Source: Peter Epstein for Streetwise Reports 05/24/2018

Peter Epstein of Epstein Research makes the case for a South American copper project with what he views as excellent mineralization that is open at depth and in all directions.

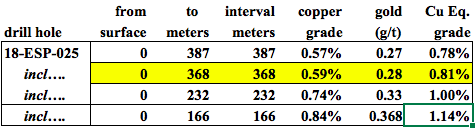

On April 20, Centenera Mining Corp. (CT:TSX.V; CTMIF:OTCQX) reported a strong partial drill hole result at its Esperanza copper-gold porphyry project in San Juan Province, Argentina. Excitement over this assay was running high. Management believed that the core looked good, so they rushed the top 166 meters (166m) to the lab.

Sometimes when expectations are elevated, actual news can disappoint. . .not in this case! The plan was to punch down to 500m, but drilling difficulties ended the hole at 387m. Esperanza remains open at depth and in all directions.

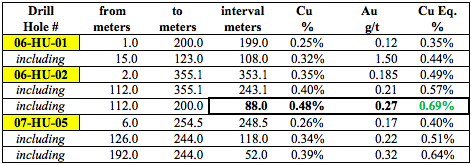

Mineralization was excellent through the 166m mark. On May 8, Centenera put out the full drill hole assay, covering 387m (from surface). Before jumping into the details, let me put into perspective the historical work that Centenera has access to. Prior drilling returned the following highlights:

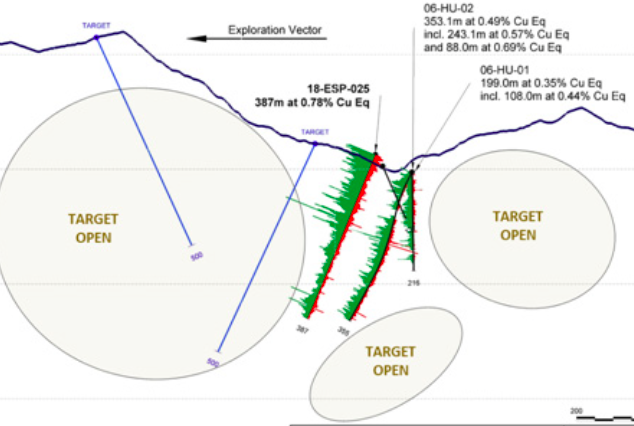

Mineralization outcrops at surface with a pyrite halo extending over a 1,400m x 850m area, drill holes generally intersected mineralization at surface and the deposit is open in all directions. The majority of holes terminated in mineralization, the deposit is open at depth. Several holes demonstrated increasing grade with depth.

These are solid numbers: The best interval was 88m weighing in at 0.69% copper equivalent (Cu eq). The goal with this year’s drilling is to find more results like these through prudent step-out drilling. When exploring porphyry targets, one needs to find both wide intervals—100+ meters—plus high-grade—say 0.60–1.00% Cu eq.

Having said that, the depth of a porphyry target matters a lot. All else equal, at and near-surface deposits can be viable at lower grades because prestripping (mining waste rock, or overburden, to reach an orebody) is expensive and time-consuming. That’s why this first full assay from Centenera’s 2018 drill program is so exciting; a wide interval, plus a strong grade, plus continuous mineralization from surface.

Drill hole 18-ESP-025 collared in mineralization that continued to the bottom of the hole at 387m (hole abandoned due to drilling difficulties). Mineralization remains open at depth.

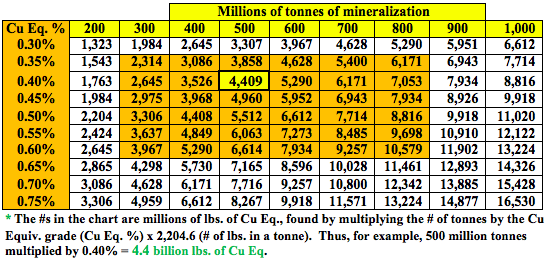

There are a number of porphyry exploration and development projects around the world with 0.30–0.40% Cu eq orebodies. The lower the grade, the smaller the margin for error, and the greater the need for abundant size. Centenera’s May 8 announcement places it well on the way to establishing economic grade. Now it’s a matter of delineating a large-scale deposit. A surface expression of 1,400 x 850 meters is a good start.

