Source: Thibaut Lepouttre for Streetwise Reports 05/22/2018

Calling it “one of the hottest exploration regions in Canada,” Thibaut Lepouttre of Caesars Report describes how one company is preparing for the short summer exploration season.

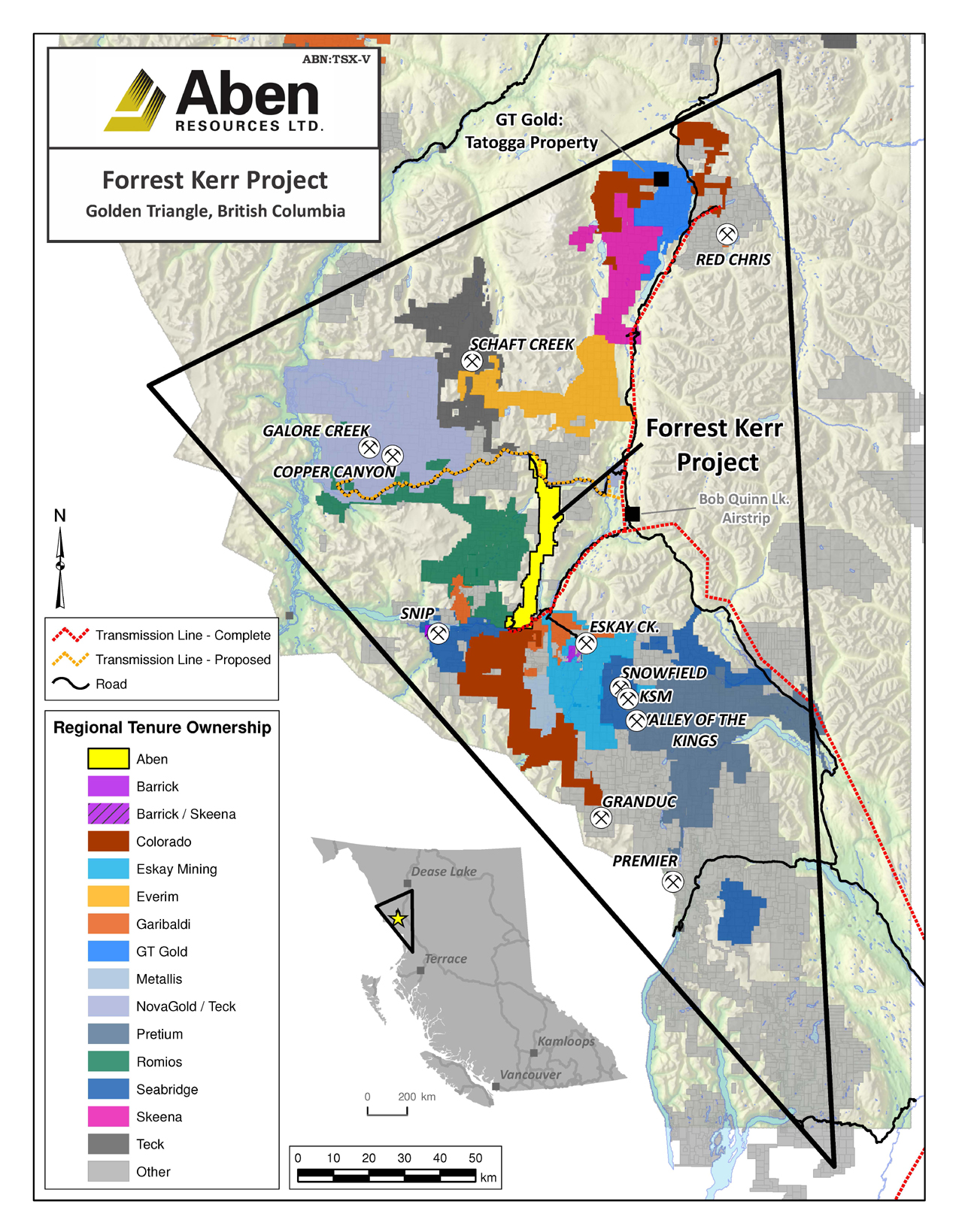

One of the hottest Canadian exploration regions in Canada in the past few years has been the Golden Triangle in British Columbia. Unfortunately the exploration season is pretty short, as companies have just a few months to get in and drill holes before the weather changes. This means exploration companies need to be able to hit the ground running to maximize their efforts. One of those companies is Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTC.MKTS), which is getting ready to drill its flagship Forrest Kerr Gold project again.

The Flagship Forrest Kerr Property

Aben Resources acquired the 23,000-hectare Forrest Kerr project in British Columbia’s Golden Triangle region in 2016. This region was just heating up again after remaining dormant for a few decades. The development of the Valley of the Kings and Red Chris Mines (owned by respectively Pretium Resources Inc. [PVG:TSX; PVG:NYSE] and Imperial Metals Corp. [III:TSX]), as well as new infrastructure development by the government, has led to an increased level of exploration activity in the region.

