Source: Streetwise Reports 05/15/2018

This small-cap energy firm’s Permian Basin drilling and testing have been showing good results, and the company has just started.

The price of West Texas Intermediate (WTI) crude oil is staying above $70/barrel, the highest it’s been in over three years.

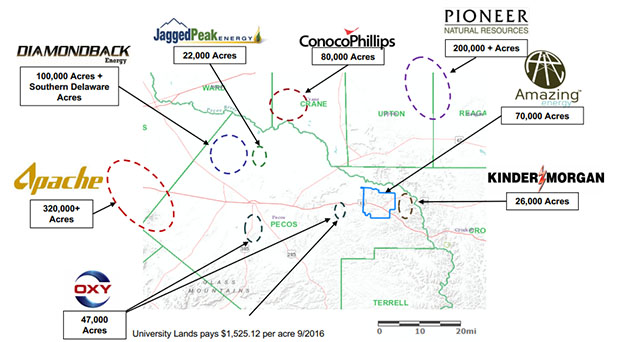

Amazing Energy Oil & Gas Co. (AMAZ:OTCQX), an independent small-cap energy company, holds rights within 70,000 contiguous acres leasehold in Pecos County, Texas, in the Permian Basin. Its neighbors include Kinder Morgan, Pioneer Natural Resources, ConocoPhillips, Jagged Peak Energy, Diamondback Energy, Apache and Occidental Petroleum.

The company has drilled its first wells and is moving ahead with plans to drill more. The company recently announced that it had reached a production milestone of 100 boe/day in April.

Will McAndrew, CEO of Amazing Energy stated, “We are very excited with the progress of our production as we continue to perform reworks, completions and our drilling program, announced in January 2018. We have an aggressive oil and gas exploration and production plan within defined sections of the rights within the 70,000-acre leasehold focus area.”

“If we factor in both the economics of these wells and the favorable leasehold agreement that Amazing has, I don’t expect shares to stay low for long.” – Keith Kohl, Pure Energy Trader

On May 14, Amazing announced that the company plans to initiate in the next several weeks a chemical squeeze program “around the outer perimeter of Section 91 where the company previously initiated drilling, completion and production operations.” The company says the program “should allow for improved fluid entry on existing wells targeting the Queen formation.”

“We expect to spud a new well within the next 90 days and build on our recent success while expanding our knowledge and production of the Queen A and B and other formations. With the results from our most recent well, we are now looking closely at potential production from drilling horizontal wells in the San Andres formation utilizing the data from Haliburton’s new RockVision logs,” McAndrew noted.

The company has also stated that it has “accomplished increased drilling efficiencies with each new well and expects the trend to strengthen in the coming year as the play matures. Further innovation using the latest drilling techniques are expected to decrease operational costs as production increases.”

Amazing’s goal is to drill and complete or re-work three additional wells per month by the end of the third quarter of 2018.

The bigger picture is also promising. A March 2017 report from Baker Hughes projected $15.3 Billion Probable Reserves on all of its acreage.

Within Amazing Energy’s rights within the 70,000 acre leasehold of Permian Basin land holdings, there could be thousands of new drilling sites. Making matters even more interesting is that Amazing’s land is near the prolific Yates Oilfield, which has produced more than 1.6 billion barrels of oil. The Amazing land is also stacked pay, so it may be possible to extract oil from multiple zones.

Keith Kohl, writing in Pure Energy Trader on May 3, noted that Amazing “expects that it will be drilling and completing, or re-working, at least three additional wells per month by the end of the third quarter. Furthermore, Amazing also plans to spud a new well within the next 90 days and build on its latest success. I’m still shocked the market hasn’t caught on yet. If we factor in both the economics of these wells and the favorable leasehold agreement that Amazing has, I don’t expect shares to stay low for long.”

Technical analyst Clive Maund wrote in a March 17 article about the company, “the prospects for this stock are very bright. . .holders should stay long and it is viewed as an immediate strong buy again here.” Amazing has 48.4 million shares in issue, of which the float is about 22 million.

Bob Moriarty of 321 Gold noted on March 7 that “with a market cap today of under $50 million, the company price doesn’t reflect the future value. Look for more and more news flow. And oil flow while they are at it.”

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Jake Richardson compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Amazing Energy. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Amazing Energy. Please click Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise …read more

From:: The Energy Report