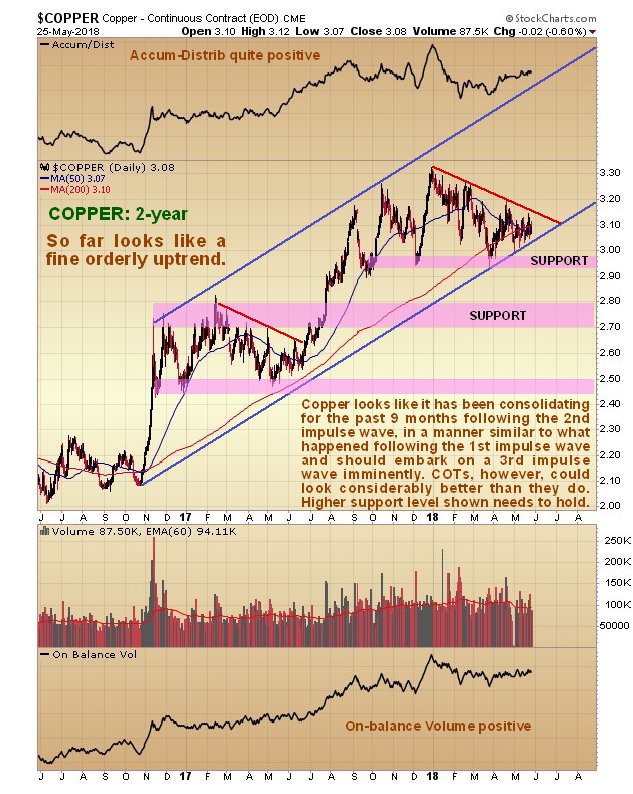

On the 2-year chart all becomes clear: copper is advancing within a well-defined parallel bull market uptrend channel, and we can see that the sideways pattern that has built out over the past nine months since early last September looks like a consolidation following the upleg in the middle of last year, that should be followed by another upleg imminently. However we are also aware that there is some risk that it is a top because of the Dome shape of the pattern, and the rather unsupportive COT, so while we are expecting another upleg to develop, we cannot rule out a downside break and thus we can say that the higher support level shown on the chart needs to hold to maintain the bullish outlook.

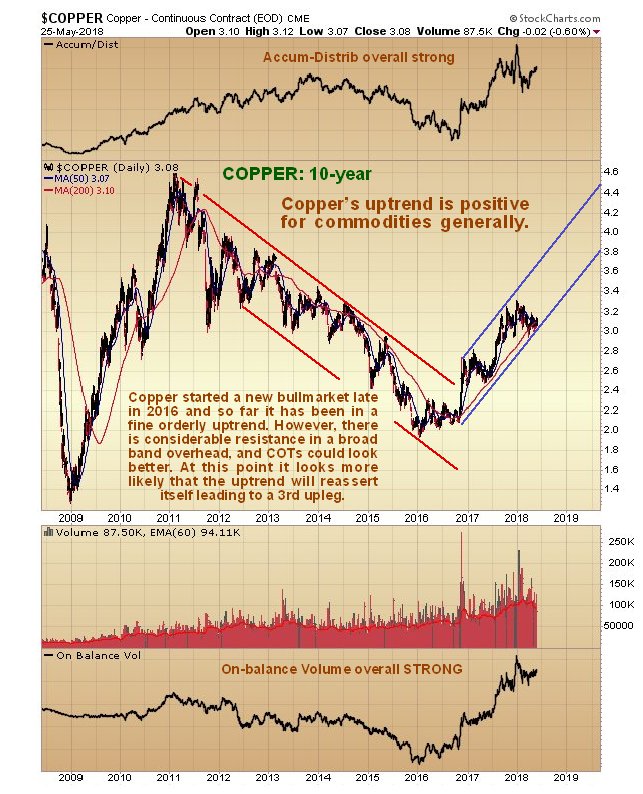

The long-term 10-year chart shows that the current bull market in copper started late in 2016 with a sizable upleg. While a third upleg is now expected to develop, we can see that copper will encounter a considerable degree of resistance on the way up, and since this exists across a broad band, no specific resistance levels are drawn on the chart. Volume indicators are strong overall which increase the likelihood of another upleg developing.