The Golden Triangle has been the hot spot of gold exploration and production throughout the past few decades. Placer gold was initially discovered along the Stikine and Anuk Rivers in mid-1800s, and the exact point where both rivers combined was the scene of a new gold rush. These small-scale placer gold operations continued for several decades until a first mine was developed right after the First World War.

But the most famous mines in the Golden Triangle district were undoubtedly the Snip Mine (1.1 million ounces recovered at an average grade of 27.5 g/t gold) and the Eskay Creek Mine (producing 3 million ounces of gold and 160 million ounces of silver). A very prospective region, indeed.

Aben seems to have negotiated a good deal considering the company has to issue just 7 million shares and complete CA$3 million in exploration expenditures by June 2020. That gave Aben a four-year period (from 2016-2020) to test the merits of the project while incurring the expenses needed to reach full ownership of the project. It’s very likely Aben will be completing its exploration expenses by the end of this year, which would secure its 100% ownership two years ahead of schedule.

Looking at the historical data provided by the previous owners of the project, it’s understandable that Aben’s technical team was charmed by the property. Kiska Metals Corp. (KSK:TSX.V)(one of the previous operators) drilled a very short but ultra-high-grade interval of 0.45 meters containing 359.7 g/t gold and 1.95 meters containing 101 g/t gold. You obviously cannot expect these high-grade results to pop up everywhere on the property, but these intervals, combined with in excess of 20,000 samples, were a good enough reason for Aben to get back in the field for its 2016 and 2017 exploration programs.

