Source: The Critical Investor for Streetwise Reports 05/01/2018

The Critical Investor provides an update on funding and exploration at a high-grade zinc project in Peru.

Ayawilca project; drilling location

1. Introduction

Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) came a long way doing its financings without the Canadian brokerages, supported by Sentient and IFC, but finally it was time to let them in as the upcoming/ongoing drill programs, resource estimate and Preliminary Economic Assessment demanded a substantial treasury, preferably raised well before it will be needed. The raised amount of no less than C$16.2M is among the highest for base metal explorers for the last year or so, although I believe it had a substantial impact on the share price.

The company also released new drill results for West Ayawilca and Zone 3. For West, the stepout hole was pretty successful, the Zone 3 results didn’t return much but this wasn’t entirely unexpected, as mineralization was expected more in the vicinity of hole A18-113 (more to the north), of which the assays are coming up soon. What this all might implicate for investors can be read in this update.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Tinka’s performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka’s management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

2. Financings

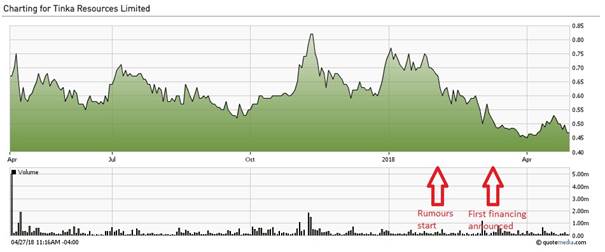

With the rainy season limiting drill result news flow, and a new cash injection to be foreseen in the not too distant future, most of the attention on Tinka Resources was focused on a new round of financing after the last results on Ayawilca came out in February, as discussed in my latest update. Rumors started swirling around in January about Canadian brokers wanting a piece of the Tinka pie, and coincidentally the share price started sliding soon after this, not in line with the neutral Venture/base metal sentiment:

Share price Tinka Resources 1 year timeframe; source tmxmoney.com

This might not have been that coincidentally, as careful observers of the markets often could notice likewise drop-offs after word gets out (for example, when the company is doing road shows for a financing) a company is going to raise fresh cash. Stock movers like interested parties (banks, brokers, big investors) have a clear incentive to get the lowest price possible on such a financing, and especially if they can get additional warrants they might, for example, even sell (part of) an eventual position and buy back with warrants attached, often getting the shares at a discount, as financings are usually done at a slight discount. In addition to this there was also heavy selling pressure from a sell recommendation of a U.S. newsletter right before PDAC.

The first round of financing was finally announced at March 13, and involved a C$7.008M bought deal @C$0.48 plus a half warrant (@C$0.75 for 12 months). The Canadian syndicate was led by GMP Securities and consisted of Canaccord, Beacon, CIBC and Industrial Alliance, which received 6% commission in cash of gross proceeds. There was a C$1.051M over-allotment option, which was exercised in full, resulting in C$8.059M proceedings, and it was a short form prospectus, meaning that the shares can be sold directly after closing of the financing without the usual four-month hold period.

At the same time, the company was undertaking a non-brokered private placement, which consisted of two tranches, C$5.77M (closed April 9) and C$2.4M (closed at April 27), totaling C$8.17M, under the same terms (@C$0.48 with a half warrant @0.75 for 12 months) except these securities are subject to the usual four-month hold period. The largest shareholder, Sentient Global Resources Fund IV, was a big buyer of this placement, bringing its total holdings of Tinka at 24.7% of outstanding shares, and 23.8% fully diluted. The other big shareholder, International Finance Corporation (IFC), participated in the second tranche as well, exercising its contractual rights regarding the offering, bringing its holdings to 11.5% outstanding and 13.2% fully diluted. On a side note: assuming a finder’s fee of 6%, there was a Peruvian broker taking up a participation of about C$653k, so Tinka managed to get some local interest in the end.

The company plans to use the net proceeds of C$16.2M to fund exploration expenditures at the company’s Ayawilca project in Peru, an updated resource estimate and a PEA, as well as for other corporate purposes and general working capital. CEO Graham Carman had this to add according to the news release:

“The Company is now fully funded to carry out its planned exploration programs for the next 18 months. Drilling has already been stepped up to three rigs, and we look forward to disclosing the results of the drill programs, and other planned work such as metallurgical tests, as results come to hand.”

It is good to see that Tinka doesn’t have to go back to the markets for the first 1.5 years. Although there was quite a bit of (future) dilution added because of the relatively low price and the warrants of the last capital raise, which wasn’t always appreciated among investors, management did well by pulling the trigger by lack of better offers. The golden rule in mining is always, if you can get the money, you have three priorities: 1. take it 2. take it 3. take it. Management told me they didn’t get better offers earlier on, contrary to rumors in the industry, so there is only so much you can do as a junior it seems. The issued and outstanding share count stands at 271M at the moment, and the fully diluted number is about 301M shares.

The markets are digesting this financing now, and it seems to me that the current C$0.46-0.48 …read more