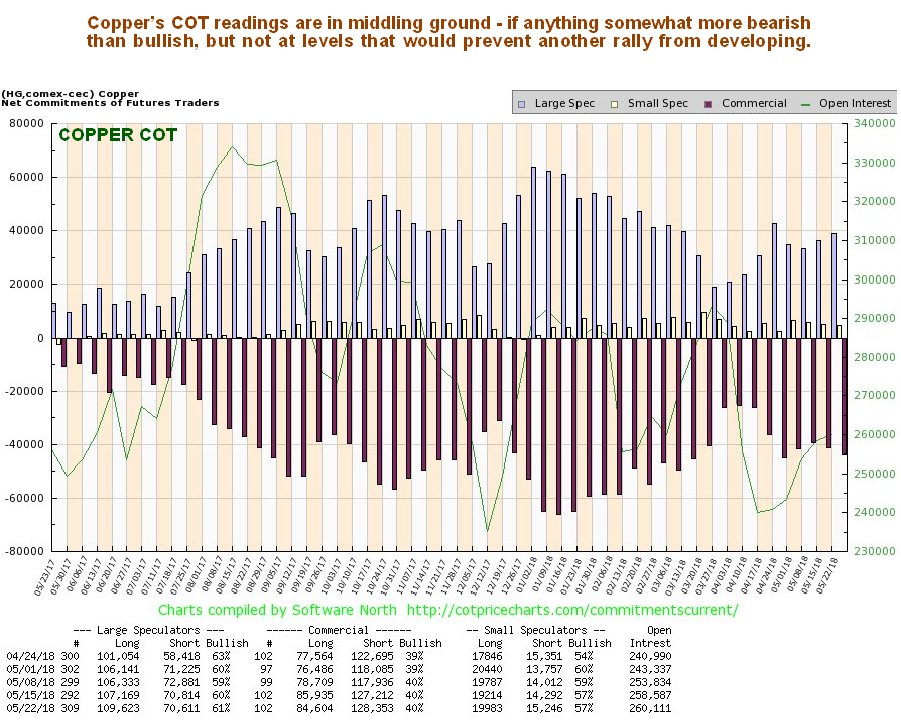

Finally we can see that latest COT readings are not very encouraging, with rather high Commercial short and Large Spec long positions. However, although they are higher than we would like to see, they are not at levels that preclude another rally developing, especially as there is nothing to stop them rising to clear new high readings for the year.

Our conclusion then is that copper is more likely to break out into a third upleg than it is to break down, although we are not blind to that possibility. We will now proceed to examine the charts of a range of copper stocks that look like they are poised to advance, and this being the case, increase the probability that copper will break to the upside soon.