The east-west cross-section shows complete results from 18-ESP-025 and a few previous drill holes. The exploration vector to higher grade Cu and gold (Au) is interpreted to be west, where two targets are highlighted. All drill holes are open at depth, and there’s significant untested ground to the west & east. In the image, green = Cu grade and red = Au grade.

By large-scale I mean >3 billion pounds Cu eq. This year’s drilling will be testing for bulk tonnage potential. Readers please note, the company might not be able to identify that large a number in a maiden resource estimate, but perhaps management can do so over time.

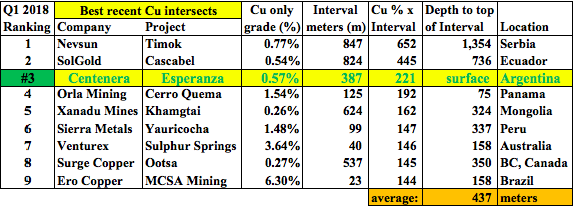

According to the company, drill hole 18-ESP-025 would have ranked #3 among top global Cu intersections drilled in Q1/2018 (intersections ranked by Cu portion only, x interval width in meters). Despite a very promising Cu-Au project, and several other properties in Argentina, Centenera’s market cap remains at CA$10.2 million / US$7.9 million.

The above ranking is of projects where Cu is the primary metal and does not take into account other commodity credits. For example, Esperanza has meaningful gold credits that are not included. In addition to being at surface (versus an average depth to the top of interval of 437m), the Esperanza project is in a favorable mining province in Argentina, in fact the single best province—San Juan (as measured by the latest annual Fraser Institute of Mining Survey).

A 0.40% Cu eq. NI 43-101-compliant resource estimate would mark a robust outcome. Although there’s limited evidence of large scale to date, management’s goal is to find at least 500 million tonnes of mineralization (by no means a sure thing). Five hundred million tonnes at a grade of 0.40% would equate to nearly 4.5 billion Cu eq pounds. Management’s stated goal for its projects is to “drill, add value and advance to JV or sale.”

I expanded the above chart from a prior article I did on Centenera Mining to include higher grades along the left side. This does not mean I believe an overall mineralized grade will be up to 0.70–0.75% Cu eq, but in a constrained open-pit scenario (a subset of the entire deposit), perhaps a Cu Eq of 0.40%+ could be achieved.

Near-term catalysts

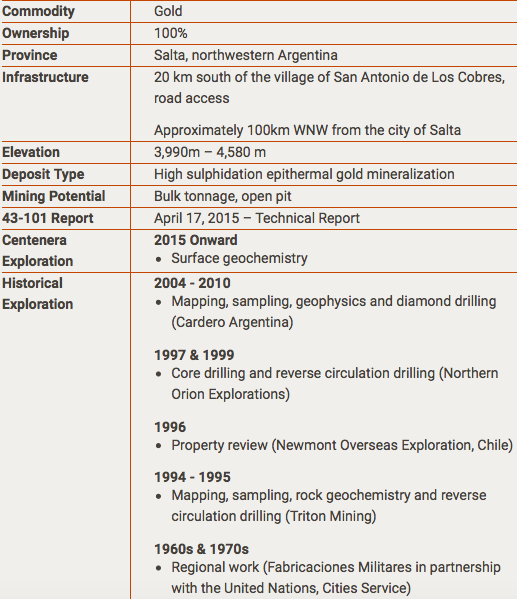

Centenera has several catalysts worth watching for. First and foremost: another drill result in June. That hole was completed to a depth of approximately 450m. Also, a possible update on its 100%-owned Organullo epithermal gold project in Salta province—the best province in Argentina.

A study conducted in 2012 (using historical drill data) resulted in potential tonnages & exploration target grades of gold. These potential exploration target quantities and grades are conceptual in nature; insufficient exploration and geological modelling has been done to define a mineral resource.

The conceptual (initial) target is between 600,000-960,000 ounces gold, grading between 0.92-0.94 g/t Au. Management acknowledges that Organullo will require a lot of drilling.

Another important catalyst is the upcoming closing of Centenera’s CA$3 million capital raise. Once fresh capital has been banked, investors will stop worrying about that perceived overhang.

In the second half of …read more

From:: The Gold Report