Long term experienced junior mining investors knows that the Holiday Tax Loss Selling Season is usually the best time to pick up bargains. Even in down bear market years January and February are usually favorable, however, we may be on the verge of some of the best years in mining ever! Notice the significant rallies off these lows the past 3 years.

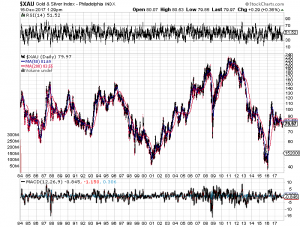

I knew we hit a bottom in the miners when at the end of 2015 I got a call from an old time broker that mentioned to me the XAU Gold Miners Index is lower than when he started out in early 80’s. Since that time we has a bounce in early 2016 but not much since then.

The bargains in the juniors are still out there and we may be headed into a great exploration cycle that may be a once in a lifetime opportunity as the mining sector has never been this much ignored since the late 90’s dot com bubble after hitting a forty year low cycle at the end of 2015.

That time was very similar to right now where young people are quitting their jobs to trade bitcoin…back in the late 90’s everyone was quitting their jobs to day trade dot coms. Right before the crash. I remember when so many were flipping houses back in 2008 before the housing foreclosure crisis.

Look at what these record low interest rates manipulated lower by quantitative easing has created in the $DJIA. Its out of control and we could be headed into a much worse crash then even 1929.

Having been in the mining investment business for many years and looking at charts the last time we hit peak discovery was in the mid 90’s. For the last 20 years we have been living off the work of the explorers from the last gold rush which started in the late 70’s.

Many old time investors believe in a forty year cycle in gold rush exploration cycles. Looking at those calculations the last real gold rush was in late 70’s after a significant inflationary cycle. For close to forty years gold has come down from those levels and don’t think it can’t happen again. As soon as the stock markets pop along with bitcoin and bonds you could see gold and silver making double digit percentage gains daily. Similar to what we saw after the dot com bubble burst and when housing went into the gutter.

Meanwhile lets take a look at some stocks making some big news going into 2018 and making technical breakouts.

Metallic Minerals $MMG.V $MMNGF looks like it could be forming a breakout from a year long base breaking above the 200 DMA and a downtrend. They hit some bonanza high grade silver at their property in Keno Hill right near Alexco $AXU in the Yukon.

Cobalt 27 $KBLT.V CEO Anthony Milewski just raised $85 million to purchase physical cobalt which he thinks is still cheap even though it is breaking out near $35. It was $50 back in the 80’s when they didn’t even know about the lithium ion battery

Cobalt Power $CPO.V $CBBWF could be on the verge of a rerating as the TSX approved the acquisition of Canadian Cobalt which makes Cobalt Power into one of the largest land owners in the Cobalt Camp next to First Cobalt $FCC.V $FTSSF and near several historic mines.

Cobalt Power $CPO.V $CBBWF could be on the verge of a rerating as the TSX approved the acquisition of Canadian Cobalt which makes Cobalt Power into one of the largest land owners in the Cobalt Camp next to First Cobalt $FCC.V $FTSSF and near several historic mines.

In addition, Lico Energy $LIC.V $WCTXF had a nice breakout as well on really good cobalt drill results. They believe the drilling is confirming their historical geological model and want to put this into production with their great JV partner the huge multi billion commodity king Glencore.

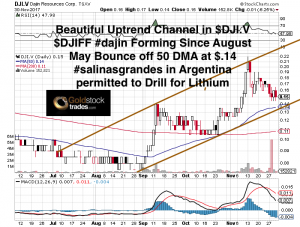

Dajin $DJI.V $DJIFF is beginning to form a beautiful uptrend channel since August as lots of activity for the company is happening both with their Salinas Grandes property partnered with LSC Lithium $LSC.V and they also raised money to drill their Teels Marsh Nevada Project which has water rights and is permitted to drill. I expect a rerating higher as it is still one of the cheap high quality lithium plays.

Finally, keep a close eye on Viscount Mining $VML.V $VLMGF which is also making a really high grade silver discovery right here in Colorado. I expect more news from this discovery in 2018 and possibly a retest of old highs back at $.72 almost double from where it is today.

Have a great weekend,

Jeb Handwerger

Disclosure: I own shares in all companies mentioned except Cobalt 27. All companies mentioned were or are website sponsors except Cobalt 27. This means I have a conflict of interest as I may be biased towards my website sponsors and my shareholdings as I could reap financial gain if they increase in value. Please do your own due diligence as I am not a financial advisor, I am biased and this contains forward looking statements which may never come to fruition due to the many risks in business and mining. Caveat Emptor! I may buy or sell shares in these companies with no notice to readers.

_______________________________________________________

Sign up for my free newsletter by clicking here…

Order premium service by clicking here…

Please see my disclaimer and full list of sponsor companies by clicking here…

To send feedback or to contact me click here…

Tell your friends! Please forward this article to a friend or share the link on Facebook, Twitter or Linkedin.

For informational purposes only. This is not investment advice. May contain forward looking statements.

From:: GoldStockTrades.com