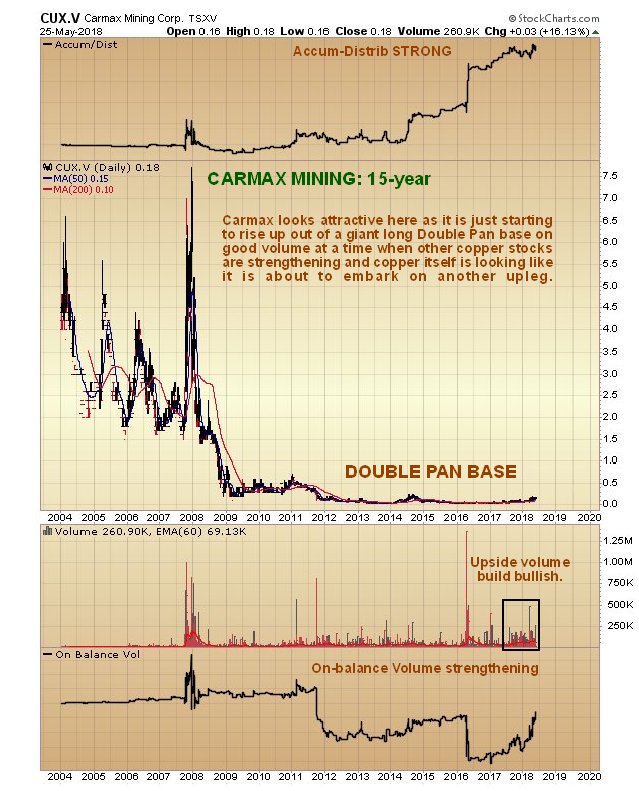

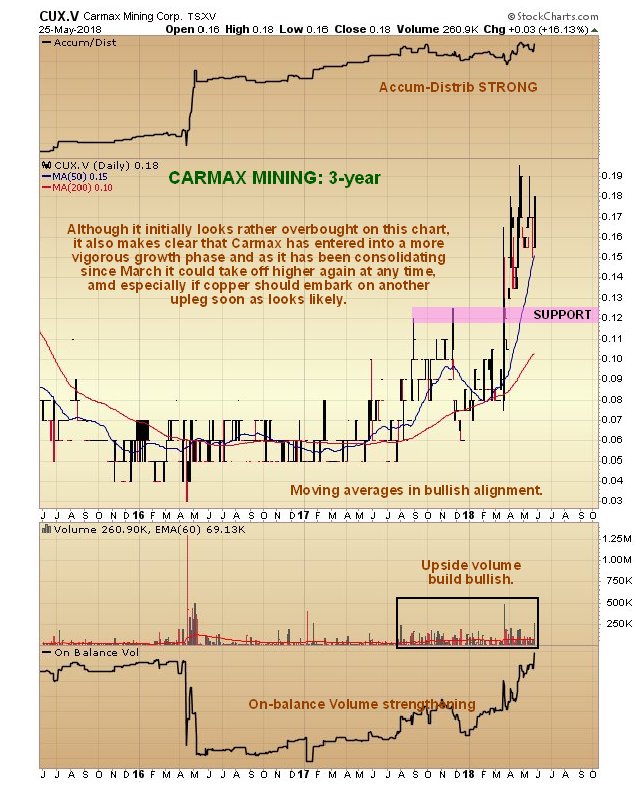

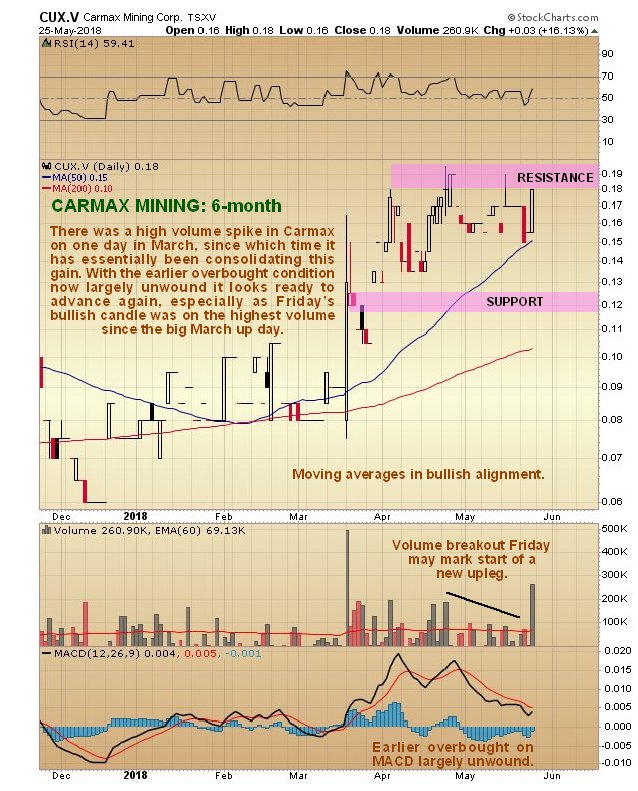

Carmax Mining Corp. CUX.V, CAXPF on OTC, C$0.18, $0.12

Carmax Mining website.

