Source: The Critical Investor for Streetwise Reports 05/23/2018

The Critical Investor examines a company that has been diligently exploring a copper-zinc project in British Columbia.

Kutcho project, VP Exploration Rory Kutluoglu

1. Introduction

After entering the markets with a big splash in December 2017, on the back of an almost monumental deal (for a nano cap) with Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), Kutcho Copper Corp. (KC:TSX.V) has been working quietly but diligently behind the scenes, to set up everything for further development of their high grade copper-zinc Kutcho project in British Columbia.

Their goal is to advance the deposit to ultimately double the current size, and by doing this improve current 2017 Pre Feasibility Study (PFS) economics when the Feasibility Study (FS) will be completed a year from now. In this article I will discuss proceedings for this year, revisit economic potential and valuations, and will have a more in-depth look in the WPM stream, in order to show it is in fact a good deal for Kutcho Copper compared to others.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Current status and plans

Before I continue with current activities, let’s have a look at a few basics first. Kutcho Copper has $4.5M in cash at the moment after receiving the first US$3.5M payment from WPM on April 4, 2018, and C$20M in debt. The second payment of US$3.5M is expected in August of this year. As a reminder, management and Board controls 10% of shares which counts as above average skin in the game. Wheaton Precious Metals holds 13% and Capstone Mining is the largest shareholder with 16%.

As of May 18, Kutcho Copper has a share price of C$0.59 and a market cap of C$28.18M, with only a very tight 47.77M shares outstanding (fully diluted 70.1M, all options and warrants out of the money at C$1.00, expiry in 3 years). The average daily volume of last month is 43k shares, which is about 10% of the average of the first 2 months.

Share price over 1 year period

After the big entry in December, the stock gradually went down lower as everybody that was interested took a position in these first months, and buying pressure and volume decreased. When looking at the chart it seemed that the C$0.45-50 level functions as a solid bottom and an indicator of minimum fundamental value the market was willing to pay for Kutcho, as there were no strong catalysts or marketing since Dec 2017-Jan 2018. As the summer drill program is about to start and further catalysts are expected, I expect investor awareness for this company improving again, facilitating a second wave of new entrants.

As a reminder, Kutcho Copper management has planned the scale of the upcoming field program such that they can achieve all the technical data collection for the feasibility in one field season. The easy field season up there is May 21 to October 31. Outside this window, things are not impossible, just more expensive, and therefore the company is looking to complete all drilling requirements within this period.

All kinds of equipment, supporting the upcoming field program, is being transported to location at the moment. Camp construction and commissioning is anticipated to be completed by June 1st, and drilling with two rigs will commence on June 15th. According to COO Duncan, if needed the number of rigs will be scaled up to four in order to finish before the winter break. The 2018 field program will look to expand resources through infill drilling for inclusion in the FS, and to provide data for the optimization of metallurgical recoveries and geotechnical parameters.

Under the engineering lead of Ausenco, the recently hired engineering firm to do the FS, the team consists of: Sim Geological Inc. for resource modeling, Holland & Holland for metallurgical engineering and process design, Terrane Geoscience Inc. for geotechnical engineering, and SRK Consulting for open pit and underground mine design among others.

I am not too familiar with the other names, but Ausenco is a worldwide operating firm, worked for majors like BHP, Glencore, Newmont, Vale and numerous others like copper/base metal focused Hudbay, Las Bambas, Teck, and also did a good job at Atlantic Gold’s Moose River project. I am happy to see SRK, which I regard as one of the top two or three in the mining business, doing the mine design. This will probably generate a lot of confidence in the quality of this study and its economics.

Exploration camp used by Kutcho Copper

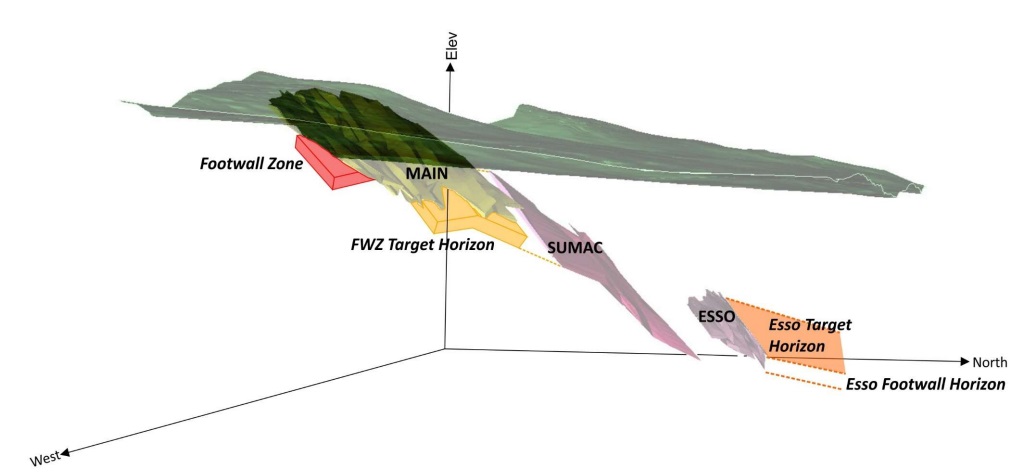

Although the upcoming drill program will focus on infill drilling, several priority drill ready targets prospective for additional resources have also been prepared. These prospective targets include, as mentioned in the corresponding news release:

– Mineralized drill intersections along strike and down plunge to the west from the Esso deposit (one of three VMS deposits comprising the Kutcho project) including 7.1 metres @ 1.96% copper, 5.24% zinc, and 18.0 g/t silver in DDH 94-B3. These intercepts could represent extensions to the high-grade Esso deposit or a potential new deposit.

– The FWZ, a relatively narrow sulphide lens (2 to 5 metres thick) which lies beneath the Main zone and which was subject to an historic estimate prepared as an internal document for Esso Minerals in 1979, of 230,000 tonnes averaging 1.47% copper, 5.52% zinc, 0.4 g/t gold and 43.7 g/t silver. The FWZ may have potential along strike and down dip for additional mineral resources. This mineralized zone demonstrates that additional horizons across the property are productive for VMS style mineralization:

– Main mineralization is open down-dip along 800 m, or 57%, of the total strike for this deposit, indicating potential for resource expansion down-dip.

– Esso mineralization is …read more

From:: The Gold Report