Source: The Critical Investor for Streetwise Reports 05/09/2018

The Critical Investor discusses a maiden resource estimate for a lithium deposit in Nevada.

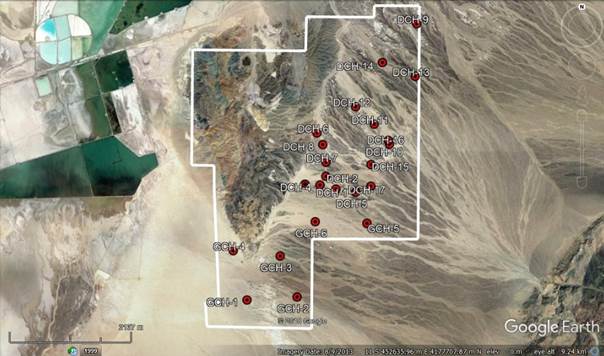

Drilling at Dean claystone project; Clayton Valley, Nevada

1. Introduction

Some juniors can be agonizingly slow on following up to their self-imposed timelines and ability to deliver results, however there are exceptions. Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:Frankfurt) is proceeding at breathtaking pace, going from its first drill hole at the Dean claystone lithium project in Nevada, U.S. to the very recent announcement of a maiden resource estimate on both Dean and Glory projects in just over a year. Not only this, the company also managed to beat various estimates in the field, including my own, with some margin, as it released a 6.54 Mt lithium carbonate equivalent (LCE) resource estimate. By doing this, Cypress established itself instantly as the holder of a 100%-owned world class sized lithium deposit, which is quite something for a junior with a tiny market cap.

The next step will consist out of two parts: developing and completing metallurgical testing for viable recovery methods (also known as met work in the industry) and doing a Preliminary Economic Assessment (PEA) to provide economics. The met work is ongoing and guided by very experienced CEO Bill Willoughby who holds a PhD in engineering and metallurgy, and the PEA is scheduled for the end of August or September. As the resource of Dean/Glory is quite large, the potential for a project with very impressive economics could be realistic. After talking to management and various industry experts, I will provide a hypothetical outlook on this potential, and together with this my view on valuation potential.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Maiden Resource Estimate

Cypress Development released its maiden resource estimate on its fully owned Clayton Valley lithium project on May 1, 2018, and it sure was impressive. The total resource for the Dean and Glory properties came in at 6.54 Mt LCE, which consisted of an Indicated mineral resource of 597 Mt at an average grade of 899 ppm (0.09%) Li, which equates to a contained 2.857 Mt of lithium carbonate equivalent (LCE), and an Inferred mineral resource of 779 Mt at an average grade of 888 ppm (0.089%) Li, which equates to a contained 3.683 Mt of LCE. The total number of 6.54 Mt beat my estimate by about 20%, according to my estimated target of 5.45 Mt LCE, and also my top margin target of 6Mt.

Again, as a continuous reminder, examples of world class sized LCE deposits in each category are brine projects like Cauchari/Olaroz (Orocobre: 6.4Mt LCE, SQM/Lithium Americas 11.7Mt LCE), clay projects like Sonora (Bacanora: 7.2Mt LCE) or hard rock projects like Whabouchi (Nemaska: 4.06 Mt LCE).

The average grade of about 893ppm Li is somewhat lower than my estimated average of about 950ppm Li, but this isn’t out of line and a normal deviation to my numbers as I am estimating without advanced software used by engineering firms. The cut-off grade was also set somewhat low at 300ppm Li, which probably helped to increase the resource but also lowered the average grade.

The deposit is outlined by 23 core holes for 1,891m drilled during 2017 and 2018. As the deposit is lying at surface and is pretty superficial (no deeper than 150m, usually starting at surface) and mineralization appears to be very continuous, drilling it off is relatively very cheap to build tonnage. The deposit remains open at depth, with 21 of the 23 holes ending in lithium mineralization. As this mineralization at the endings of drill cores averaged 300 ppm Li, my view is that the company will not find much more economic mineralization (assuming 800–900ppm Li) at depth, and will focus on infill drilling and advancing the current mineralized body, which is already world class.

Management estimates that an additional 30 drill holes are required to upgrade the Inferred portion of the mineral resource to the Indicated category. The large tonnage of the deposit lends potential to target higher grade lithium mineralization for the PEA, as is seen within the intercepts between GCH-06 and DCH-13:

After discussing this with management, it seems that enough of the deposit is eligible to mine at a higher grade compared to the average grade of the maiden resource. All in all, an average grade of 1,000ppm Li seems to be realistic, and I will use this as a base for my hypothetical PEA estimates later on.

Preliminary test work conducted at SGS Canada Inc. (Lakefield) and Continental Metallurgical Services LLC has shown the material exhibits high lithium extractions with short leach times. Lithium extractions greater than 80% can be achieved in 4 to 8 hours using conventional dilute sulfuric acid leaching. Currently, Hazen Research Inc is conducting additional leach tests and preliminary results confirm high lithium extractions for new mineral zones.

The presence of acid leachable lithium presents significant cost savings by avoiding calcine and regrind of material during processing. Preliminary results also show the consumption of sulfuric acid and other reagents are relatively low, to the tune of 100kg/t LCE.

It was also stated in the news release that the production of high-purity lithium carbonate (a typical salable product) was demonstrated in the laboratory using conventional recovery methods, but the big question always remains costs on a commercial scale with these kinds of bench scale tests, and the potential for economic removal of impurities. This is the next big step Cypress is facing through continuing with its ongoing met work, and as mentioned in earlier updates, if the company succeeds in this department the resource all of a sudden becomes commercially viable and minable, implying vast upside for valuation.

At the same time, Cypress also plans to proceed immediately with a PEA based on the current …read more

From:: The Energy Report