By Frik Els

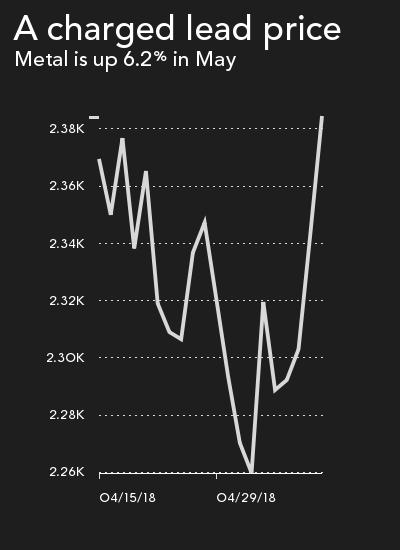

Lead’s recovery from nine month lows continued on Tuesday with benchmark prices on the London Metal Exchange rising 1.5% to $2,380 a tonne ($1.08 a pound).

“Lead from a raw materials side is probably the tightest commodity market out there. There has been a big clamp down on Chinese private sector mining. China is around 60 percent of primary lead supply,” BMO Capital Markets analyst Colin Hamilton told Reuters.

Prices were likely to hit $2,640 in the third quarter according to BMO marking the investment bank as one of the most bullish on the outlook for the metal, mainly used in batteries. A FocusEconomics report published on Tuesday shows consensus forecast among analysts of $2,428 a tonne in Q3. Lead peaked in January this year at $2,643.

Over 2014-2016 global mined lead supply shrank by roughly 500,000 tonnes, or 10%. This year, consultancy Wood Mackenzie forecast a market deficit of 115,000 tonnes and 56,000 tonnes in 2019 after a 119,000 shortfall last year. More than 50% of annual lead supply is from the secondary market and in the US as much as 80% is recycled material.

Headline stocks in LME-registered warehouses have fallen by a third since the start of last year to 131,225 tonnes.

(With Reuters)

The post Lead price comes roaring back appeared first on MINING.com.

From:: Infomine