Kutcho Copper Corp. KC.V, KCCFF on OTC, C$0.59, $0.426

Kutcho Copper website.

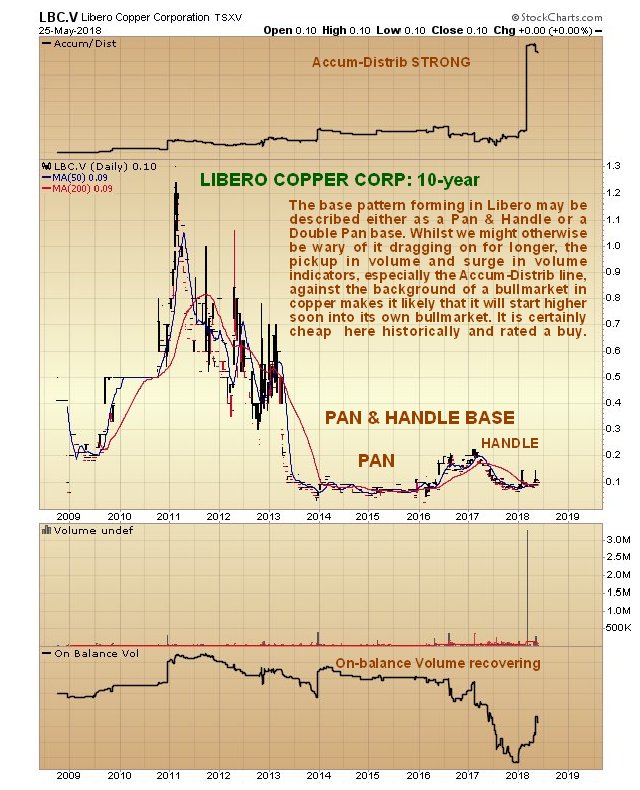

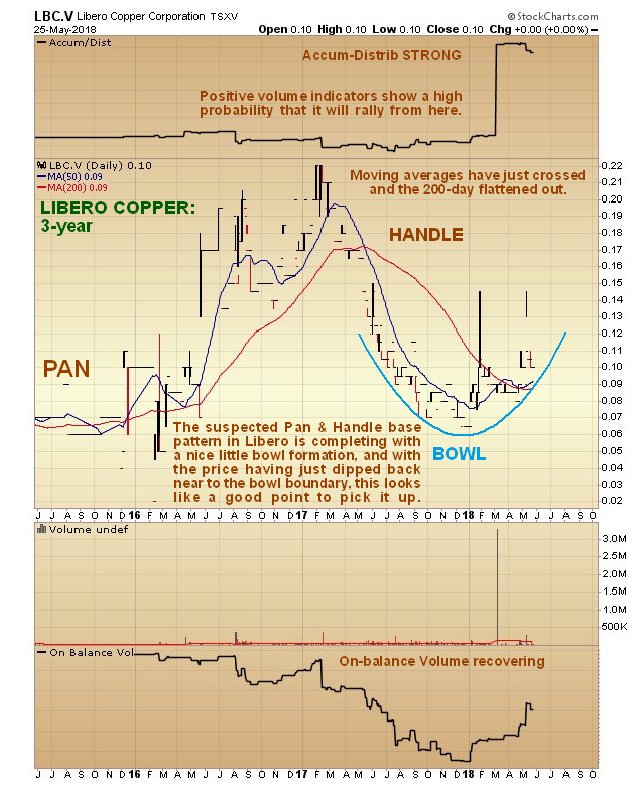

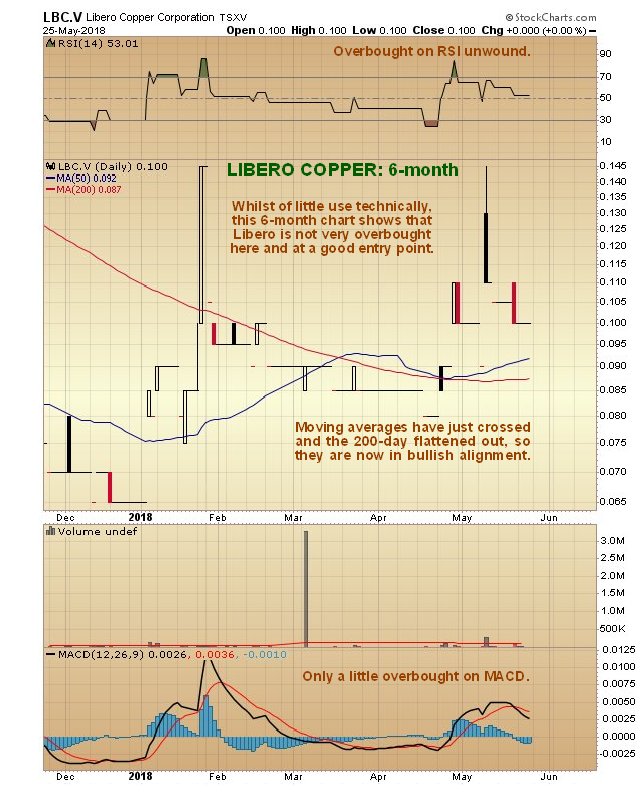

Libero Copper Corp. LBC.V, C$0.10

Libero Copper website.

