Source: Streetwise Reports 05/07/2018

As all eyes are trained on British Columbia’s Golden Triangle for this summer’s drill season, a gold explorer prepares to begin a large-scale drill program.

British Columbia’s Golden Triangle is home to huge mines like Eskay Creek, which was once the world’s highest-grade gold mine and produced 3.3 million ounces of gold at an average grade of 45 g/t and 160 million ounces of silver at an average grade of 2,224 g/t.

Last season’s gold-silver discovery at the Saddle prospect by GT Gold Corp. and high-grade gold results at Colorado Resources’ Golden Triangle properties have renewed interest in the area.

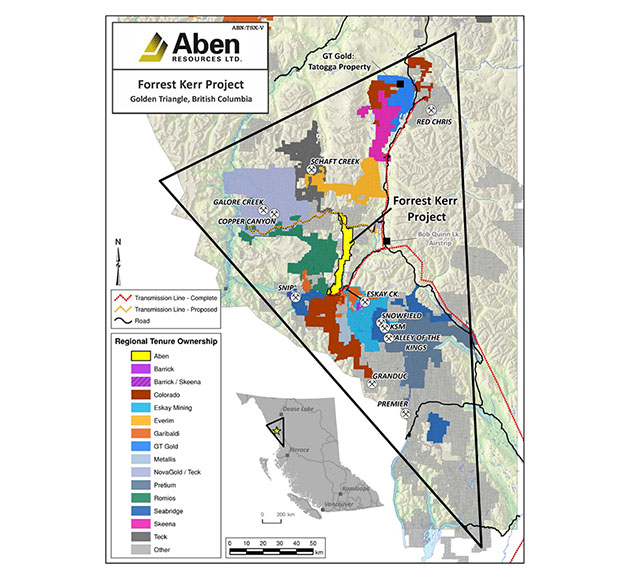

Aben Resources Ltd.’s (ABN:TSX.V; ABNAF:OTC.MKTS) Forrest Kerr Gold Project is located in the heart of the Golden Triangle and the company is gearing up for this summer’s exploration.

Fresh off a private placement that raised CA$2.32 million, Aben Resources has a treasury with over C$3.5 million, which it plans to deploy for summer exploration at Forrest Kerr.

“Aben is in a good position now with cash in the bank and a very clear exploration plan for the summer.” – Gwen Preston, Resource Maven

Drilling at Forrest Kerr in the early 1990s returned assay results that included 9.87 g/t gold over 29 meters in the Carcass Zone and 33.4 g/t gold over 11 meters in the Boundary Zone, but high drilling costs and limited accessibility precluded significant follow-up.

However, major infrastructure improvements have made the Golden Triangle area, once considered very remote, much more accessible, as well as more cost effective to drill. The Galore Creek access road is on the north end of Aben’s property; at the south end roads and powerlines provide access and electricity from low-cost hydroelectric facilities.

Last summer, Aben drilled nine holes at Forrest Kerr, which returned highlights of 10.9 g/t Au, 14.6 g/t Ag and 1.5% Cu over 12 meters with a high-grade core of 21.5 g/t Au, 28.5 g/t Ag and 3.1% Cu over 6 meters.

Early to mid-June is the target date for the beginning of drilling at Forrest Kerr. The company plans to start announcing drilling results mid-summer.

Aben CEO Jim Pettit told Streetwise Reports, “The drill results continue to reveal the near-surface high-grade gold mineralization present at the underexplored Boundary Zone and demonstrate that the area has immense potential for new discoveries. The Boundary Zone mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets yet to be drill-tested. Aben will aggressively target the new discovery in 2018 with drilling this summer and a focused geological ground program.”

Resource Maven analyst Gwen Preston, wrote on April 25, “Aben will start by testing along the fault to extend the Boundary North zone. They will also test a series of targets to the south, along presumed parallel structures that offer gold-in-soil anomalies and rock samples. All told there is a 4-km long corridor of soil anomalies and rock samples that deserves a closer look, especially because it runs right along the boundary between the Stuhini and Hazelton groups (a stratigraphic boundary that almost every gold occurrence in the Golden Triangle is related to) and is bordered on the other side by a major fault, which creates a kilometer-wide corridor with the right structural attributes to host gold.”

“All told, Aben is in a good position now with cash in the bank and a very clear exploration plan for the summer,” concluded Preston.

In addition to Forrest Kerr, Aben is acquiring an up to 80% interest in the Chico Gold Project in Saskatchewan and holds a 100% interest in the Justin Gold Project in southeast Yukon.

The company boasts has veteran management with lots of experience in the region. The company chairman, Ron Netolitzky, is a well-known mine finder, and is associated with major discoveries in the Golden Triangle such as Eskay Creek and Snip. This area is near where Aben’s flagship Forrest Kerr project is located.

President and CEO Jim Pettit has a long history in the mining field and served as the chairman and CEO of Bayfield Ventures Corp., which was bought by New Gold. Vice-President for Exploration Cornell McDowell has worked for numerous companies including Gold Reach Resources, where he took the Ootsa project from the initial stage through a positive PEA. Geologist Tim Termuende is the CEO of Eagle Plains Resources and was involved with early exploration of Forrest Kerr. He also comes from a geological family and he has been in this field for decades.

Aben Resources has caught the attention of industry watchers. Rick Mills, in Ahead of the Herd on May 7, wrote, “investors are aware of the [Golden Triangle] play, but they are eager for another discovery like Garibaldi’s to keep driving interest forward into the summer drilling season. Who could that discovery hole come from?” Among the possibilities he lists is Aben Resources.

Mills noted that among the historical drilling on Aben’s Forrest Kerr property, “the most promising intersection was in the Boundary Zone hole, which returned 33.4 g/t gold over 11 meters including 326 g/t gold over 0.45 meters. A nine-hole drill campaign that started last summer showed continuous mineralization in the first three holes of the North Boundary Zone.”

“The North Boundary Zone mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets yet to be drill-tested. Aben anticipates doubling the 2017 drill program at Forrest Kerr this year, as the company chases more high-grade mineralization found in the new North Boundary zone in a southerly direction up to possibly 12 kilometers,” Mills stated.

Aben has 63 million shares issued and outstanding and its market cap is approximately CA$11 million.

Technical analyst Clive Maund profiled Aben on April 10, writing, “Aben is believed to have an active drill season coming up, and speculative interest is expected to mount as it progresses, resulting in potentially big gains from the current low price. Great entry point here at the long-term trendline. …read more

From:: The Gold Report