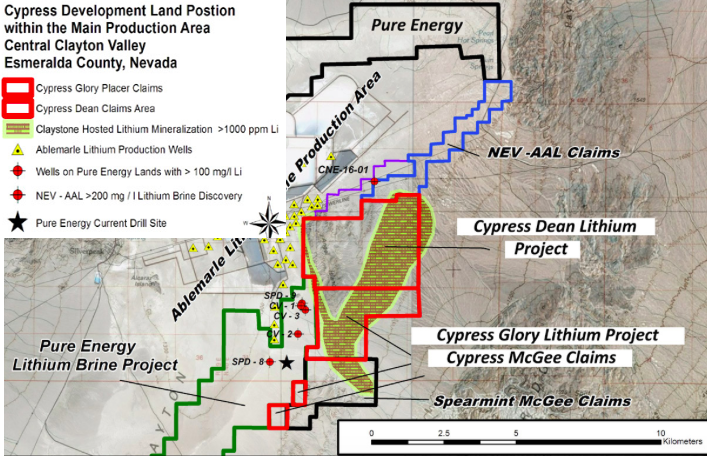

Source: Peter Epstein for Streetwise Reports 05/02/2018

Peter Epstein of Epstein Research discusses the maiden resource estimate for a Nevada lithium project.

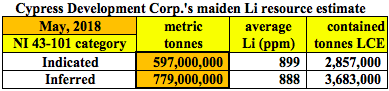

WOW! Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:Frankfurt) killed it with its maiden NI 43-101 compliant lithium resource estimate yesterday! The whisper number was 4 to 6 million Inferred tonnes of Lithium Carbonate Equiv. (LCE), (which would have been a tremendous result), but Global Resource Engineering Ltd. determined there’s an estimated 6.54 million metric tonnes LCE.

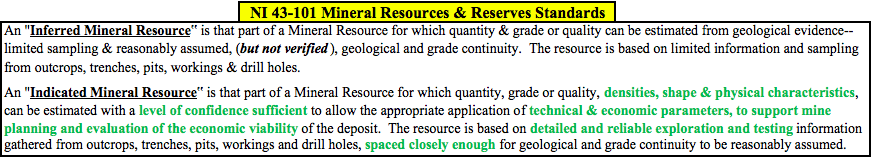

Perhaps even more exciting than the size of the resource, (we knew it would be large), was something I never even considered, 44% (2.857 M tonnes) of the resource is in the “Indicated” category. I thought it would 100% Inferred. That just goes to show how strong the continuity of the lithium zones is in this giant, thick, tabular formation—where 21 of 23 drill holes ended in mineralization.

In the boxed paragraphs above, notice the added level of evidence or “confidence” (highlighted in green) needed to be designated an Indicated resource vs. Inferred. The sizable Indicated portion will make it easier and less costly to reach PEA stage (expected in Sept/Oct). Importantly, Cypress is funded through PEA, especially as a wave of options and warrants will likely be exercised on the back of this news.

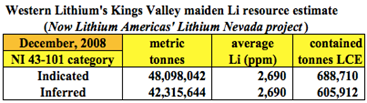

Putting this into perspective, consider that Lithium Americas Corp.’s (LAC:TSX; LAC:NYSE) (formerly Western Lithium) clay-hosted Li project (then called Kings Valley) also in Nevada, had the following maiden mineral resource estimate:

It had an impressive 53% of its total resource classified as Indicated, but the absolute size of the resource was 24% & 16%, respectively, the number of tonnes of LCE in Cypress Development’s maiden Indicated & Inferred resource.

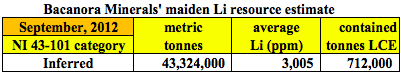

Bacanora Minerals Ltd.’s clay project in Sonora Mexico had the following maiden resource:

Bacanora Minerals’ (London: BCN) maiden resource was 25% the size of Cypress Development’s Inferred resource. However, Bacanora had no tonnage at all in the Indicated category.

Fast forward to today, Lithium Americas’ project now hosts a combined Measured & Indicated resource just shy of 6 million tonnes LCE, plus an Inferred inventory of about 2.3 million tonnes. Recall that LAC has a clay-hosted lithium project, also in Nevada. An entirely new (will replace the prior) Preliminary Feasibility Study (PFS) on LAC’s clay project is expected in June.

