Source: Maurice Jackson for Streetwise Reports 04/20/2018

As electric vehicles grab a larger share of the automotive market, the sourcing of raw materials becomes increasingly important. Sam Broom of Sprott Global Resource Investments, in this conversation with Maurice Jackson of Proven and Probable, discusses the supply and demand equations for two essential elements in EV batteries, nickel and cobalt.

Maurice Jackson: Welcome to Proven and Probable, where we focus on metals, mining, and more. We are speaking with Sam Broom, an investment executive at Sprott Global Resource Investments. Today, we will discuss nickel and cobalt propositions for his portfolio.

Sam, you’ve truly carved out a niche for yourself in the nickel and cobalt space. Many speculators don’t hear much about these metals and the value propositions that they may present. Let’s begin with nickel. At the 10,000-foot level, share with us the supply and demand fundamentals for nickel.

Sam Broom: Nickel is actually quite an interesting market. It was a darling back in the early to mid-, even to late 2000s, up until about 2007–2008, where the price rose dramatically. A lot of people and a lot of speculators made a lot of money in the nickel market in the 2000s.

What happened was the Chinese came up with a new way of producing largely stainless steel, which was the main use for nickel. Formerly, Chinese companies used refined nickel to produce stainless steel. Nickel is a fairly rare metal. There’s not a lot of high-quality deposits out there, but the Chinese figured out a way to turn ferronickel, which was basically an iron-rich nickel dirt, a withered rock. You could now use that as a replacement for refined nickel in creating stainless steel.

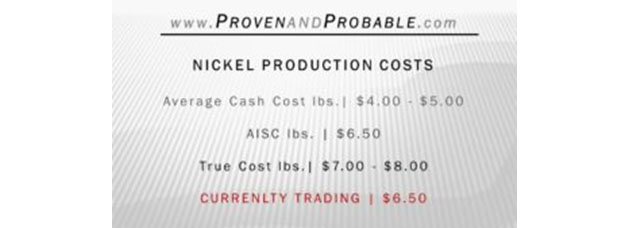

That truly was almost like a shale oil moment for the nickel market, and drastically changed the cost structure of the industry. It also coincided with the global financial crisis in 2008, and then nickel promptly fell off a cliff. It was trending at about $54,000–55,000 a ton. It was as low as almost $7,000 a ton about a year ago. So that’s we’re talking an 80% decline over the last 10 years, in terms of the nickel price.

What resulted was all of a sudden you hit this flood of nickel, or iron-rich nickel, nickel pig iron, or ferronickel, that flooded into the market from places like Indonesia and the Philippines. It basically destroyed the price of nickel. If you look at a long-term chart of nickel, the refined nickel stores on the LME, you’ll see exactly what happened. Basically, supply went through the roof, and then we saw this huge accumulation of nickel. The nickel market was in a huge surplus for years and years.

To this very day, there are still huge amounts of nickel on the LME, compared to historical norms. That’s why a lot of people still steer clear of the market. One key thing to note, though, is for the last few years, the nickel market or the refined nickel market has been in a deficit. If you look at that very same chart, you’ll notice that stock piles have been starting to draw down, and that’s initially what got my attention. That’s a key thing for investors and speculators to keep an eye on.

The draw down has actually been in excess of what I was expecting at this point in the cycle, so clients of mine will know that I’ve been talking about nickel for the better part of about 6 to 12 months as being a commodity I think could be one of the best performing commodities over the next few years. The tide is turning, and it’s actually exceeding my expectations so far.

Maurice Jackson: You made two interesting points here. You have a supply deficit and an 80% reduction in price. That really prompts some unique opportunities. Do you foresee a catalyst that will constrain supply in the future, or add to the demand?

Sam Broom: The main driver that I see moving the nickel price is it’s a very crucial ingredient in just about every type of lithium-ion battery there is out there. If you look at all the various chemistries, most of them are very nickel-rich.

What we’re seeing or just starting to see is increased buying from those getting set in the electric vehicle space where they don’t actually need refined nickel, nickel metal. The EV industry uses nickel sulfate, which is basically a nickel salt, but you can make that. You can process refined nickel into nickel sulfate. We’re starting to see a little bit of an impact from that.

Nickel is also what I would term a kind of an affluent commodity. Stainless steel is obviously something that an increasingly wealthy population consumes in greater quantities as they become affluent. Global growth in places like China and in the developing world is driving this nickel drawdown at the moment, but I do foresee that in the near future, probably not in the next 12 months, but maybe 18 to 24 to 36 months down the track, the growth of the electric vehicle industry is going to be what drives refined nickel demand.

The key thing to note here is that all of that additional supply that came onto the market back in the late 2000s with the invention of nickel pig iron is completely unsuitable and unusual in the electrical vehicle space. So basically, that can go towards servicing demand from stainless steel fabrication and production, but it cannot be used at all to create electric vehicles and to go into the cathode of lithium-ion batteries.

In a nutshell, that EV demand is going to directly impact on what we term “class one nickel,” which is what the LME stock piles represent.

Maurice Jackson: You hit on some very key points here, and that’s a lot of ambiguity that I heard regarding the nickel space. There’s excess …read more