Source: Michael J. Ballanger for Streetwise Reports 04/30/2018

Precious metals expert Michael Ballanger discusses the gold and silver ratio.

“SHE-NAN-I-GANS”

pronunciation: “SHəˈnanɡənz/”

Noun informal

1. “secret or dishonest activity or maneuvering.” as in “widespread financial shenanigans had ruined the fortunes of many”

2. “silly or high-spirited behavior; mischief.”

To start off, I find it astounding that of all the ways that dictionaries might cite the usage of the word “shenanigans,” they elected to discuss it in its context to the financial industry and how shenanigans have “ruined the fortunes of many.” To wit, as we move into the month of May, we are entering the six-month period during which stock prices have historically faltered, setting up the old saw that one should “sell in May and go away.” I first used that phrase (which I have since grown to detest) back in 2009 when I determined that the TSX Venture Exchange at 737 was quite cheap relative to its 2006 high at 3,300 so I wrote one of my first pieces for Streetwise Reports entitled “Sell in May and Make Some Hay” after which the TSXV peaked at 2,400.

I thought then (as I do now) that the there was something rather odd occurring in the junior mining markets because while the blue-chip averages were in full recovery mode, the micro-cap explorcos were not getting any of the love being doled out by the Fed’s QE and Tarp programs. Investors were completely confident in the hot momentum stocks (like the banks) but were not terribly confident in the inflation beneficiaries like the gold miners, whose junior brethren were largely domiciled on the TSX.V. It seemed to me then (as it does now) that a hefty dollop of insidious “SHENANIGANS” was being carried out in covert fashion, the likes of which moved from the ridiculous to the sublime with the April (2011) massacre in the gold and silver markets that most certainly were to be found under the headline of “shenanigans” and most certainly “ruined the fortunes of many.”

Now, while not nearly the scope or breadth of the criminal collusion of 2011, the past few weeks have a similarly pungent aroma arising from the price behavior of a) stocks, b) volatility (UVXY), and c) gold and gold miners.

Shenanigation #1) Stocks:

You will recall that I came out in late January of this year with the S&P 500 north of 2,825 and told the world that “it’s time for the beast to exhale” after which the S&P dropped like a stone to 2,352. That move was met with a couple of interventions with the first in February and the second in March at exactly the 200-dma. The color commentators on CNBC mentioned the 200-dma 87 times the day of the February bottom and 46 times during the day of the March bottom, while the phrase itself showed up in print over 10,000 times. The S&P 500 was up over 300 points from the February and March lows largely in anticipation of “earnings season” but in the past two weeks, both the S&P and the NASDAQ have been hobbled by a “sell the news” behavioral quirk, which, for me, is a sure-fire signal that bigger investors are viewing Q1/2018 as the peak for the business cycle.

Interestingly, we know now that the big boys needed a robust retail buying season in order to off-load their portfolio positions so the narrative was, understandably, that earnings would be “blow-out” and take stocks higher and that is the shenanigans that transpired back in February and March with the rescues at the 200-dma. The retail pitch sheet was constructed on the earnings outlook, not the tape action such that the brokers could say they were “right” about the EPS parade and hide under their desks.

Shenanigation #2) Volatility:

Again, not to try to blow my own horn (at least not to any great degree), between January 16 and February 6, I fired off a number of tweets regarding volatility with a specific reference to the triple-leverage ETF (UVXY:US) that was sitting at $9.00 in mid-January and was the most heavily shorted ETF on the planet to the extent that even the new chairman of the Fed admitted that they too were short. So, since VIX-suppression has been a well-known but under-advertised mechanism used by the Criminal Interventionalists to juice stock prices, it appeared to me as the utmost “Fade the Fed,” contrarian, set-up trade EVER. As it turned out, I honestly did not expect them to allow the VIX much above 15 but it actually went to 49.61 and did so in a mere three weeks after I positioned myself for an upside “probe” in volatility without thinking it would be an upside EXPLOSION in volatility.

In sum, what backfired on the masses was that they were betting blindly that Fed shenanigans would continue unabated and that being short “VOL” was the “smart-money trade.” It might have been labelled “Shenanigans gone wild” because it turned out to be a highly satisfying trade from both a psychological and financial perspective.

Michael Ballanger @MiningJunkie

Buying 1000 UVXY @ $9.10 STOP @ $7.95 target $50 by June

8:17 AM – 16 Jan 2018

Approximately 21 days later, I followed up with this tweet:

Michael Ballanger @MiningJunkie

sold another 30% UVXY @ $25 holding 20% of original position at cost of minus $7.31

7:06 AM – 6 Feb 2018

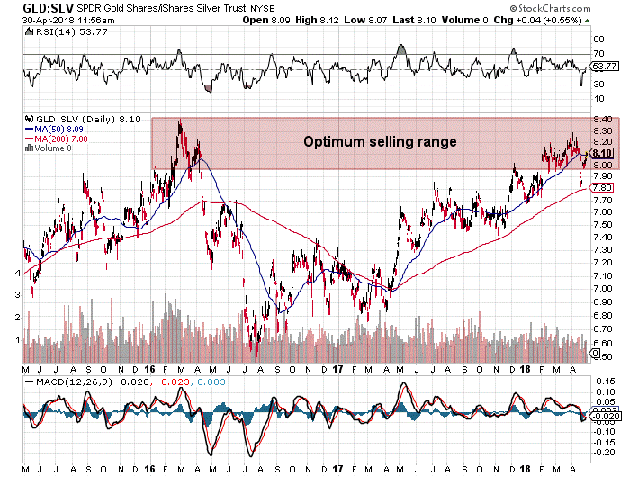

Shenanigation #3: Gold and Gold Miners:

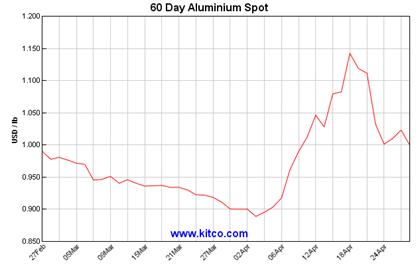

The third example of out right financial fraud was the price-capping farce we have experienced in gold and silver since 2011, which continues today amidst widespread acknowledgement by CEOs in their MD&As and in the forward guidance offered by companies using any commodity or energy caught in the crosshairs of the impending global trade war. Global trade wars (or even the threat of such) are not good for business and are, in fact, INFLATIONARY because of supply dislocations which cause price distortions.

So, with the recent spike in aluminum prices, why is it that a commodity …read more