By Yianni Sakarellos

The Dow Jones Industrial Average

Investors experienced highly volatile equity markets in Q1 2018, with the Dow Jones Industrial Average (DJIA) plunging 1,600 points at its session lows on February 5, 2018. The DJIA closed down 1,175 points that day, its worst point decline in history.

Market participants were and still are primarily fearing uncertainty stemming from the new Federal Reserve Chairman Jerome Powell, concern over rising interest rates, expectations for higher inflation, and rising wages for Fortune 500 companies which are heavily leveraged with debt.

Global geopolitical risk also remains elevated with instability in the Middle East and North Korea. Under President Trump we have seen major reform to US foreign trade policies with new tariffs being set in place impacting global trade and impeding the recovery of the global economy.

Gold market snapshot

All of the above point investors to gold as they seek a short term hedge against volatility. It’s often heard that one’s portfolio should have a weighting of precious metal exposure with an allocation ranging between 5%-10% depending on the investors risk profile. Gaining exposure to gold can be done in a variety of ways such as purchasing physical bullion, a gold backed ETF, or the simplest form via gold equities.

At the time of writing the YTD (Year-To-Date) performance of gold in 2018 is +1%. But a consensus view held by the top global gold producers hold a much more constructive view for 2018 and beyond.

In Barrick Gold’s most recent presentation the company highlighted drivers of the gold market:

- Financial demand

- US dollar

- Real interest rates

- Physical demand

- China/India/Central Banks

- Mine supply flat to falling

- Market commentators generally constructive of gold price going forward

Much of the daily price fluctuations in gold are inversely correlated with the US dollar. The DXY (US Dollar Index) provides oversight of daily strength or weakness for the USD as it’s indexed against the top 5 global currencies. We can see from April 18, 2018 till now the DXY strengthening which inversely correlated with spot gold falling from approximately US$1,350 per ounce to just above US$1,310.

The US economy is now in a period of rising interest rates which will further bolster the US dollar which adds near term pressure to the gold price, but further analysis is necessary to review the fundamentals.

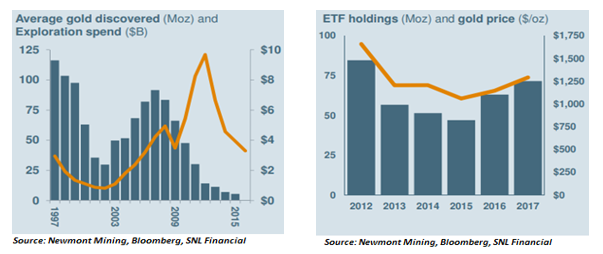

Since the end of the bear market in 2015, we have seen gold prices trend up making higher lows which appears to be reflective of the increased investment demand due to heightened systematic risk. Physical demand continues to come from central bank (Russia, China, and Turkey) purchases, physical gold-backed ETFs (SPDR), and jewelry demand. Jewelry demand is the largest factor in the demand equation as it accounts for approximately 50% of gold demand with the main buyers being China (Lunar New Year Festival) and India (Wedding season).

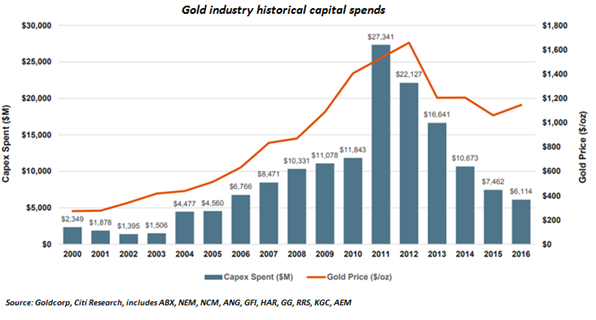

In 2017 gold mine production globally was approximately 105M troy ounces. According to Goldcorp the fundamentals support strong gold pricing in the near term. The company highlighted that mine supply is expected to marginally decline by 1% annually through 2021. Furthermore, an analysis of the top 10 gold producers shows a reduction in developmental capital spending by >80% since 2012.

Due to underinvestment in the form of exploration and capital expenditures, empty project pipelines, and a lack of new discoveries, these all factor into declining mine production and reduced supply in the coming years. These are all major catalysts for the gold price and why new gold discoveries are attracting premium valuations and investor’s attention right now.

Discovery oriented gold equities

One of the newest gold discovery stocks is Evrim Resources (TSX-V: EVM) which released results from Trench #1 & #3 on April 9, 2018 with a headliner of 193.5 meters of 2.09 g/t gold at their 100% owned Cuale project. On those results early investors saw the stock rise approximately 250% since the start of the year.

The investment community was closely watching as they knew follow up results from cross cut trench’s #2 & #4 were soon to be released which would add a “footprint” or provide dimensions to the mineralization at surface. Evrim was quick to release those results and published them on April 16, 2018 with a headline number of 106.2 meters grading 13.61 g/t gold at Cuale. This took EVM up to C$1.70 at its intra-day high for a 500% return YTD.

The performance of EVM is synonymous with the scarcity the gold exploration sector is currently experiencing with the lack of new legitimate gold discoveries made in the last several years. Resource investors and exploration speculators are “hungry” for the next significant find and are willing to pay a premium to partake in such an opportunity.

Aside from the fact that EVM’s management has skin in the game and that Cuale offers exploration upside, is that the deposit style is an epithermal gold-silver target which are known for being one of the lowest cost, largest scale, and long life mines when put into production.

Another gold orientated discovery company, Westhaven Ventures (TSX-V: WHN) run by a group of serially successful explorationists, is currently drilling a potentially high grade epithermal gold target in an underexplored and emerging gold belt. At the end of 2017, Westhaven made a significant discovery at their Shovelnose gold project. After nearly a decade of drilling, they appear to have vectored in on a gold mineralized feeder structure.

These are the structures that, given this type of deposit model, one can expect to find high grade gold mineralization at or near. Eager to get back and follow-up this newly discovered area, the South Zone, Westhaven initiated a 2,800m in late March.

Drill results are starting to come back and it appears their targeting continues to improve. A news release disseminated yesterday highlighted 28.7 meters of 2.6 g/t gold, including 17.7 meters of 3.9 g/t gold and 2.9 meters of 9.7 g/t gold at a depth of 178 meters in hole …read more

From:: Mining.com