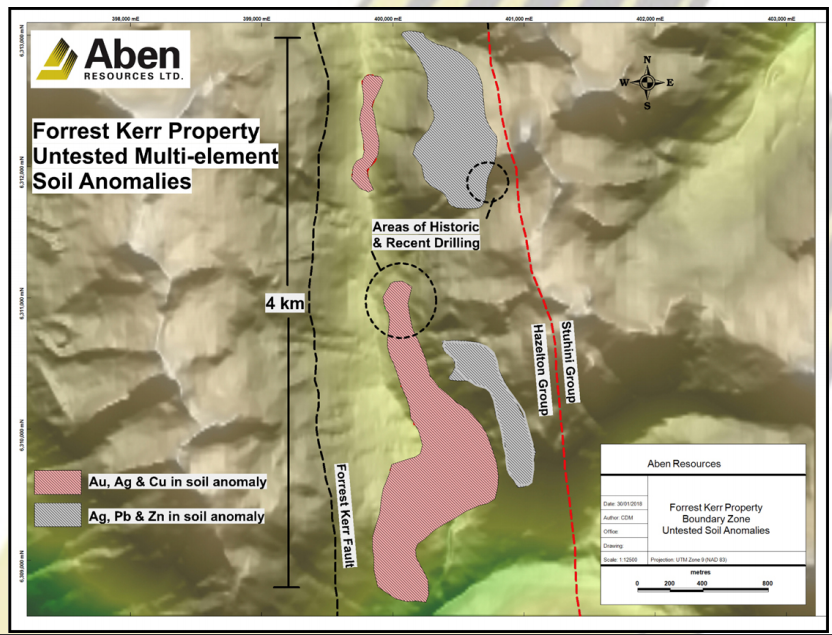

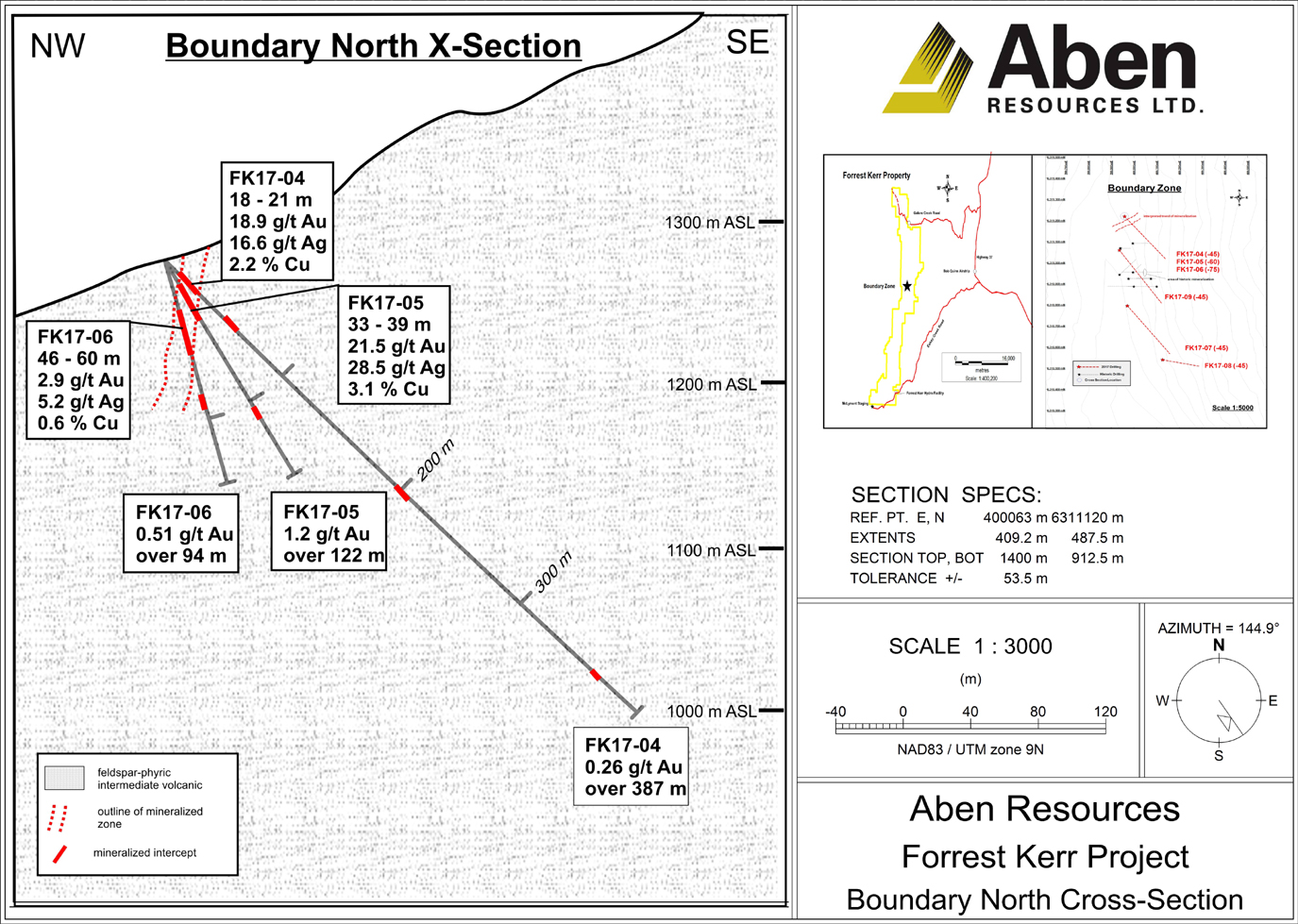

After analyzing all the data gathered from the 2016 exploration season, Aben immediately designed a nine-hole drill program, completing 2,445 meters of diamond drilling in the summer of 2017. The first three holes were drilled at the Carcass Creek Zone and didn’t immediately yield the expected/desired results as only short intervals of low-grade mineralization were encountered. Before the company could target the expected structure from a different angle, the drill program at Carcass was suspended for safety reasons, and the next six holes were drilled at the more important Boundary Zone.

This zone was Aben’s high-priority drill target after analyzing the 2016 assay results and fortunately these six holes did provide the desired results. A first batch of three holes was drilled from the same drill pad at different angles (45, 60 and 75 degrees), and encountered 10 meters at 6.7 g/t gold, 6.36 g/t silver and 0.9% copper (with a higher grade interval of 3 meters at 18.9 g/t gold, 16.6 g/t silver and 2.2% copper) in the first hole, followed by 12 meters of 10.9 g/t gold, 14.6 g/t silver and 1.5% copper in the second hole (drilled at a 60-degree angle). And the final hole of that series of three (drilled at a 75-degree angle) encountered 14 meters at 2.91 g/t gold, 5.2 g/t silver and 0.6% copper.

These are excellent high-grade results, indicating a narrow high-grade zone within a very broad mineralized zone, which Aben Resources will undoubtedly want to follow up on. It’s still very early days at the Boundary Zone, but Aben now has a pretty good idea of how to make its 2018 drill program as efficient as possible.

It’s now also cheaper to get an exploration program going in the Golden Triangle. The recent completion of major infrastructure works at and around the Golden Triangle have renewed the interest of exploration companies in this area as it’s now easier to explore, and a discovered deposit now actually has a chance of becoming a mine without needing Snip-like grades. The Forrest Kerr property is definitely blessed with excellent access to infrastructure: a hydro dam has been built on the southern part of the property boundaries, and this resulted in the construction of access roads and, more importantly, a 287-kilovolt power line.

That’s an important step forward. It doesn’t increase the odds of finding a deposit (as you’ll still need to apply “pure” geology), but it definitely makes it easier and cheaper to explore.

Share Structure

Although Aben Resources just raised CA$2.3M at CA$0.125 per share, it has done a great job keeping its share count under control. The company currently has just 78.1 million shares outstanding, and that’s after issuing 6.3 million shares at CA$0.125/share in a hard-dollar financing, and 8.55 million flow-through shares at CA$0.18. Both tranches were accompanied by a three-year warrant with a strike price of CA$0.25 per warrant.

As Aben Resources still had some cash on …read more

From:: The Gold Report