Likewise, Bacanora’s net attributable resource has soared to 4.1 million tonnes LCE (Measured & Indicated), and 3.2 million tonnes (Inferred). Bacanora’s BFS-stage clay project is in Sonora Mexico.

Near-term Catalysts to Keep Market on its Toes

Readers should know that there are important near-term catalysts leading up to a PEA as soon as August (I’ve been saying in September/October). First and foremost, ongoing metallurgy test results will be released. The full maiden mineral resource technical report will be filed on Sedar this month. And, assays from up to 30 new drill holes are coming this spring and summer. Management expects to be in talks with prospective strategic partners, but there’s no rush because, as mentioned, Cypress is funded through PEA.

Cypress should be able to substantially upgrade its NI 43-101 compliant Indicated & Inferred resource to the Measured & Indicated categories, potentially ending up with a resource around the same size and level of confidence (albeit lower grade) as Lithium Americas’ and Bacanora’s. In fact, in today’s press release management stated that it believes 30 additional drill holes would be sufficient to upgrade the Inferred portion to Indicated.

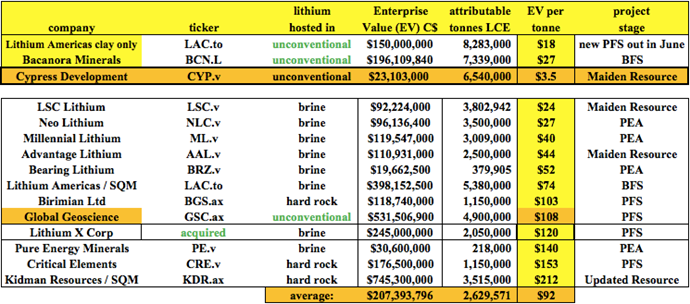

Cypress’ Indicated-only portion at nearly 3 M tonnes LCE is larger than most hard rock, and many brine projects around the world. Cypress is trading at Enterprise Value (EV) to tonne LCE ratio of just C$3.5, (share price C$0.33 intra-day May 1) and that’s on a fully diluted share count. Compare that to C$18/t for Lithium Americas (I assume 25% of LAC’s EV is attributable to its Nevada clay project), C$27/t for Bacanora, and an average of C$92/t for several other global hard rock and brine projects (most peers in the chart below are more advanced than Cypress).

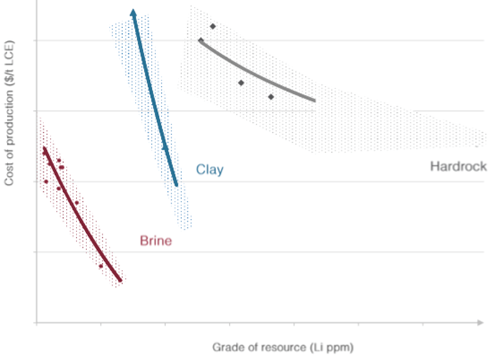

The graph below, from a recent Lithium Americas’ corporate presentation, shows where clay-hosted lithium projects fit into the conventional world of hard rock (mostly in western Australia) and brine (mostly in Chile and Argentina). Generically speaking, clay is right in the middle on both operating costs and lithium grade. What the chart doesn’t show is that the most significant clay projects (BCN’s, LAC’s and now CYP’s) are quite sizable—much larger than the average conventional lithium project.

To recap, this is a major advancement for Cypress. It puts the company on the map, not just U.S. and North American maps, but global maps. A KEY TAKEAWAY is that the amount of TIME and CASH needed to drill out the entire resource for a Bank Feasibility Study (BFS) next year should be relatively low, especially compared to the time and capital deployed by Lithium Americas and Bacanora to get to PFS and BFS, respectively. Cypress is now (in my opinion only) in a position to deliver a BFS in mid-to-late 2019 at a total cost (including company overhead) of <C$10 million.

Also of major importance in today’s press release:

- Preliminary test work conducted at SGS Canada Inc (Lakefield) and Continental Metallurgical Services, LLC has shown the material exhibits high lithium extractions with short leach times. Lithium extractions of greater than 80% can be achieved in 4 to 8 hours using conventional dilute sulfuric acid leaching. Currently, Hazen Research Inc is conducting additional leach tests and preliminary results confirm high lithium extractions for new mineral zones.

- The presence of acid leachable lithium presents a significant cost savings by avoiding calcine and regrind of material during processing. Preliminary results also show the consumption of sulfuric acid and other reagents …read more