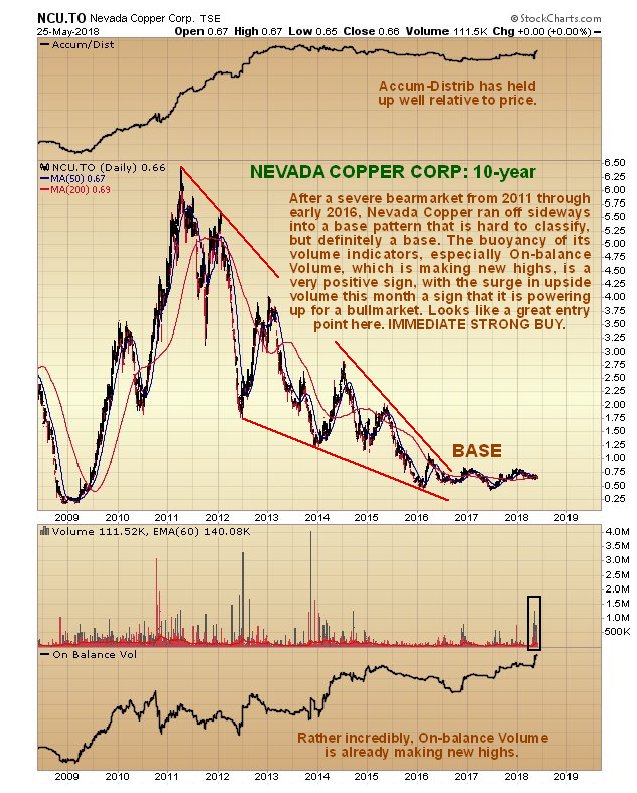

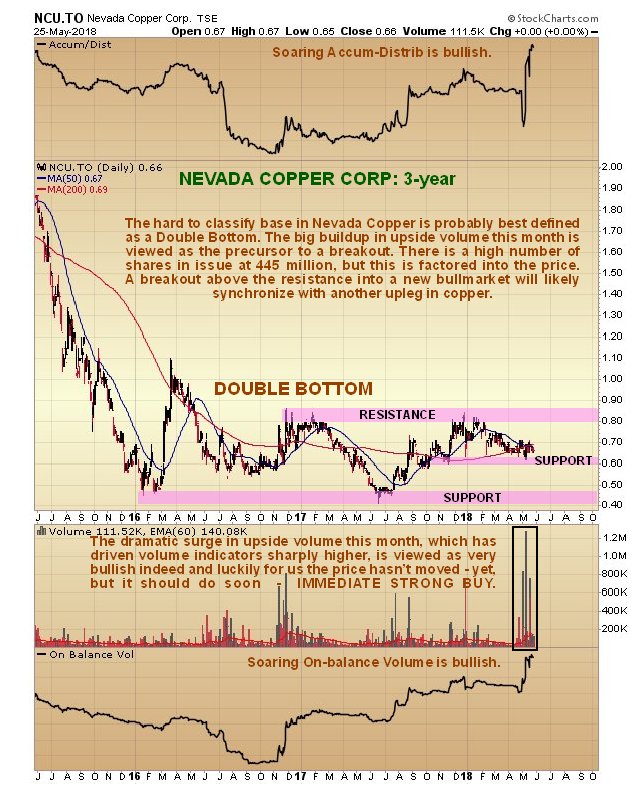

Nevada Copper Corp. NCU.TSX, NEVDF on OTC, C$0.66, $0.514

Nevada Copper website.

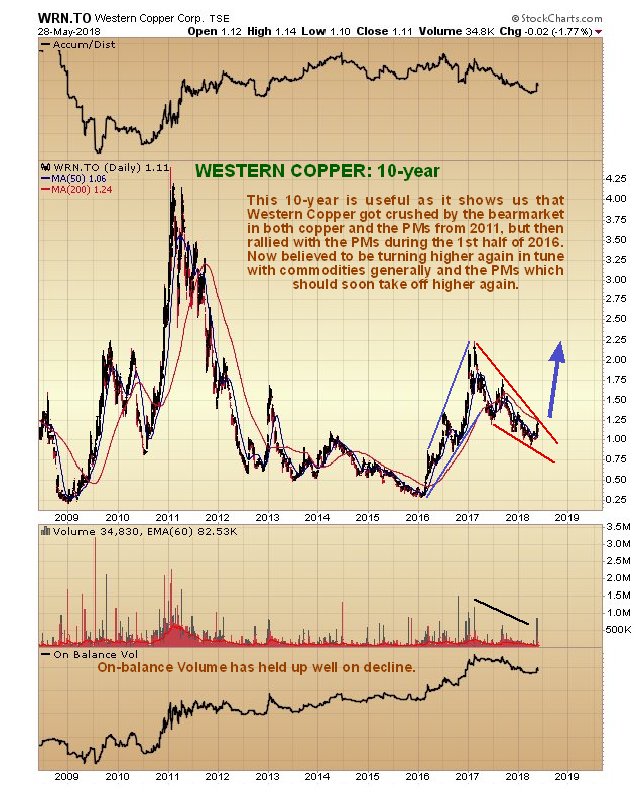

Western Copper and Gold Corp. WRN.TO, WRN on NYSE, C$1.11, $0.87

Western Copper website.

The number of shares in issue for the stocks listed above is as follows: Carmax 73.8 million, Kutcho 47.7 million, Libero 44.2 million. Nevada Copper has a hefty 445 million, although this is probably largely factored into the price. Western Copper has 96.6 million. Libero is very thinly traded and probably best avoided, or bought with a “stink bid” for this reason. Asked to choose just one from this list, Western Copper would probably be the best, as it is a big solid company, and the stock has just broken out of a base pattern on strong volume and reacted back to a favorable entry point.

All prices are for close of trading on Friday 25th May with the exception of Western Copper, which was added on the 29th.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has consulting relationships with ?????. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately …read more

From:: The Gold Report